The XRP community is crossing its fingers, as the pretrial conference started this morning against the Securities and Exchange Commission —SEC—.

Brad Garlinghouse and Chris Larsen are all set to defend their company. Both hired three lawyers who were exposing and defending today their evidence and arguments against the SEC.

Did the SEC warn Exchanges about XRP status?

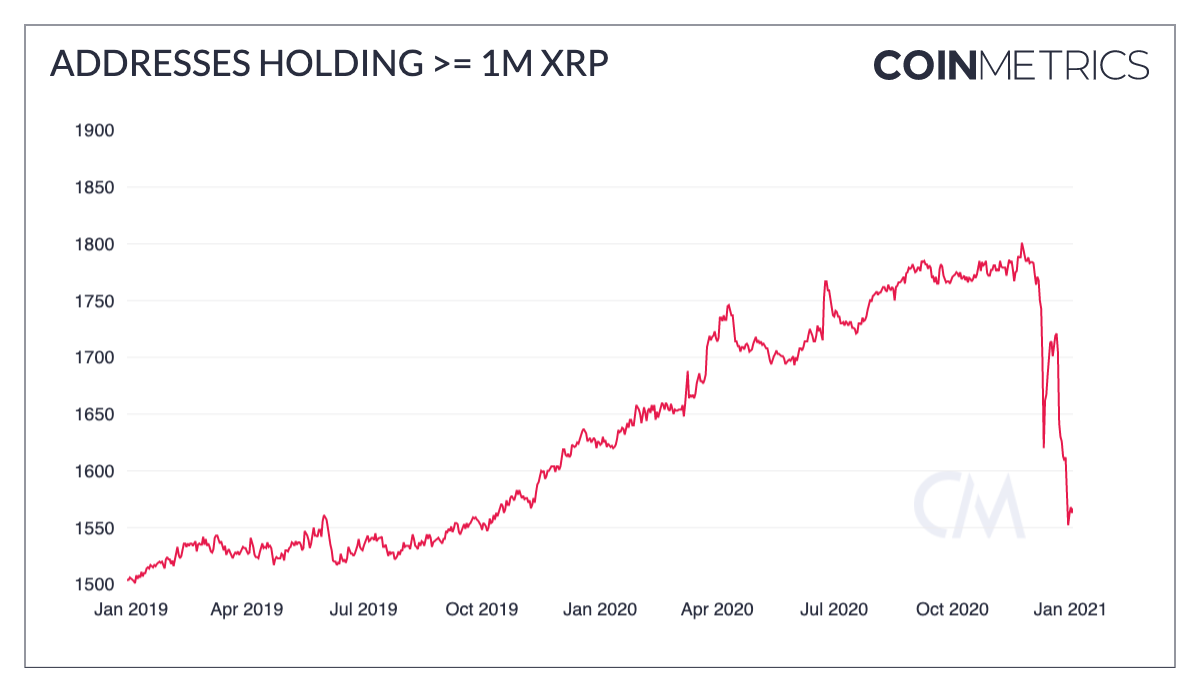

As the pre-trial developed, Ripple’s lawyer, Matthew Solomon, highlighted how the SEC dismissed exchanges and other market actors about selling XRP as a security, instead of a cryptocurrency.

According to Solomon, since 2019 the SEC never stated that exchanges and brokerages could not sell XRP, and never declared the currency’s status —whether it was a security or an investment contract.

We’ve already taken some discovery on the Securities and Exchange Commission, which revealed that the Securities and Exchange Commission was having discussions with ultra-sophisticated market actors, including exchanges, and not, apparently, telling those actors that it believed XRP was security or an investment contract as late as 2019. And, again, as this case moves forward, these facts will come to light, and it will be clear that XRP cannot establish and will not establish that XRP is a security.

Stated Solomon in the conference

Likewise, Jeremy Hogan laid down how Ripple can turn the tables against the SEC with these statements. The fundamental here is that the SEC never told exchanges and other platforms that XRP could not be sold — so the main question that the crypto-community is asking is: what is different from 2019 to 2020?

Just hours before the pre-trial, XRP surged over 5%, and keeping a steady price level between $0.52 and $0.58, after it suffered extreme swing prices yesterday.