Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Quant (QNT)

Quant QNT launched with the goal of connecting blockchains and networks on a global scale, without reducing the efficiency and interoperability of the network. It is the first project to solve the interoperability problem through the creation of the first blockchain operating system. The main aim of Quant – using Overledger – is to bridge the gap that exists between different blockchains. The backbone of the project is the Overledger network, which Quant bills as the ecosystem on which the future digital economy ecosystem will be built.

QNT Price Analysis

At the time of writing, QNT is ranked the 43rd cryptocurrency globally and the current price is US$127.72. Let’s take a look at the chart below for price analysis:

Q3 marked a turning point for QNT, with the price gaining almost 65% from its lows to probable resistance beginning near $140.30.

The price is currently struggling with the area between $128.80 and $110.33. This region could provide support after a close above, or resistance after a close below.

A retracement could reach into the daily gap and possible support around $105.41. A more bearish shift in the marketplace will likely aim for the relatively equal lows near $97.65, and the potential support just below that begins around $90.34.

Continuation to the upside will likely target the monthly high near $136.19. However, probable resistance beginning at $150.77 and $162.30 could cap or slow down this move.

2. Decentraland (MANA)

Decentraland MANA defines itself as a virtual reality platform powered by the Ethereum blockchain that allows users to create, experience, and monetise content and applications. In this virtual world, users purchase plots of land that they can later navigate, build on and monetise. Decentraland uses two tokens: MANA and LAND. MANA is an ERC-20 token that must be burned to acquire non-fungible ERC-721 LAND tokens. MANA tokens can also be used to pay for a range of avatars, wearables, names and more on the Decentraland marketplace.

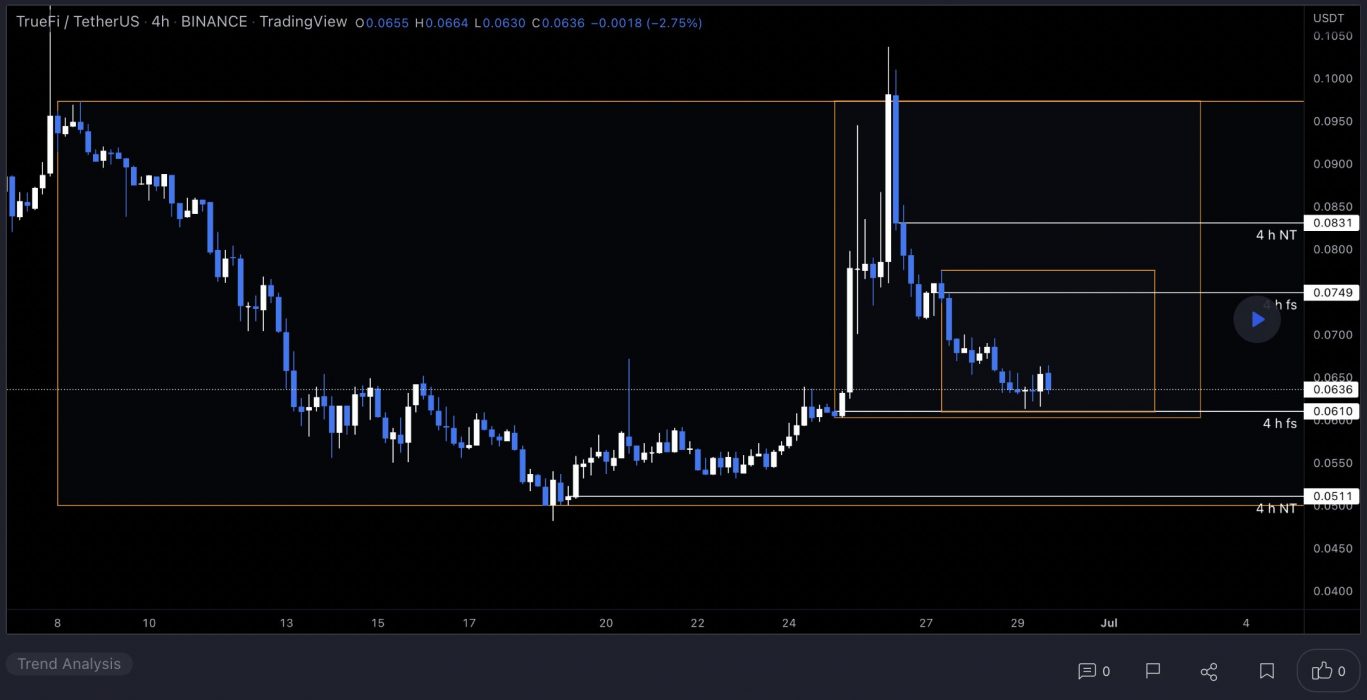

MANA Price Analysis

At the time of writing, MANA is ranked the 36th cryptocurrency globally and the current price is US$1.07. Let’s take a look at the chart below for price analysis:

MANA dropped 80% from Q1 to Q2 and made a low near $0.7800. It has consolidated above this low since June.

The price may find support between $0.9508 and $0.9037. This level saw accumulation on July 17, contains the 9 and 18 EMAs, and borders the July monthly open.

A deeper retracement could reach near $0.8790. A drop to this level would rebalance more inefficient trading on the daily chart. It could also run bulls’ stops below today’s opening price and July 16’s swing low.

The price is testing the closest resistance, at $1.18. Bears entered shorts here before last week’s drop. It’s also near the 40 EMA.

If this resistance breaks, $1.25 to $1.32 may provide the next resistance. This area is between the 61.8% and 78.6% retracement of the last month’s downtrend. Bulls also rejected bulls here in late June on the weekly chart.

A more significant rally might reach an area of inefficient trading on the monthly chart from $1.36 to $1.40. This move would sweep most bears’ trailed stops above relative equal highs up to this level. Yet, bulls aiming for this level may want to be cautious since the overall trend is still bearish.

3. PancakeSwap (CAKE)

PancakeSwap CAKE is an automated market maker (AMM) – a decentralised finance (DeFi) application that allows users to exchange tokens, providing liquidity via farming and earning fees in return. PancakeSwap uses an automated market maker model where users trade against a liquidity pool. These pools are filled by users who deposit their funds into the pool and receive liquidity provider (LP) tokens in return. PancakeSwap allows users to trade BEP20 tokens, provide liquidity to the exchange and earn fees, stake LP tokens to earn CAKE, stake CAKE to earn more CAKE, and stake CAKE to earn tokens of other projects.

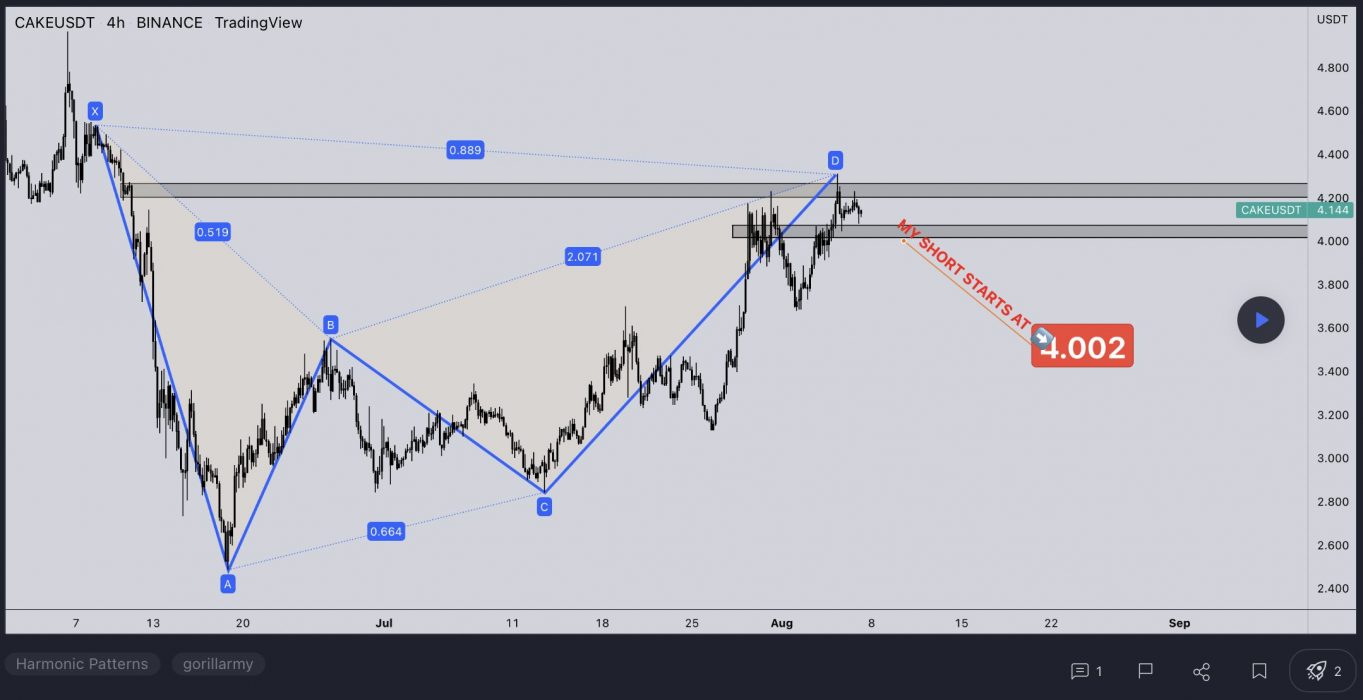

CAKE Price Analysis

At the time of writing, CAKE is ranked the 72nd cryptocurrency globally and the current price is US$4.40. Let’s take a look at the chart below for price analysis:

CAKE‘s 80% decline after Q2 created relatively equal lows near $3.05 before bouncing over the local range’s midpoint near $4.60. A bullish altcoin market could help CAKE bulls regain a stronger bullish trend.

Aggressive bulls could look for entries in the daily gap starting near $4.30. The monthly open aligns with more probable support near $3.22.

A stop run below the monthly open near $3.15 might provide a more favourable entry. A more substantial bearish move – perhaps from a sharp drop in Bitcoin’s price – could challenge support near $3.00, just above the equal lows.

Resistance rests just above, with the zone from $4.75 to $4.90 likely to provide a short-term ceiling. A break through this level may target resistance just under the cluster of relatively equal highs near $5.12.

Beyond these highs, resistance near $5.28 provides a final challenge before attacking an old daily swing high near $5.43.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.