Amid Vladimir Putin’s invasion of Ukraine, the US and EU have announced a plan to isolate Russia from the international financial system, including blocking some banks from the Society for Worldwide Interbank Financial Telecommunications (SWIFT), the messaging networking underpinning global finance.

What is SWIFT and Why Does It Matter?

SWIFT is a global cooperative of financial institutions formed in 1973 when 239 banks from 15 countries came together to establish a way to handle cross-border payments. Today, SWIFT connects more than 11,000 financial institutions across more than 200 countries.

Best understood as a simple email system that enables secure messages across its members, SWIFT facilitates an average of 40 million messages a day including orders, payment confirmations, FX exchanges, and trades. Importantly, SWIFT doesn’t actually do any transfers or holding of funds, but it’s a critical part of the communication infrastructure that enables cross-border money flows. Think of it as a vital part of the global financial system’s plumbing.

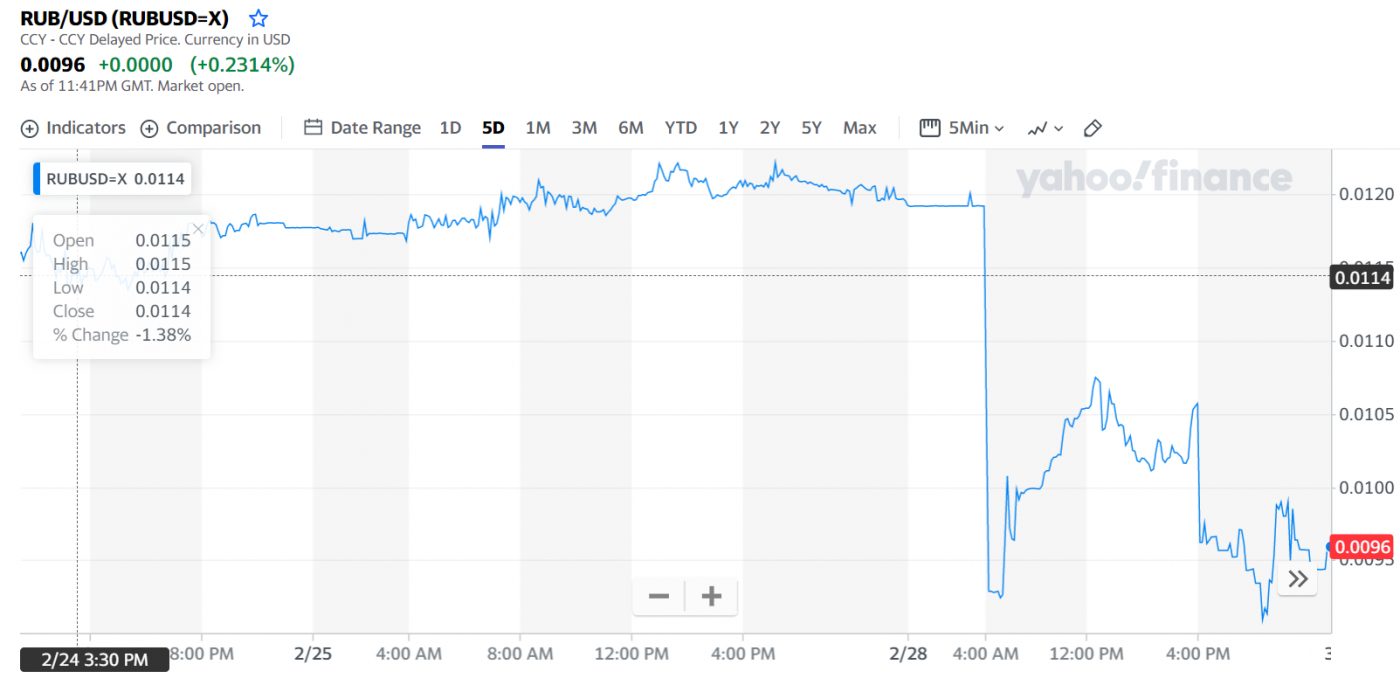

Consequences of Being Cut Off SWIFT

While SWIFT isn’t a political organisation, it has often been used as a geopolitical tool as part of sanction packages. Cutting Russia out from the SWIFT system would prevent its access to some US$630 billion in central bank reserves and dramatically impact its ability to conduct global trade. This was highlighted by the EU Commission:

Cutting off Russia from SWIFT is, however, a genuine double-edged sword. The Federation remains a key energy producer for much of Europe and further abroad. It is therefore anticipated that sanctions would not apply to its energy sector.

At this point, it isn’t clear how this will play out. However, it is something Russia has no doubt long foreseen, given that it has been building an in-house system since 2014 specifically to handle situations like this.

Crypto to Get Around Swift

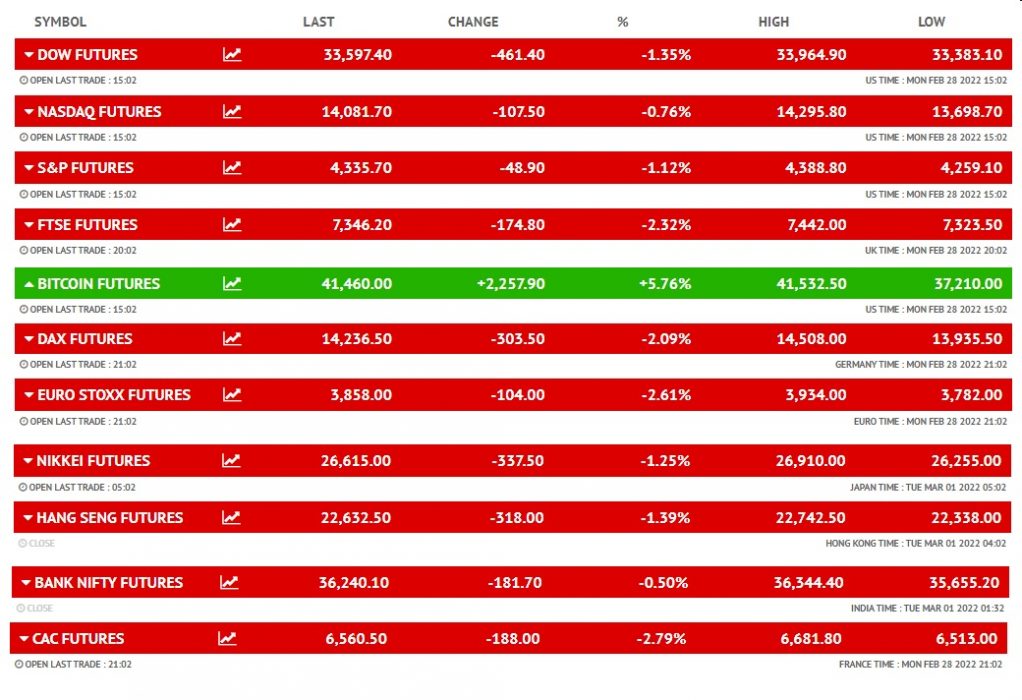

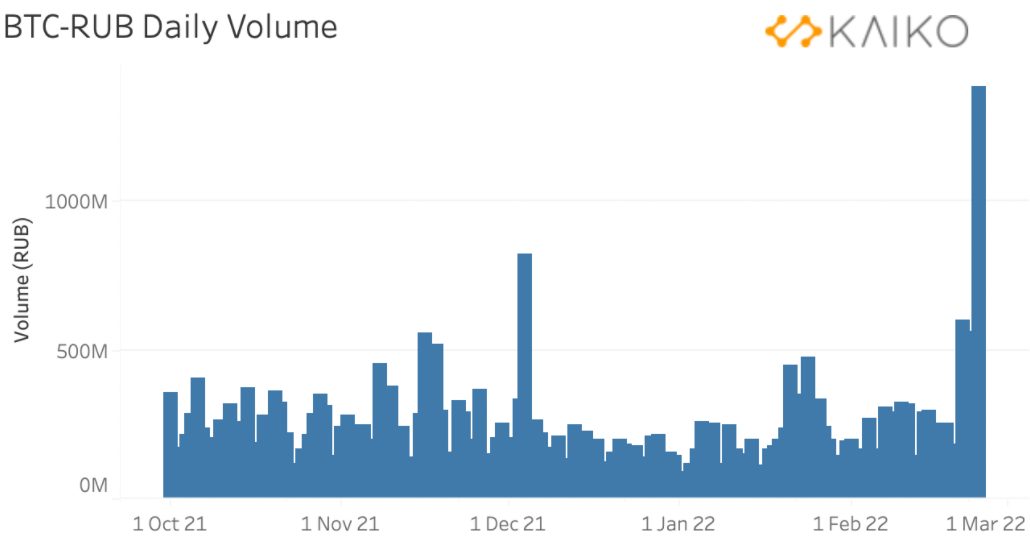

While nothing has been confirmed as yet, it’s self-evident that unlike SWIFT, cryptocurrencies are incapable of censorship, making them a perfect vehicle for circumventing sanctions.

The caveat, of course, is that they would need to be genuinely decentralised. For example, if the US discovered ETH was being used to circumvent sanctions, what are the chances of the Ethereum Foundation getting a call asking for Chainalysis-identified addresses to be banned?

Recognising the danger of decentralised digital assets, the European Central Bank has started moving at lightning speed to get its crypto regulatory framework in place:

In the end, it’s worth remembering that crypto is apolitical and neutral. Like knives, electricity, the internet or fists, it can be used by good and bad actors alike. Even though Cuba and North Korea have both used crypto to get around sanctions, it’s best to view assets such as Bitcoin as a neutral technology.

How this saga plays out, and whether this marks the beginning of the end for US dollar hegemony, remains to be seen.