Numeraire (NMR), the native token for Numerai, a San Francisco-based hedge fund built by a network of data scientists, has outperformed the ailing crypto market by skyrocketing over 100 percent in just over a week.

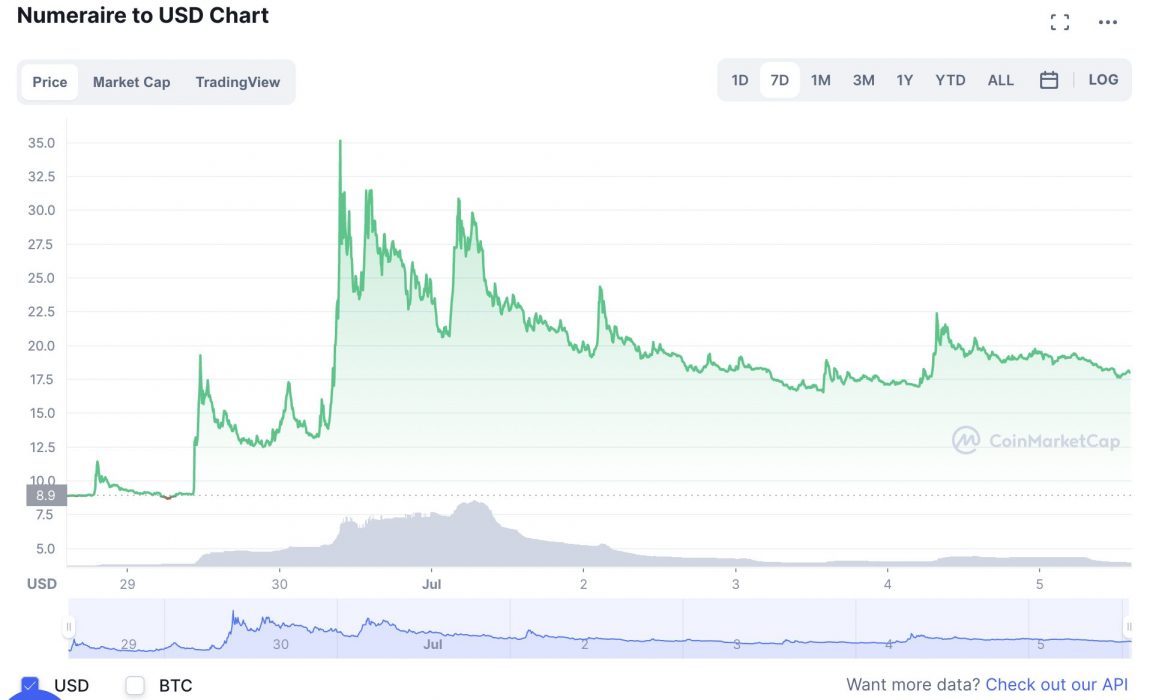

At the time of writing, NMR was ranked the 173rd crypto according to data from CoinMarketCap and was trading at US$17.93, up from US$9.22 just seven days ago. The token remains down more than 77 percent from its all-time high of US$93.15, which it hit in May 2021.

The NMR token is built atop the Ethereum blockchain and can be staked to power the Numerai Tournament, in which entrants compete to build machine learning models based on abstract financial data to predict the stock market.

According to the project website, the models also determine the hedge fund’s bets: “The staked models of Numerai are combined to form the Meta Model which controls the capital of the Numerai hedge fund across the global stock market.”

Reasons for Surge Remain Unclear

Numeraire also powers the staking protocol Erasure, which aims to increase trust in online information by requiring information sources to stake their offerings, as inaccurate information causes the stakes to be destroyed. It remains unclear what caused the token to surge to such heights, but developers did announce last week that the project had almost one million NMR stakes across the tournaments:

Obscure Projects Defy Crypto Odds

A couple of crypto projects have come out of nowhere to take the market by storm and have shown some serious growth. Earlier this week, Ethereum-based, decentralised blockchain platform Stratis witnessed its native token STRAX rocket 103 percent in a 24-hour period, cooling off from a rally that at one point had reached 160 percent. And last month it was reported that NuCypher (NU) token had soared 87 percent amid its merger with the Keep Network.