Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Coti (COTI)

COTI markets itself as the first enterprise-grade fintech platform that empowers organisations to build their own payment solutions, as well as digitise any currency to save time as well as money. COTI is one of the world’s first blockchain protocols optimised for decentralised payments and designed for use by merchants, governments, payment DApps, and stablecoin issuers. The ecosystem has a DAG-based blockchain, proof-of-trust consensus algorithm, multiDAG, GTS (Global Trust System), a universal payment solution, and a payment gateway.

COTI Price Analysis

At the time of writing, COTI is ranked the 185th cryptocurrency globally and the current price is US$0.1003. Let’s take a look at the chart below for price analysis:

COTI has been ranging since its swift collapse in early May. Bulls and bears are battling between adjacent support and resistance surrounding $0.1036. This proximity may cause more consolidation until a strong move shows the next direction.

The area of resistance showed inefficient trading on the weekly chart. Price has rebalanced this area, so bears are free to take the price lower. Meanwhile, the upper part of accumulation on the weekly and the 9, 18 and 40 EMAs form support below.

A break lower might reach for inefficient trading on the daily chart near $0.0941. This level saw accumulation before mid-July’s run on bulls’ stops. It’s also under the July monthly open and the high of previous inefficient trading on the weekly chart.

If the price breaks higher, an area near $0.1315 could provide the next significant resistance. A move to this level would rebalance early June’s fast drop. It’s also near the June monthly open.

Bulls’ stops under relative equal lows, near $0.07689, might be the next bearish target if the downtrend resumes. This level still shows inefficient trading on the monthly and weekly charts.

2. DeFiChain (DFI)

DeFiChain DFI is a blockchain platform built with the mission of maximising the full potential of DeFi within the Bitcoin (BTC) ecosystem. The software platform is supported by a distributed network of computers and is designed to facilitate fast and transparent transactions. The development team positions DeFiChain as an innovative blockchain project and offers solutions to problems like scalability, security, and decentralisation.

DFI Price Analysis

At the time of writing, DFI is ranked the 214th cryptocurrency globally and the current price is US$1.10. Let’s take a look at the chart below for price analysis:

DFI collapsed 84% from its April high before beginning an uptrend in early July.

Bulls broke the market structure to the upside on July 7. This break resulted in a 73% climb ending with a large spike on July 22. Inside this spike, $1.2568 could provide the first resistance. It overlaps with a small area of inefficient trading in mid-June and is near the 40 EMA.

A move higher might retest July 22’s high, near $1.3922. This area shows inefficient trading on the daily and weekly charts. It’s also near the top of inefficient trading on the monthly chart.

If the rally continues, bulls should find support near $1.0852. A narrow pocket under this level, from $1.0690 to $1.050, could provide more sensitivity. This pocket shows inefficient trading on the daily and overlaps with old highs. It’s also near the 9 and 18 EMAs.

If the downtrend resumes, a wide area from $0.7233 to $0.4132 might spawn the following bullish setup. This zone shows inefficient trading on the monthly chart.

Near its midpoint, around $0.5387, is the bottom of inefficient trading on the weekly chart. This level could provide sensitivity and be a target for bears.

3. Perpetual Protocol (PERP)

Perpetual Protocol PERP is a decentralised exchange (DEX) for futures on Ethereum and xDai. Traders can go long or short with up to 10X leverage on a growing number of assets such as BTC, ETH, DOT, and others. Trading is non-custodial, meaning traders always retain possession of their assets and on-chain. Perpetual Protocol utilises a virtual automated market maker (vAMM), which provides on-chain liquidity with predictable pricing set by constant product curves. Furthermore, Perpetual Protocol designed its vAMMs to be market-neutral and fully collateralised.

PERP Price Analysis

At the time of writing, PERP is ranked the 319th cryptocurrency globally and the current price is US$0.7525. Let’s take a look at the chart below for price analysis:

PERP has been in a downtrend for almost a year. In June, it set its all-time low.

Currently, the price is consolidating. The weekly accumulation high near $0.750 should support the price if bulls are buying. This retest would allow more buying as the price runs other bulls’ trailed stops under $0.757.

Yet, the closest resistance is nearby, at $0.783. This level is near the 9 and 18 EMAs, and also showed inefficient trading on the daily chart. This old inefficient trading may cause it to begin offering resistance.

If the closest support breaks, higher timeframes suggest that $0.628 might be the next support. This level is under the July open near the origin of the rally. Bulls rejected bears here in mid-June.

A drop to this level should make bulls cautious. It could mean that swing lows near $0.586 and $0.502 are the bearish targets.

If bulls do find support, they may be targeting a wide area from $1.026 to $1.170. This range shows inefficient trading on the weekly chart that the price may need to fill. It would also sweep bears’ stops over early July’s swing high into an old distribution area.

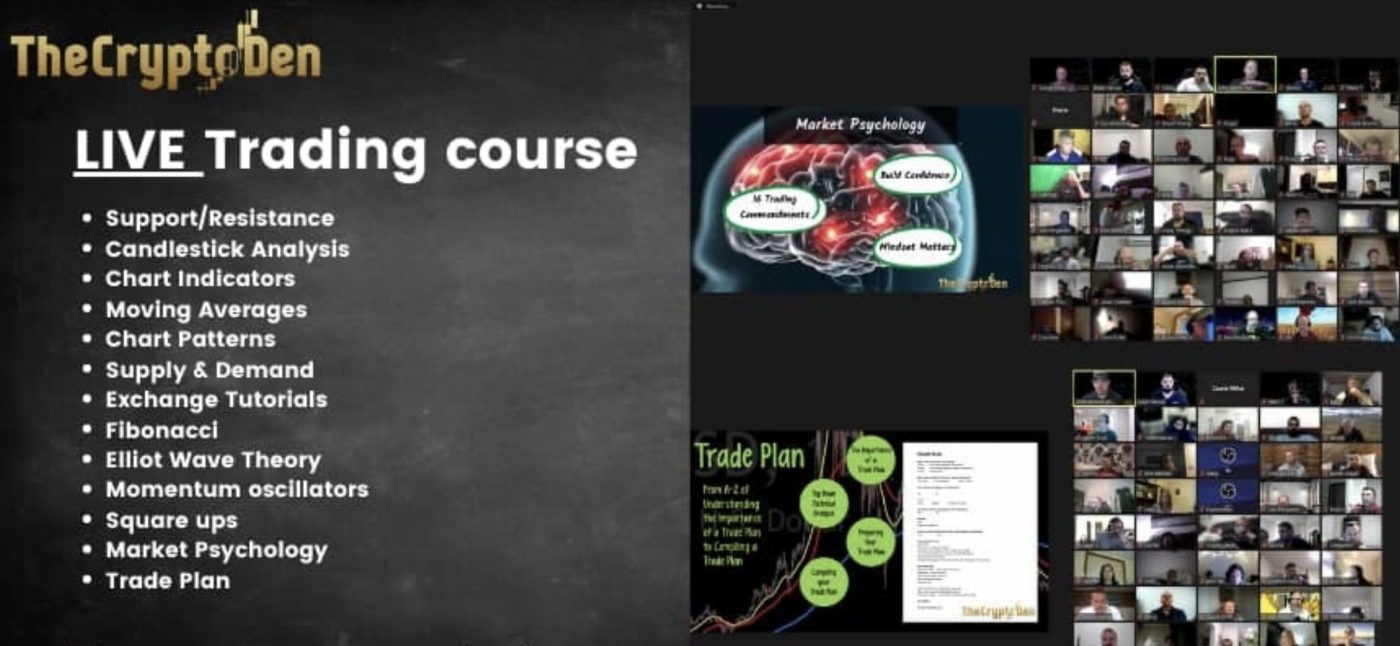

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.