Unsurprisingly, the UST depegging fiasco has triggered regulators around the world to accelerate their efforts. While some persist in being hostile towards any regulation, others have expected it from the outset:

Regulators Seize the Opportunity Amid LUNA Debacle

When history is written, this past week may well be regarded as a watershed moment for the crypto sector as LUNA plunged 97 percent overnight.

To illustrate the extent of the carnage, consider that LUNA plummeted from an all-time high of US$119 in April to US$0.000143 at the time of writing. In addition, its sister not-so-stablecoin UST has completely depegged from the US dollar since May 9, currently trading at US$0.0901.

The LUNA collapse alone saw US$50 billion in market capitalisation erased in a week, leading crypto-sceptic regulators around the world to seize the opportunity to capture the narrative.

Regulations Incoming

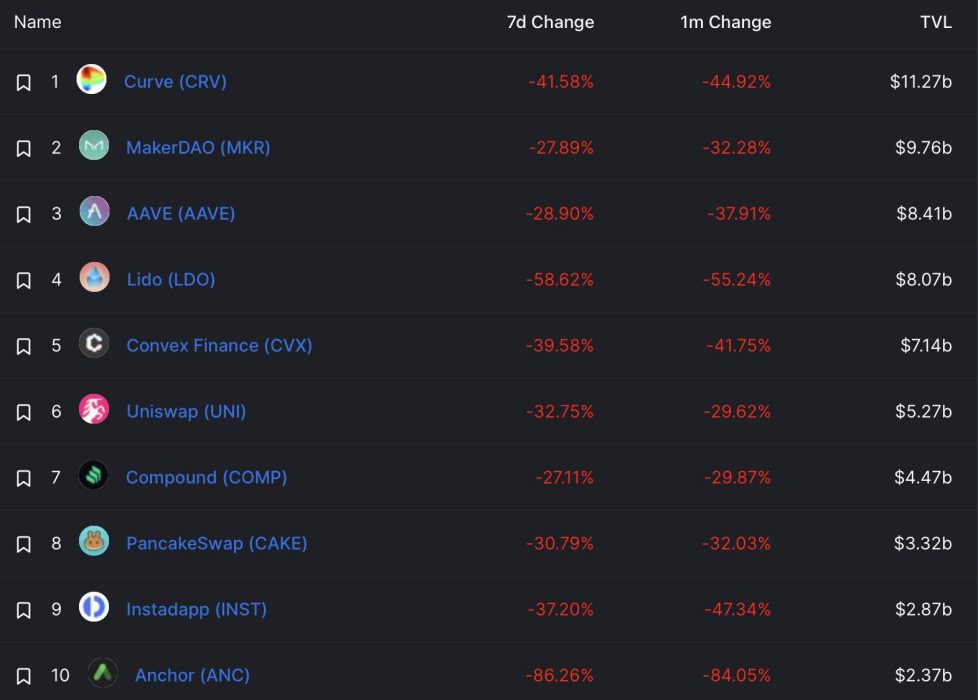

With the market down US$500 billion in the past two weeks and with UST completely depegging from the US dollar, regulators’ initial focus has been on stablecoins.

In addition, crypto regulation has been placed on the agenda for the upcoming G7 summit in Germany, with French central banker Francois Villeroy de Galhau commenting:

What happened in the recent past [UST meltdown] is a wake-up call for the urgent need for global regulation.

Francois Villeroy de Galhau, governor, Bank of France

In the US, Securities and Exchange Commission chair Gary Gensler said on May 16 that “a lot [needs] to be done here, and in the meantime, the investing public is not that well-protected”, adding: “We’re going to continue to be a cop on the beat.”

Treasury secretary Janet Yellen also told told lawmakers last week that UST’s fate underscored the need for bank-like regulations to be imposed on stablecoin issuers. An anonymous official familiar with the matter added: “In the absence of congressional action, last week’s volatility will put regulators and stakeholders on a stronger footing if they feel the need to act alone to mitigate the risks.”

Shortly after, a non-partisan report by the Congressional Research Service echoed Washington’s sentiments, arguing that the stablecoin industry lacks the regulations found in traditional finance systems to safeguard investors. The overarching theme of the policy recommendations relates to transparency and disclosure.

Separating the Wheat from the Chaff

While regulation is not welcome by many, it appears all but inevitable that it will play an increased role going forward. It’s difficult to envision how a parallel system (ie, crypto) with little to no disclosure obligations can persist for long.

As exchanges like Coinbase face class action lawsuits for selling “unregistered securities”, it’s likely that most cryptocurrencies will find themselves falling within the parameters of increased regulation.

Not everyone is concerned, however, as Bitcoiners like Michael Saylor believe that everything outside of Bitcoin is an unregistered security.