Despite its disclosing the composition of its reserves last year, some continue in the belief that Tether, the company behind USDT stablecoin, is built on a house of cards. Will its latest disclosure finally put an end to that discussion? If history is anything to go by, probably not.

Tether Has Not Always Been Keen to Open its Books

With a market capitalisation (market cap) just shy of US$80 billion, USDT remains around 50 percent larger than its closest rival, USDC, with a market cap of US$52.6 million.

Tether has historically been notoriously shy about disclosing its reserves, citing “harm to its competitive position”, and perhaps this is warranted, given that USDC’s supply is growing faster than USDT.

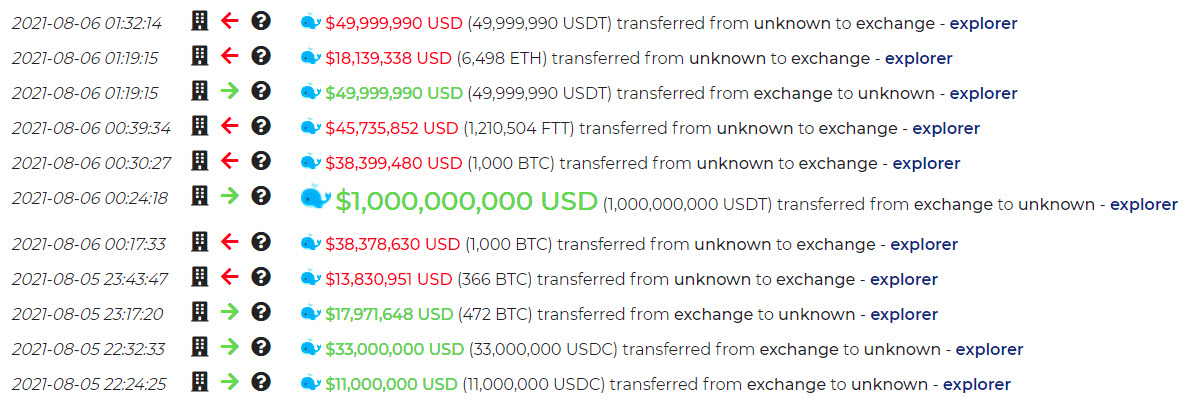

Notwithstanding, the general lack of transparency and willingness to disclose its reserves has seemingly perpetuated the view held by some, that Tether is a fraud and its “reserves” serve only to artificially prop up the broader crypto market.

Tether ‘Assurance Opinion’ Reveals Assets Exceed Liabilities

However, as per its latest disclosure, Tether has revealed that in fact its assets exceed its liabilities. The disclosure notes a 21 percent decrease in its commercial paper holdings over the prior quarter, and that the attestation, completed by MHA Cayman, affirms that as of December 31, 2021, Tether’s assets were broken down as follows:

- consolidated total assets amount to at least US$78,675,642,677;

- consolidated total liabilities amount to US$78,538,305,451, of which US$78,480,852,949 relates to digital tokens issued.

The report added that the breakdown “demonstrates that the group’s reserves held for its digital tokens issued exceeds the amount required to redeem the digital tokens issued”.

Tether CTO Paolo Ardoino highlighted Tether’s role in the broader crypto economy, citing its transparency and reliability:

We are committed to serving the fast-growing cryptocurrency market as the strongest stable asset in the Web3 economy. The utility of Tether has grown beyond being just a tool for quickly moving in and out of trading positions, and so it is mission critical for us to scale alongside the peer-to-peer and payments markets. To serve these new retail and institutional customers, Tether will continue to be the leader amongst its peers when it comes to transparency and reliability.

Paolo Ardoino, Tether CTO

Twitter Isn’t Buying It

In predictable fashion, the so-called “Tether Truthers” came out in force, decrying the “attestation”:

Why Tether has elected to go for an “assurance opinion” over an audit remains unclear. Is it protecting its competitive position by disclosing as little as possible, or is something else going on? We can’t know for sure, and so the Tether saga is no doubt going to continue for the foreseeable future.