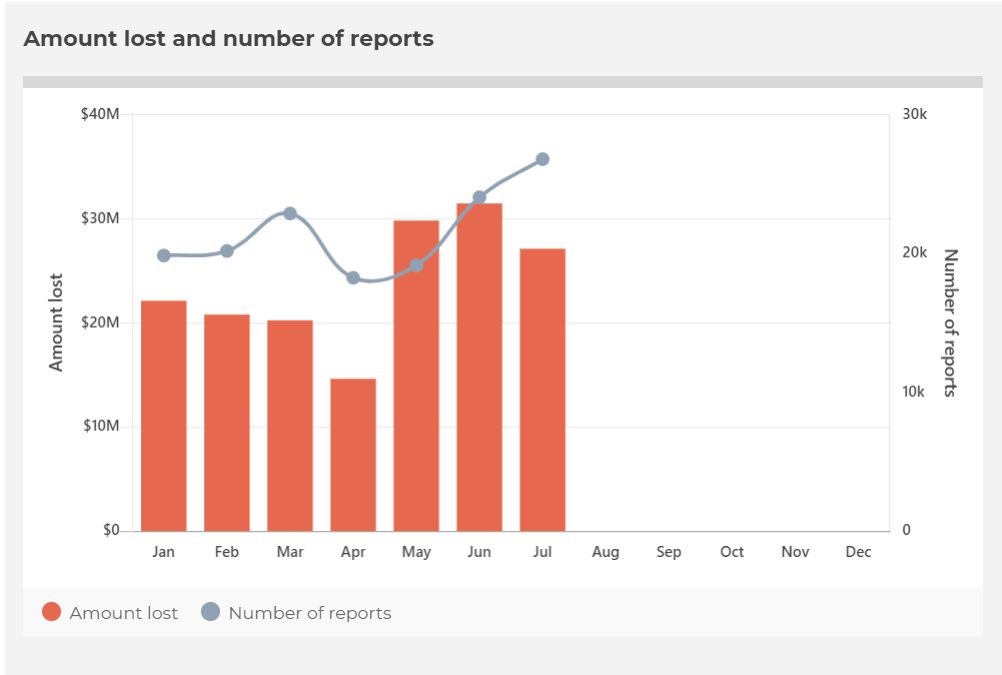

Americans are increasingly falling into the tender trap of online romance scams, backed by figures for the first half of 2021. From January 1 to July 31, the FBI logged over 1,800 complaints related to romantic deceptions resulting in personal losses of approximately US$133,400,000, much of it in cryptocurrency.

Nationwide in 2020, only 23,768 complaints categorised as romance scams were reported to the FBI, though even that figure was 4,295 higher than the previous year. The obvious exponential increase in complaints in a mere six-month period has spurred the FBI into publishing a guide for potential victims to guard against the practice.

The scammer’s initial contact is typically made via dating apps and other social media sites, the FBI warns. Having gained the victim’s trust via the cultivation of an online relationship, the scammer may then claim inside knowledge of lucrative cryptocurrency investment or trading opportunities on the pretext of “building a future together”.

The scammer next directs the victim to a fraudulent website or investment application. The victim invests on the platform and returns a small profit predetermined by the scammer.

Hook, Line, Lure and Sinker

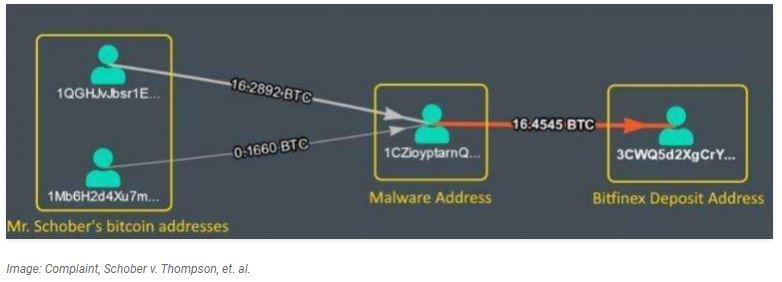

This practice invariably escalates to larger amounts of money as the scammer presses for urgency. When the victim is ready to withdraw funds again, the scammer invents reasons why this cannot happen. Additional taxes or fees need to be paid, or the minimum account balance has not been met to allow a withdrawal.

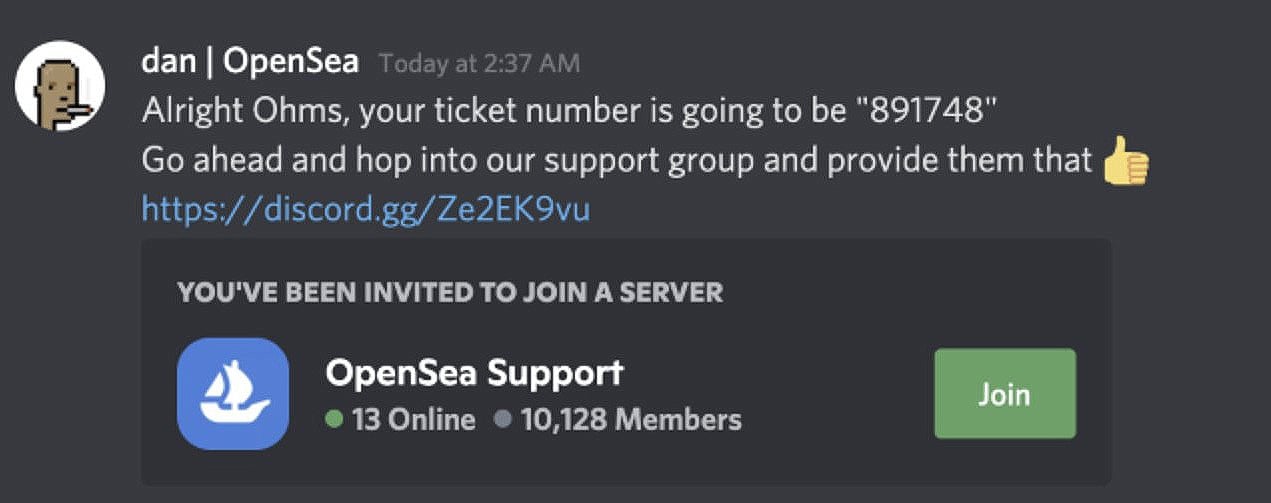

This usually encourages the victim to provide additional funds. Sometimes, a “customer service group” gets involved, also part of the scam. Victims are soon unable to withdraw any money at all, and the scammer(s) most often cut off contact with the victim and are never heard from again.

Tips to Prevent Online Eclipses of the Heart (and Wallet)

While many of these cautionary recommendations are No-Brainers 101, it may pay to keep them in mind:

- Never send money, trade, or invest per the advice of someone you have solely met online.

- Do not disclose your current financial status to unknown and untrusted individuals.

- Do not provide your banking information, Medicare number, copies of your identification or passport, or any other sensitive information to anyone online or to a site you do not know for sure is legitimate.

- If an online investment or trading site is promoting profits too good to be true, it’s most likely they’re false.

- Be cautious of individuals who claim to have exclusive investment opportunities and urge you to act fast.

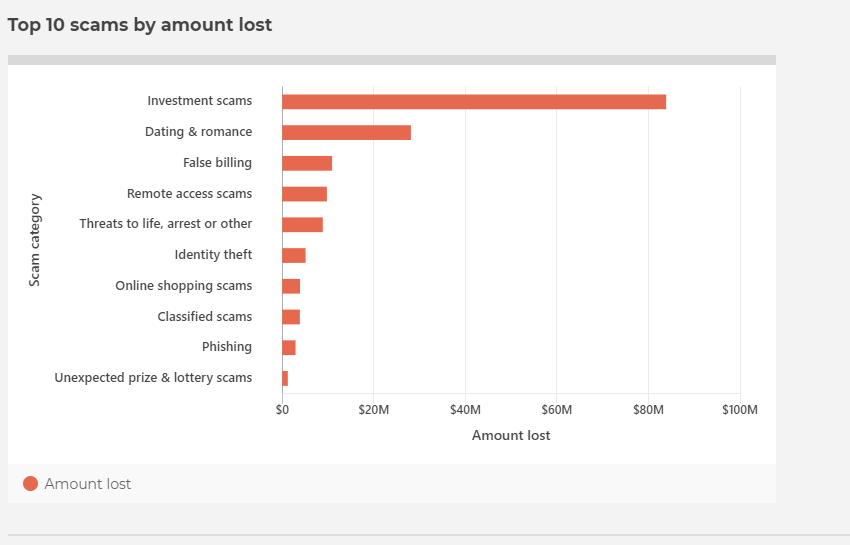

Like Americans, Australians are losing record amounts to scams of various kinds. According to an August report from the Australian Competition and Consumer Commission, Aussies lost over A$70 million during the first half of this year and more than half of that number was attributed to cryptocurrency investment scams. The top crypto-related scams in Australia, according to the report, were investment scams, followed by romance scams and personal identity mining.