NFT lending protocol BendDAO is facing the serious prospect of insolvency as the amount of Wrapped Ether (wETH) remaining in its smart contract dwindles to just a fraction of what is owed to lenders.

According to Twitter user and NFT market researcher NFTStatistics.eth, as of August 22 BendDAO only had 12.5 wETH while it still owned lenders an estimated 15,000 ETH – quite the shortfall:

This precarious situation has arisen partly because of a crash in the value of many leading NFT collections, including Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC).

BendDAO’s Model Based on NFT Value

BendDAO is a DeFi platform that allows users to borrow ETH using ostensibly ‘blue chip’ NFTs, such as BAYC, as collateral. The ETH that NFT owners borrow comes from other users who have deposited their ETH to the platform as a way to earn interest on their holdings. It’s these lenders who are at risk of being left holding the bag.

On paper, BendDAO’s model seems risky and, as it turns out, it is. The lender launched last year while the NFT market was particularly exuberant but the market has since taken a nosedive, exposing just how vulnerable this model is to market volatility.

What’s Happening Now?

BendDAO is trying to boost its ETH reserves by adjusting the rate of interest charged to borrowers and paid to lenders.

Statistics from the BendDAO website show that ETH borrowers are now required to pay over 100 percent interest on their loans (this is partially offset by 15.88 percent rewards paid in BendDAO’s own BEND token).

Lenders are being offered a whopping annual rate of 66.9 percent on their ETH and a further 4.99 percent reward paid in BEND. Due to these high interest rates, borrowers’ levels of debt grow ever larger as the value of their collateral continues to fall.

What Next For BendDAO?

NFTStatistics.eth points out that most of the NFTs on BendDAO that have defaulted and gone to auction currently have no bids, citing two key factors:

- BendDAO requires bids to be greater than the level of debt owed by the borrower and greater than 95 percent of the NFT’s OpenSea floor price; and

- Bidders are required to lockup their ETH for 48 hours.

NFTStatistics.eth also notes that as borrowers accrue more debt and NFT floor prices continue to fall, we’ll see many more NFTs default:

7) There are a lot more NFTs about to default & come to auction, either due to debt rising w these sky-high interest rates or OpenSea floor falling. See link. https://t.co/381dbEwuVw

— NFTStatistics.eth (@punk9059) August 21, 2022

(5/9)

Further according to NFTStatistics.eth, since none of the NFTs is selling, they’re not affecting the broader NFT market – but eventually they will need to sell, perhaps at a large discount, so that BendDAO can start to acquire ETH with which to pay back its lenders. If the NFTs are sold heavily discounted, we could see the prices of many NFT collections fall much further.

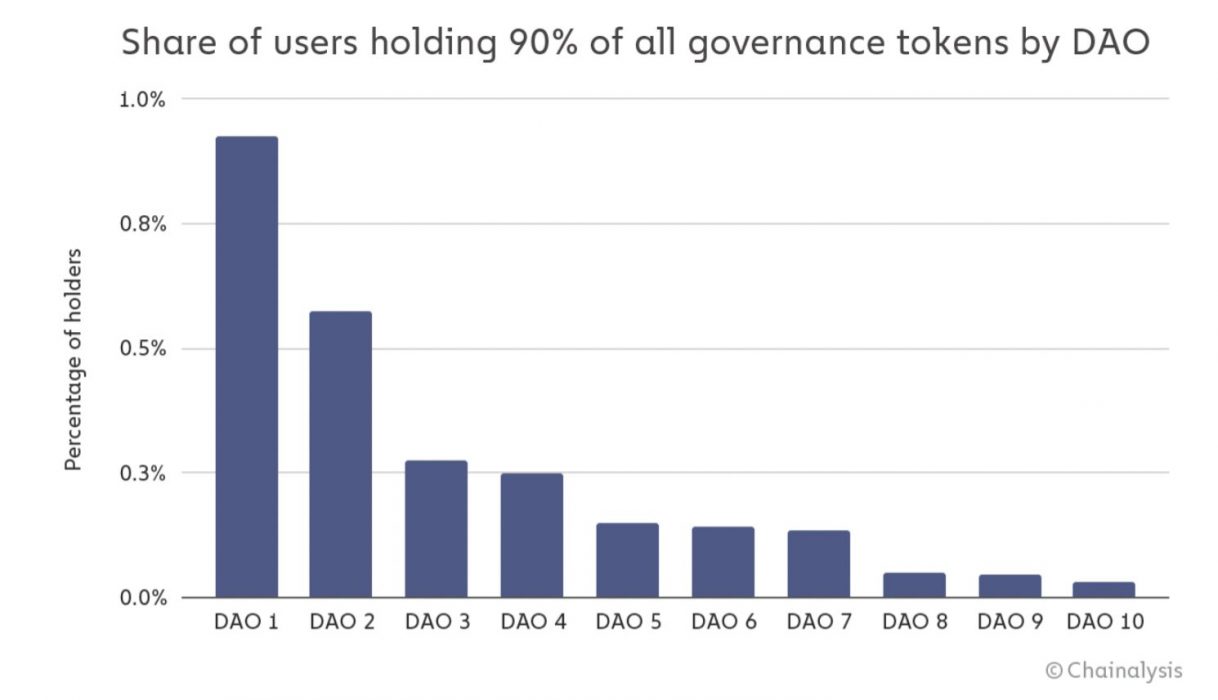

Decentralised Autonomous Organisations (DAOs), such as BendDAO, have been seen by crypto enthusiasts as a way to decentralise power and flatten organisational hierarchies, however recent research by Chainalysis has found that across 10 major DAO projects, one percent of token holders control 90 percent of voting rights.