Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. DefiChain (DFI)

DeFiChain DFI is a blockchain platform built with the mission of maximising the full potential of DeFi within the Bitcoin (BTC) ecosystem. The software platform is supported by a distributed network of computers and is designed to facilitate fast and transparent transactions. The development team positions DeFiChain as an innovative blockchain project and offers solutions to problems like scalability, security, and decentralisation.

DFI Price Analysis

At the time of writing, DFI is ranked the 210th cryptocurrency globally and the current price is US$2.24. Let’s take a look at the chart below for price analysis:

DFI has dropped nearly 60% from its late-March high and is near the bottom of a high-timeframe range extending to the beginning of 2021.

The first high-probability resistance is near $2.3867. This area shows inefficient trading on the daily chart. It’s also near the low of January 2022’s rally. The 9 EMA recently passed through this area, and the 18 EMA will soon arrive.

A more substantial rally could reach up to $3.1593. This area overlaps with the 2022 yearly open, contains the 40 EMA, and shows inefficient trading on the weekly chart.

If the market becomes significantly more bullish, $3.735 to $4.0636 could see profit-taking by bulls. This area shows inefficient trading on the monthly chart and is where distribution occurred before May’s breakdown.

On lower timeframes, the price may have formed support near $2.1561. Traders looking for a short trade on the daily chart may want to watch this area for support. Here, the price created a swing low near an area of buying last September and November.

Bulls might also find support below, near $1.9327. This area has shown chaotic buying in the past, making exact support challenging to pinpoint. However, multiple weekly swing lows have formed in this area near the bottom of the current range. These lows show past demand by bulls while also providing bears with an attractive target.

Below this level, little price action exists to provide precise support. Near $1.0052, a large, inefficiently traded area on the monthly chart was also inefficiently traded on the weekly chart. This zone could provide sensitivity during a retest as bears take profits.

2. Maple (MPL)

Maple MPL is a decentralised corporate credit market offering borrowers transparent and efficient financing completed entirely on-chain. For liquidity providers, Maple offers a sustainable yield source through lending to diversified pools of crypto’s premium institutions. The Pool Delegates that manage these pools perform diligence and set terms with Borrowers. The protocol is governed by the Maple Token (MPL), which enables token holders to participate in governance, share in fee revenues, and stake insurance to Liquidity Pools.

MPL Price Analysis

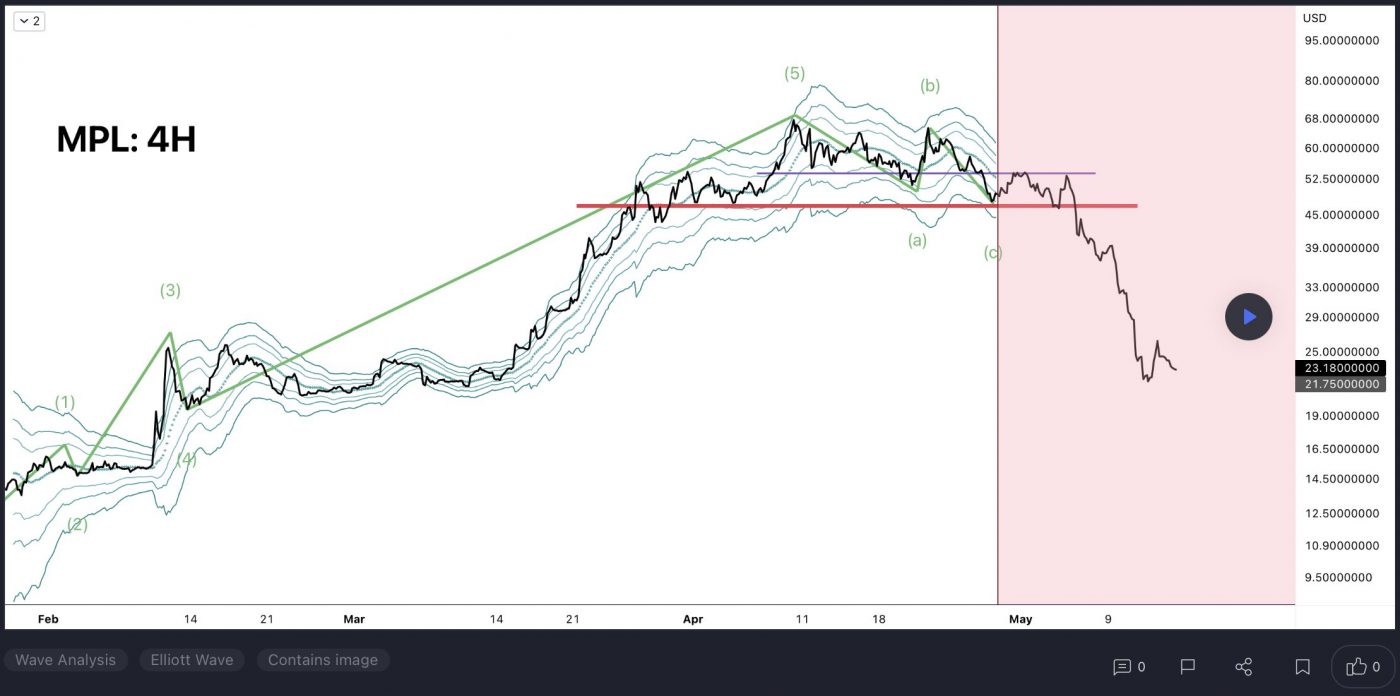

At the time of writing, MPL is ranked the 267th cryptocurrency globally and the current price is US$22.99. Let’s take a look at the chart below for price analysis:

MPL has retraced most of its 2022 rally, dropping nearly 70% into an area of old accumulation.

If the current early-week rally continues, $21.76 could provide support. This area formed a swing low on May 27 as the price created a triple-sweep formation, which sometimes suggests an incoming reversal.

Aggressive bulls buying at this level will need to be nimble since the closest resistance is just above, near $22.057. This area is inefficiently traded on the daily chart, contains the 9 EMA, and saw accumulation in March before the explosive run to all-time highs. A rally slightly higher might reach $23.64, near the recent consolidation range’s highs.

A much more significant rally could retest an area of inefficient trading on the weekly chart, near $42.28, or slightly higher where bears rejected bulls and May’s trading opened, around $53.01. A rally this high is unlikely until the overall market has a more bullish catalyst.

The price still has a significant distance to drop. The next closest support might exist near $19.76, near the top of an area of inefficient trading on the weekly chart.

Inefficient trading on the weekly chart and accumulation on the monthly chart near the 2022 yearly open, around $17.62, provides a stronger candidate for longer-term support.

3. PlayDapp (PLA)

PlayDapp PLA is an Ethereum token that powers PlayDapp, a blockchain gaming platform and NFT marketplace. PLA acts as the primary token for processing transactions on PlayDapp. Game developers can also receive PLA when users make in-game purchases. A digital asset is used within the PlayDapp Blockchain gaming ecosystem to purchase and trade NFT items within games and with the global C2C marketplace.

PLA Price Analysis

At the time of writing, PLA is ranked the 144th cryptocurrency globally and the current price is US$0.5492. Let’s take a look at the chart below for price analysis:

PLA dropped nearly 77% from its March high, forming a low in early May and retracing near the midpoint of its last impulsive move downward.

The price is testing possible resistance near $0.5422, where the 9 and 18 EMAs converge with an area of distribution on the daily chart.

If this level holds as resistance, aggressive bulls might watch $0.5320 as potential support. This area contains the recent lows and inefficient trading on the daily chart.

However, an old swing low and inefficient trading near $0.4629 has better odds of providing support for a more significant rally.

Below this region, exact support levels are ambiguous due to a lack of historical price action on exchange charts. An area between approximately $0.2500 and $0.2000 could provide support. Here, the price accumulated before a significant rally upward.

If the current resistance breaks, inefficient trading on the weekly chart and old swing lows near $0.6292 might act as a stronger resistance. A rally this high could poke slightly above, near $0.7010, where the monthly chart shows the low end of the range where October’s rally began.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.