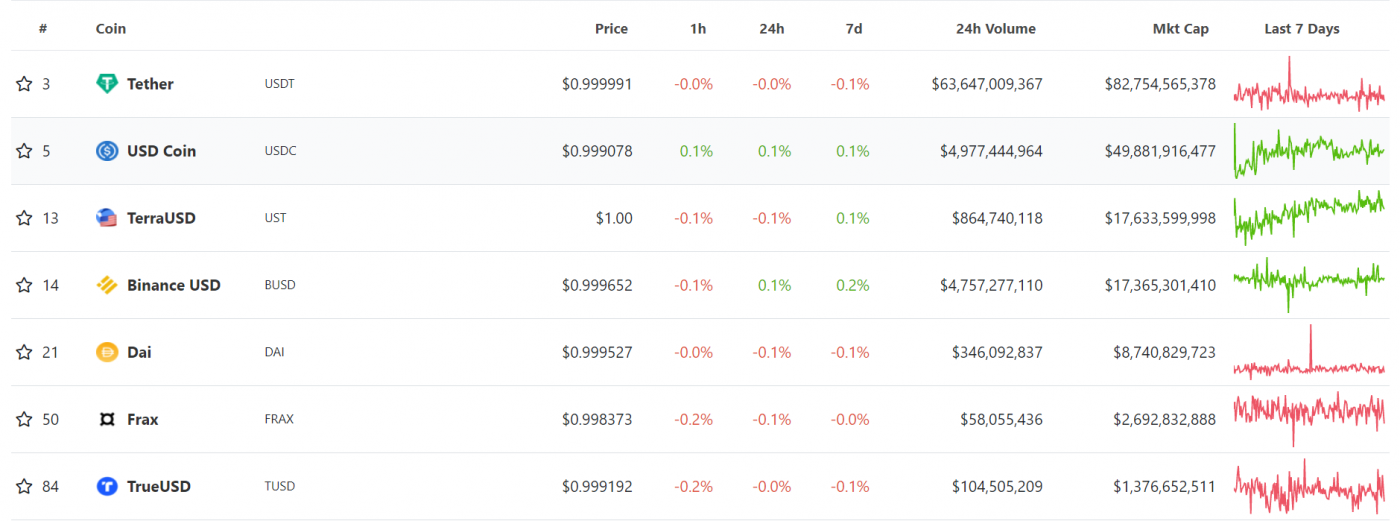

Terra USD (UST), the world’s largest and most controversial algorithmic stablecoin, lost its peg to the US dollar this past weekend which has continued into the week, causing LUNA to tumble by as much as 56 percent in a day.

UST Tokenomics Explained

UST relies on LUNA to keep its price pegged to the US dollar via a set of on-chain mint and burn mechanisms. In brief, it works as follows:

Terra maintains UST’s peg of USD through an elastic monetary policy enabled by its dual, UST-LUNA token model. When the value of a unit of UST is above the USD peg, users are incentivised to burn LUNA and mint UST. When the value of a unit of UST is below the USD peg, users are incentivised to burn UST and mint LUNA. During times of UST contraction, LUNA valuation decreases, and during times of expansion, it increases. LUNA is the variable counterpart to UST. By modulating supply, LUNA’s valuation increases as the demand for UST increases.

Terra burn/mint mechanism, Messar

What Happened?

The de-pegging appeared to commence shortly after a series of significant withdrawals on the Anchor Protocol, a lending market offering high yields to users who deposit UST:

Over the period, Anchor’s total UST deposits reduced by 17 percent from US$14 billion down to US$11.2 billion:

Oops, 2 billion of Anchor #UST deposits are gone (?) within a day. Panic time? pic.twitter.com/ncLzMov80E

— Defi Butt ⟠ (@defi_butt) May 8, 2022

In addition, a large amount of UST was also withdrawn from Curve, a decentralised finance (DeFi) protocol allowing users to swap between stablecoins. There was also evidence of a single wallet dumping US$85 million of UST on ETH and US$108 million on Binance:

The initial depeg was seemingly defended by Jump Capital, who earlier this year bailed out victims of the US$320 million Wormhole exploit. However it didn’t stop there as overnight, UST’s peg continued its freefall, reaching as low as 0.73 to the US dollar on Binance at the time of publication.

In response, the Luna Foundation Guard has deployed some of its BTC and UST reserves, although it claims that it hasn’t been sold but rather lent to market makers:

There are a lot of moving parts to this story and the saga is clearly far from over. We’re seeing UST undergo a massive crisis of confidence and at this stage it’s too soon to tell whether it will recover. Current signs are ominous and if UST fails, it’s likely to spread contagion throughout the broader stablecoin market.