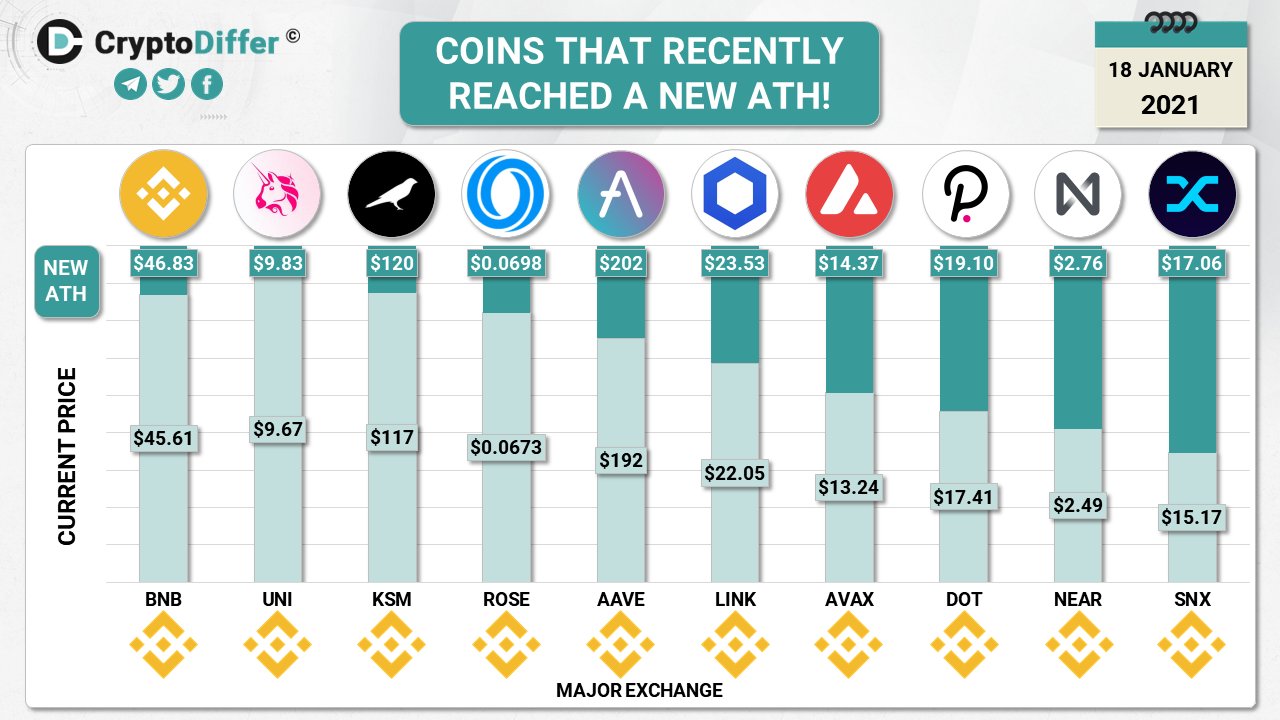

Many cryptocurrencies are starting the new year with great price movement. The leading cryptocurrency, Bitcoin (BTC), more than doubled its previous years-long all-time high (ATH) in January, reaching over US$40,000. Although BTC is down from that price range, many other cryptocurrencies are peaking at price. Some already made a high ATH recently. This is causing many traders to believe the long-awaited altcoin season is almost here.

Major Altcoin with Recent ATH

The top ten altcoins with new price ATH includes:

- Binance Coin (BNB)

- Uniswap (UNI)

- Kusama (KSM)

- Oasis Network (ROSE)

- Aave (AAVE)

- Chainlink (LINK)

- Avalanche (AVAX)

- Polkadot (DOT)

- Near Protocol (NEAR)

- Synthetix (SNX)

BNB, the native cryptocurrency of the leading exchange, Binance, made a new all-time high in value at US$46.8 on January 18. However, the price of BNB slightly dropped to US$44.33 on Coingecko during the time of writing. UNI, the governance token of the largest decentralized exchange, Uniswap, also reached a new peak of US$7.8 on January 18 but has dropped to the current price of US$9.04.

Kusama is designed to be Polkadot’s canary network. Its cryptocurrency KSM climbed to a new high of US$120, but the current price sits at US$112 on Coingecko. The native cryptocurrency of Oasis Network, ROSE, also increased to an ATH of US$0.074300 but dropped to US$0.068124.

AAVE, LINK, and DOT reached a new high of US$202, US$25.53, and US$19.10, respectively. AVAX, NEAR, and SNX also increased to US$14.37, US$2.76, and US$17.06. However, all these cryptocurrencies are trading below the ATH during press time.

Noteworthily, Bitcoin has been losing its dominance lately from about 70 percent to 66 percent, which somewhat suggests that altcoin season is almost here.