The Luna Foundation Guard (LFG) was recently formed to support decentralisation, economic sovereignty, and growth of the Terra ecosystem. Now, in an unexpected turn, it has announced that it has successfully raised US$1 billion to acquire bitcoin to underpin its decentralised stablecoin, UST:

A Move to Restore ‘Peg Parity’

TerraUSD (UST) is a decentralised and algorithmic stablecoin of the Terra blockchain, pegged to the US Dollar. In contrast to centralised stablecoins such as Tether and USDC, algorithmic alternatives do not use collateral to maintain their price. Instead, they maintain their peg by relying on complex market incentives, which LFG describes as follows:

As an algorithmic stablecoin, UST’s peg is maintained by a series of open market operations, arbitrage incentives, and countercyclical levers within the Terra protocol to offset market forces pushing the UST peg above or below one USD. LUNA, Terra’s reserve, staking, and governance asset, retains an elastic supply to help neutralise directional market pressures impacting the peg.

LFG Foundation announcement

One of the common criticisms of algorithmic stablecoins is their reflexive nature during extreme volatility, where the arbitrage incentives to bring the peg back to parity can potentially deteriorate. With the LFG announcement, the bitcoin will serve to provide an additional avenue to maintain the stability of the peg in contractionary cycles that reduces the reflexivity of the system. As LFG noted:

The reserve assets can be utilised in instances where protracted market sell-offs deter buyers from restoring the UST peg’s parity and deteriorate the Terra protocol’s open market arbitrage incentives.

LFG Foundation announcement

LFG added that while initial plans were to acquire bitcoin, it would “expand to other major non-correlated assets within the market moving forward”.

Mixed Reactions, of Course

The announcement was met with both excitement and derision, a feature expected of noisy social media platforms such as Twitter:

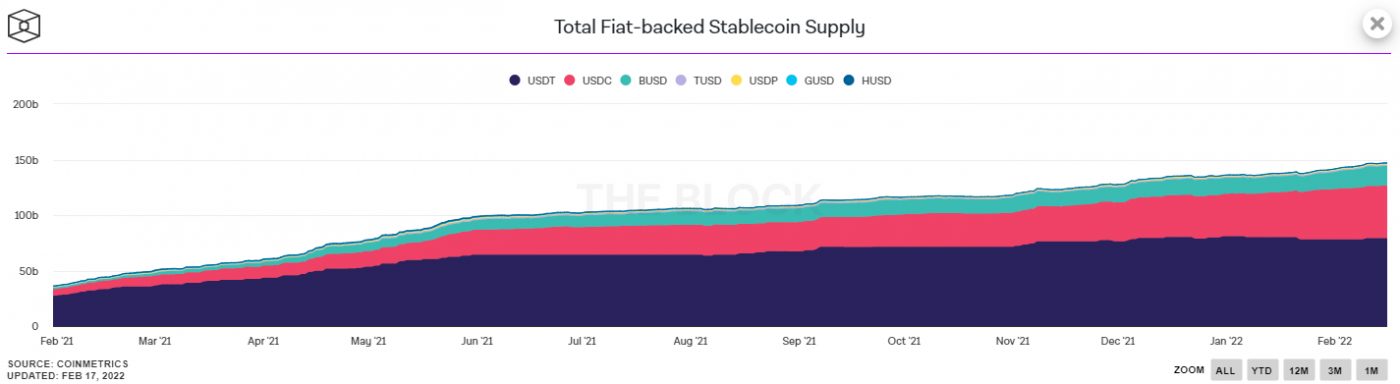

Given the increased scrutiny on stablecoins in the US in particular, and the willingness of issuers to censor addresses on request, the demand for decentralised stablecoins is self-evident.

It remains, however, to be seen whether LFG’s strategy will foster greater trust in UST. Initial signs are positive, but it is probably too soon to tell.