Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

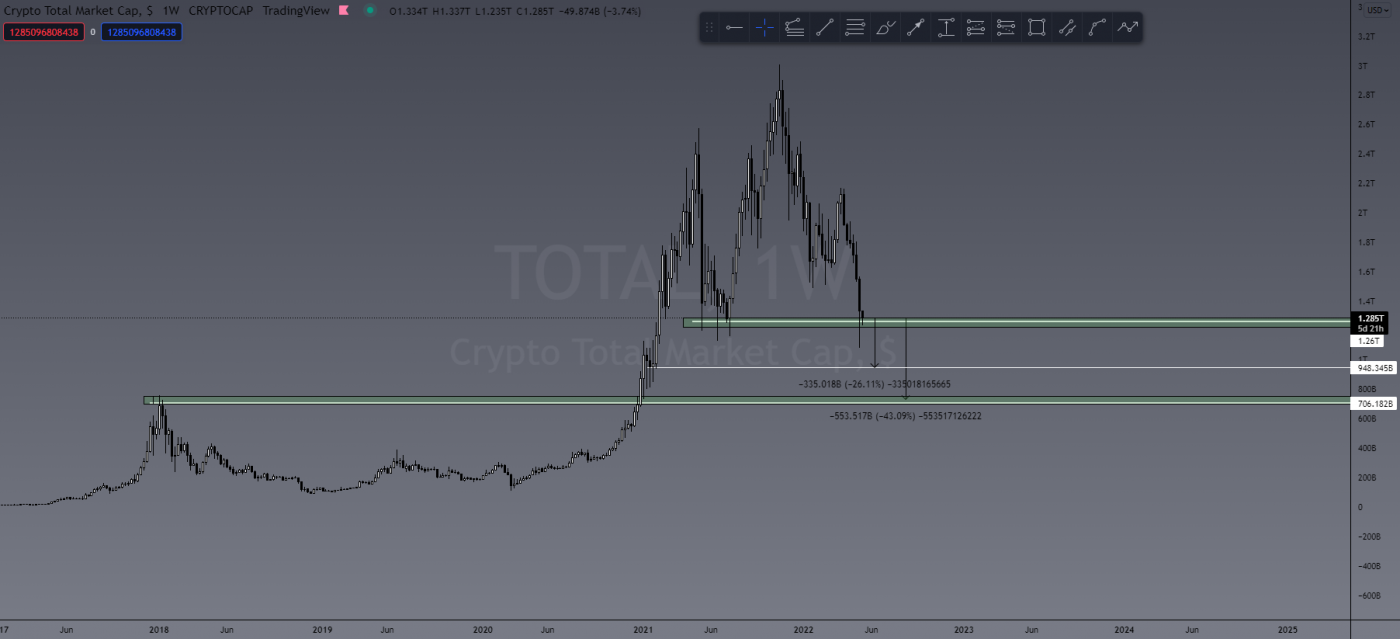

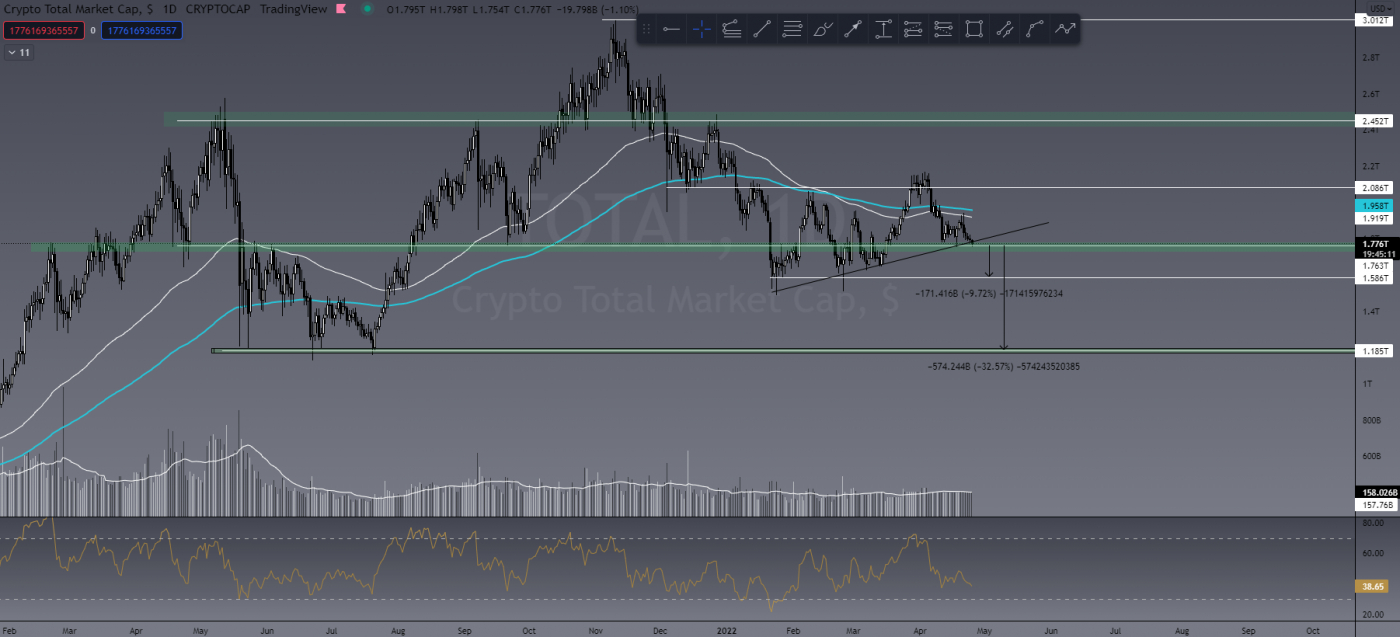

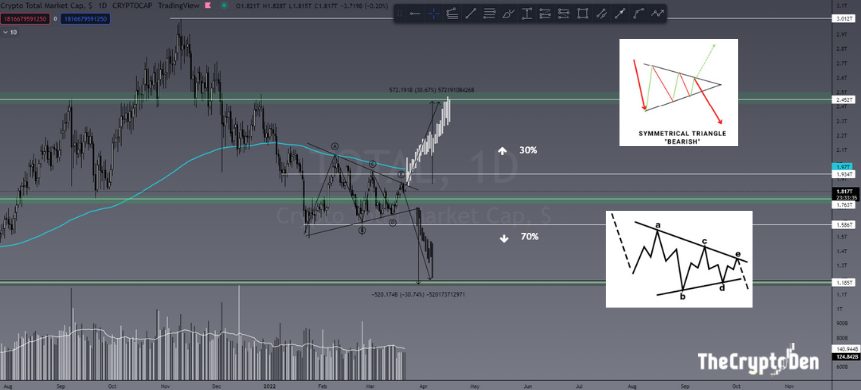

The total crypto cap doesn’t look very strong, hovering around US$900 billion, which is 70% down from its peak in November last year. It’s now been two weeks since we dropped below the US$1 trillion mark and I’m seeing no sign of strength yet. I anticipate a drop to around US$750 billion this week, which will bring the crypto market to its knees.

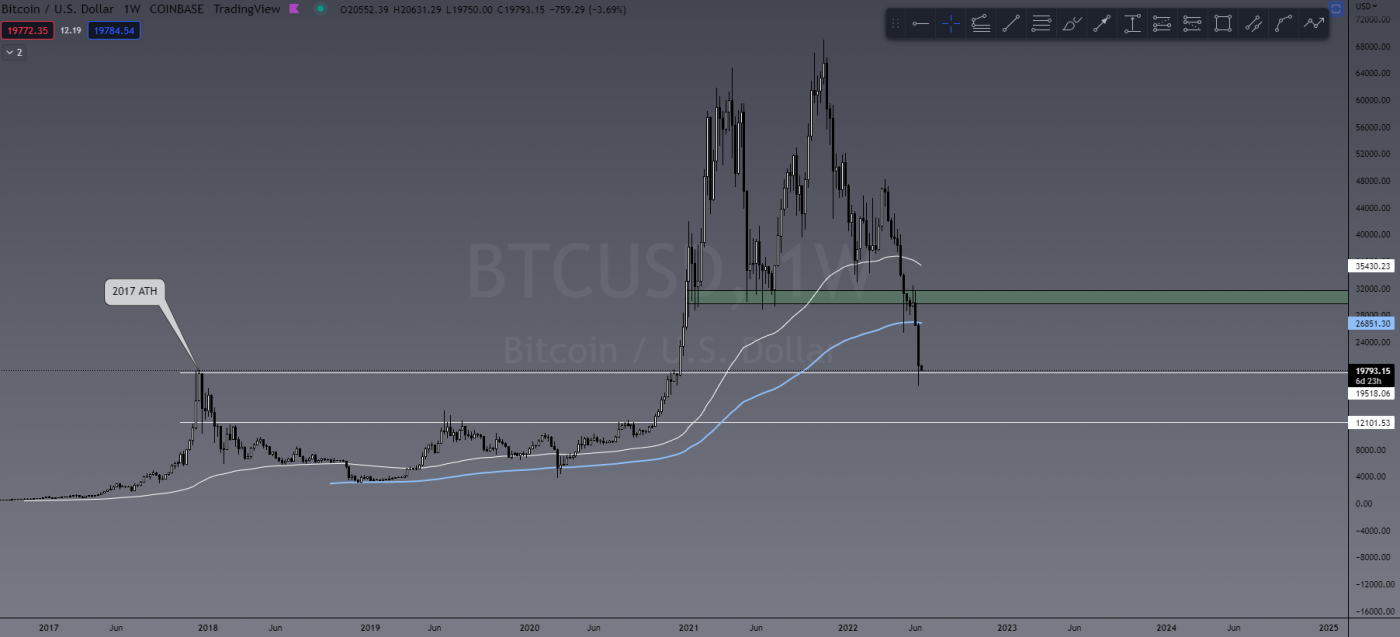

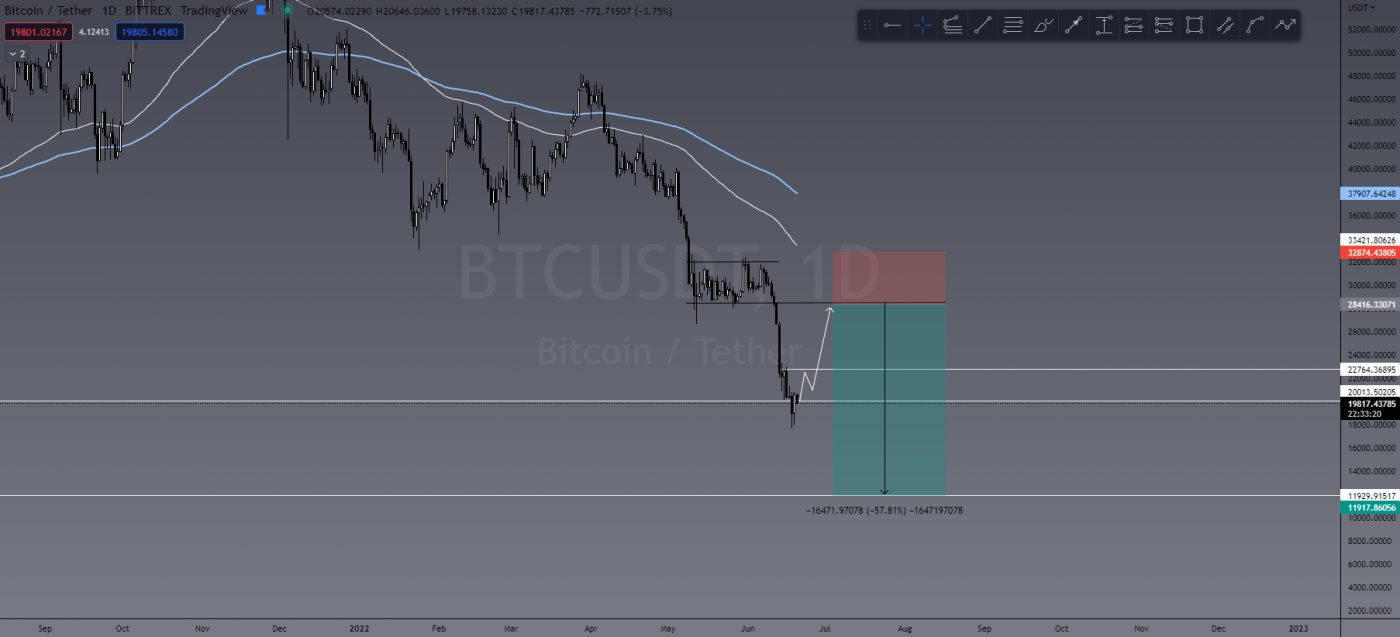

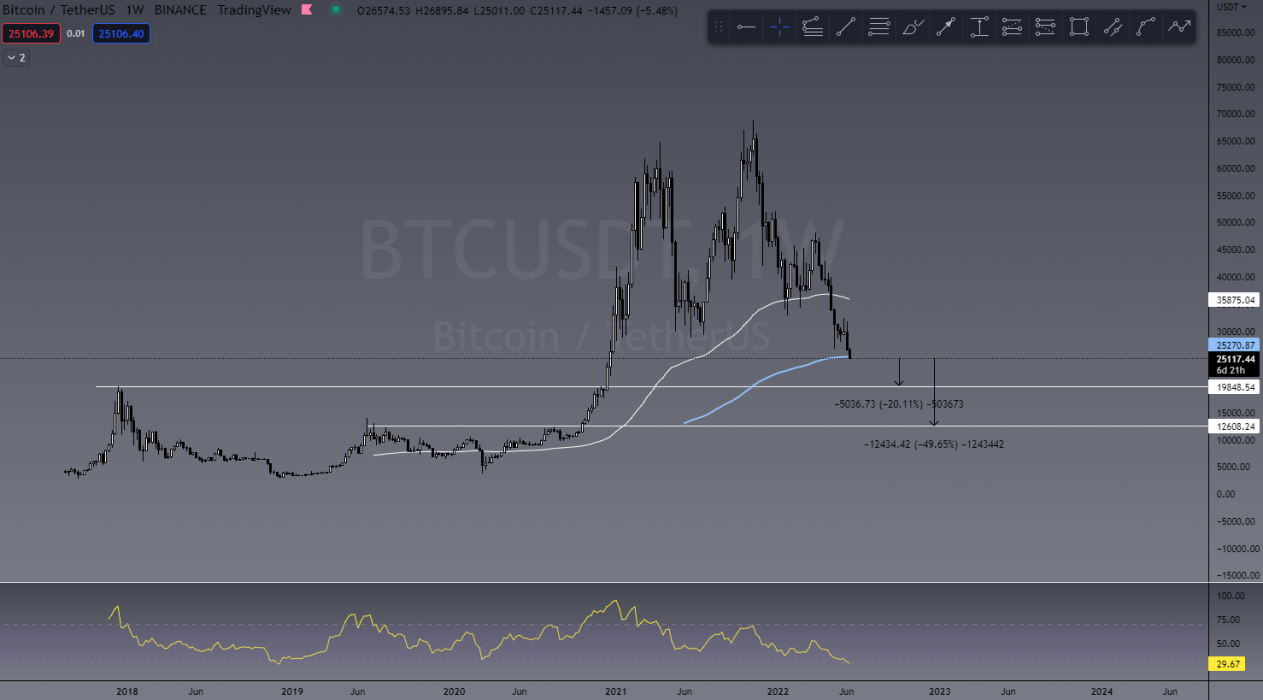

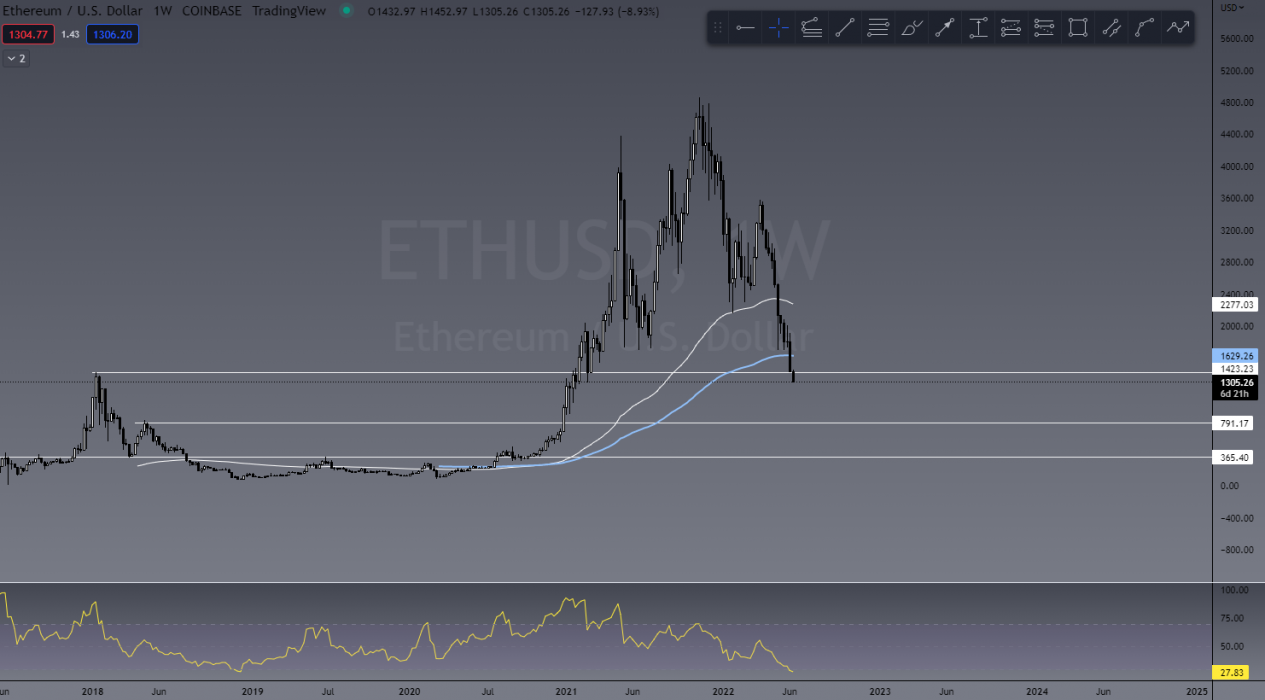

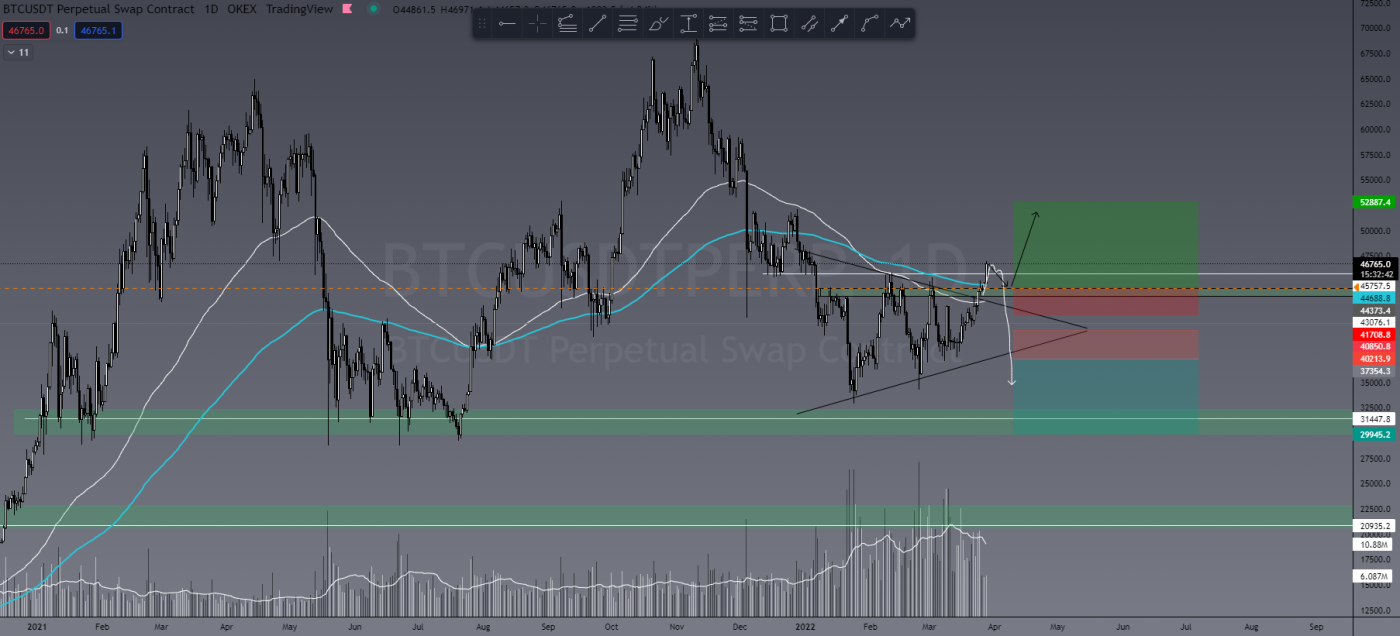

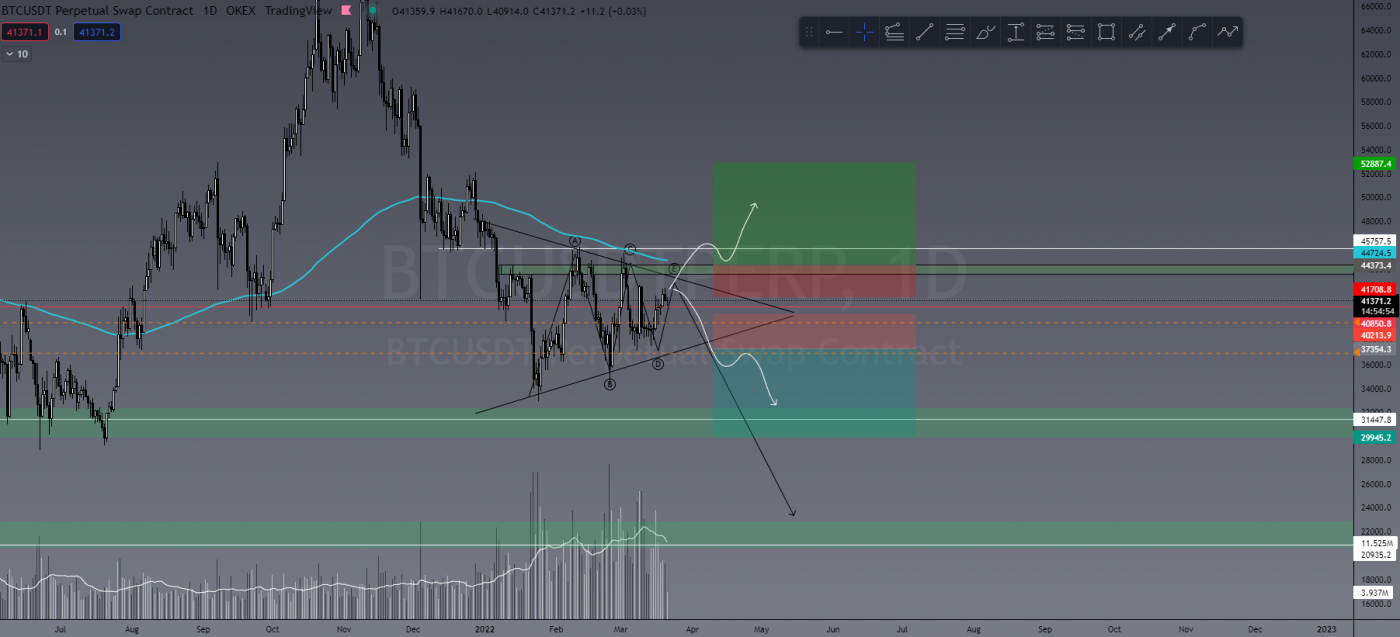

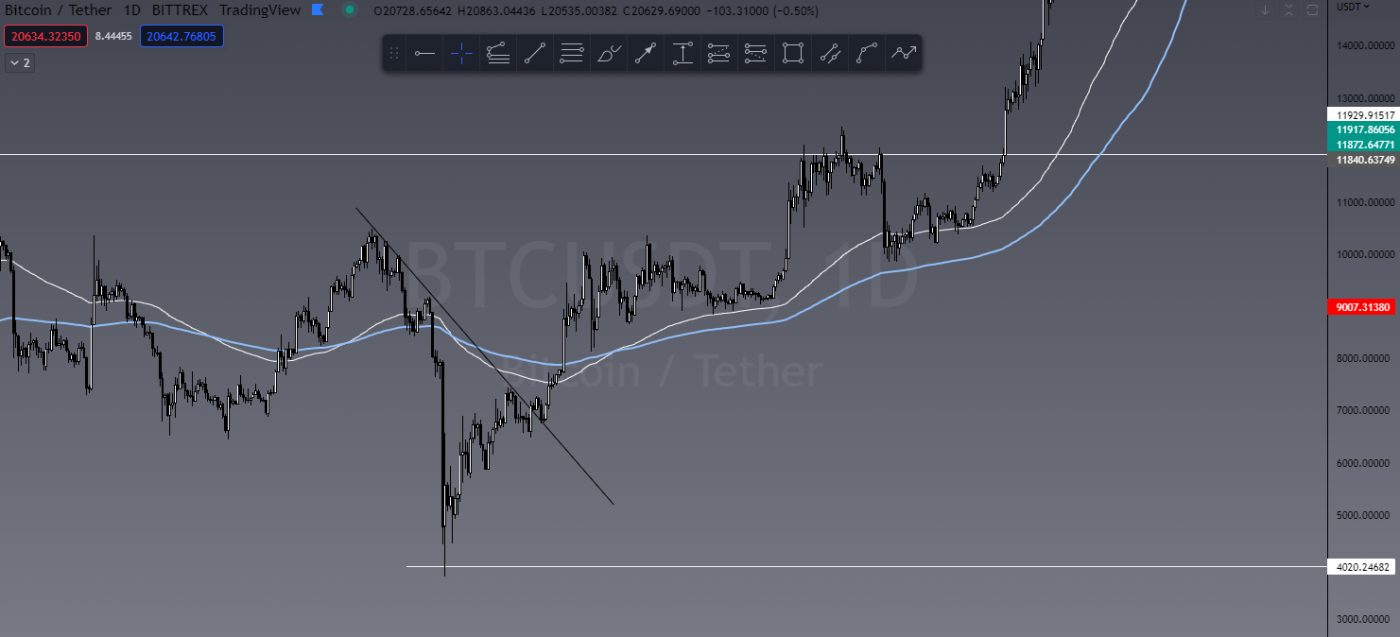

My target for the BTC bear flag I’ve been writing about for months is still around the US$12,000 zone. It will likely be dragged out a little this week with perhaps even a fake out or SFP to the upside (similar to what happened before the last drop – shown in chart below).

If we do see another leg down, I would hope it’s with high volume as the market capitulates and we start to see some reversal signs around US$12,000. I’ll be looking for a bullish hammer on a high timeframe followed by a high-volume bullish engulfing candle at that key level of support with strength showing in oscillators. If that occurs, it’s when we will likely see a breakout of the downtrend we’ve been in since November 2021.

None of this is to say BTC hasn’t already reached its bottom and could start to reverse, having tested US$20,000 as a solid level of support. It’s simply my personal belief that we will visit lower price levels and to be honest, I hope for everyone who’s holding that I’m wrong.

For myself? I wouldn’t mind buying more BTC at US$12,000.

This Week’s Trades

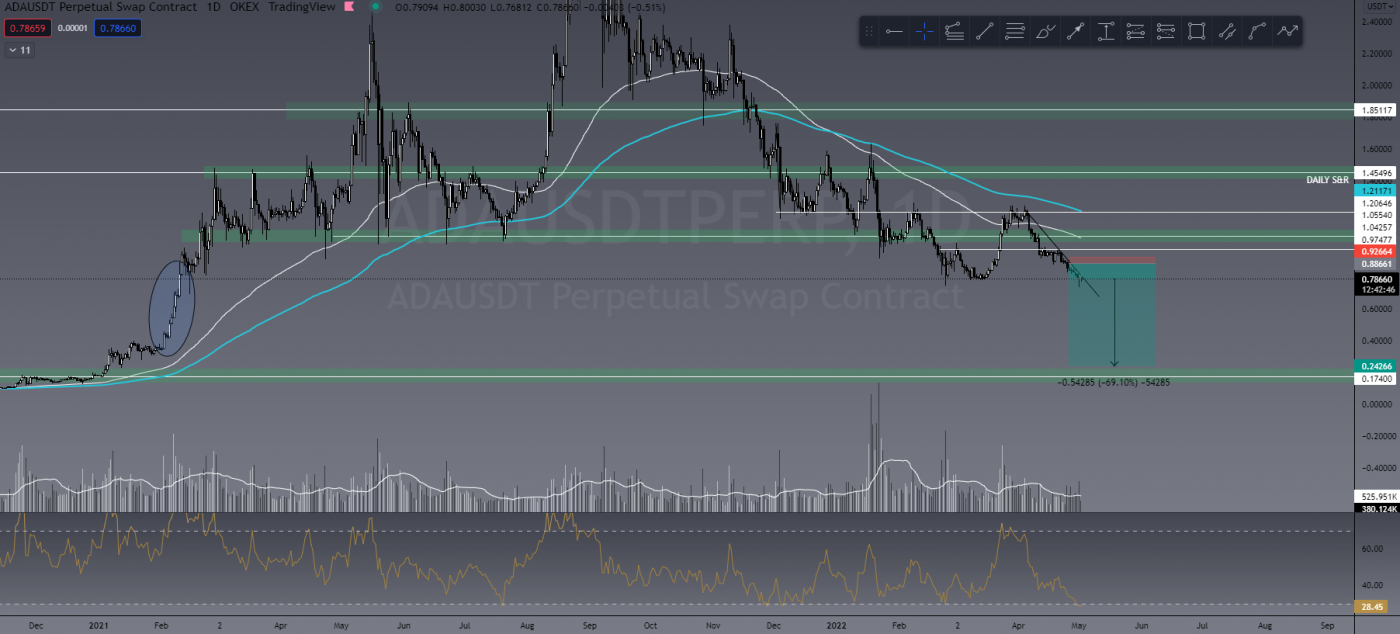

This week, due to my bearish bias, at this stage I’m looking for coins that have seen some pump action while BTC has been ranging. From here I’ll enter into short positions.

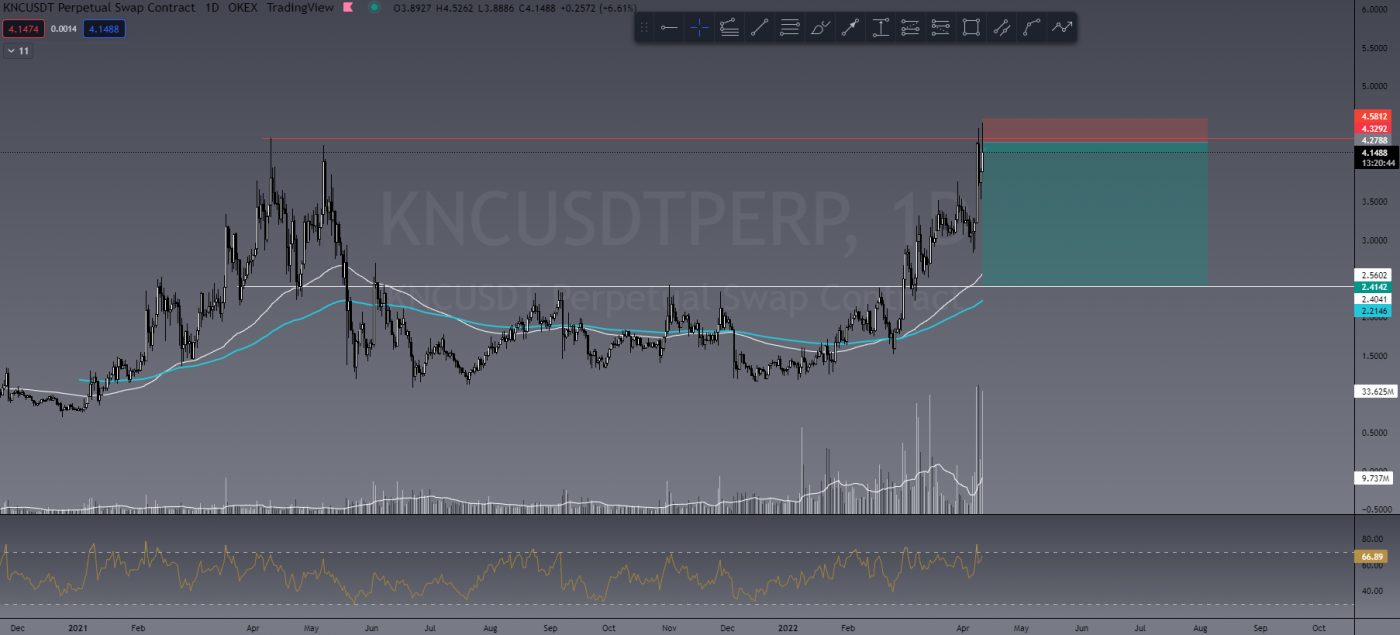

CHZ/USDT

CHZ is a good example, having seen some great price action recently as it pumped back into some key resistance levels and is sitting currently in the golden pocket of the Fibonacci retracement tool.

CONV/USDT

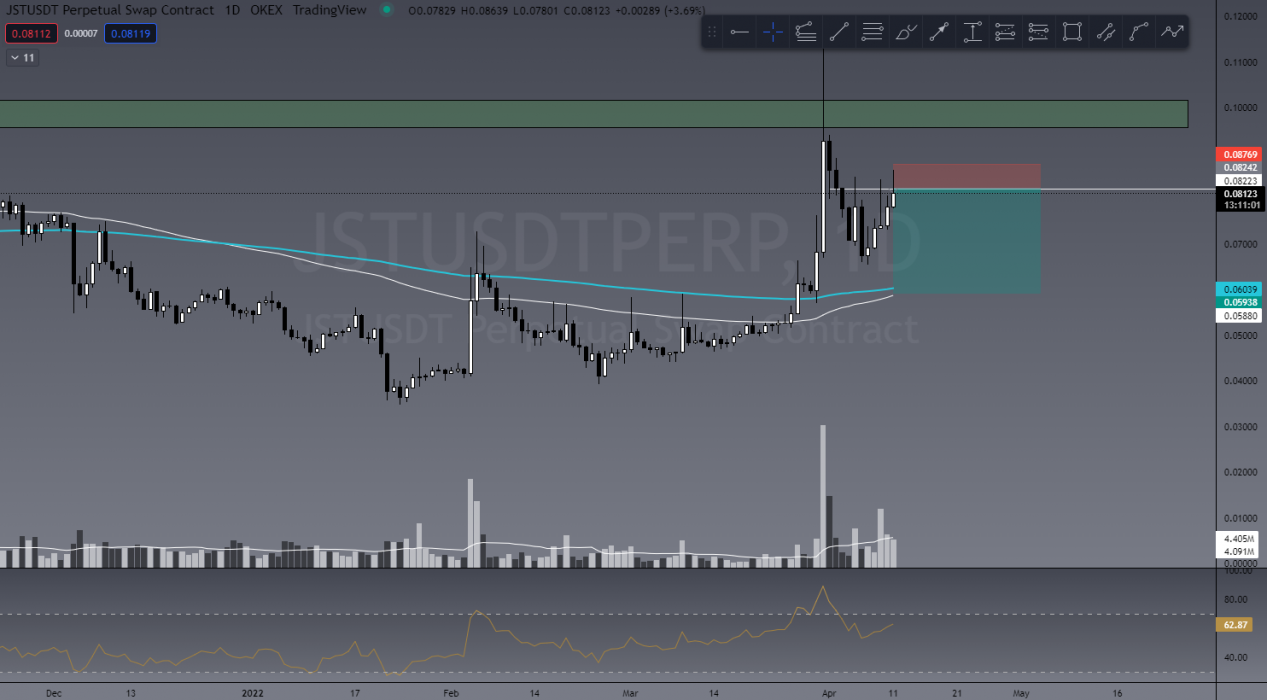

Another thing to be on the lookout for is large exhaustion wicks like what we see on CONV. These show the coin had a huge pump and ultimately sellers are still in control. Short opportunities certainly exist in actions like this.

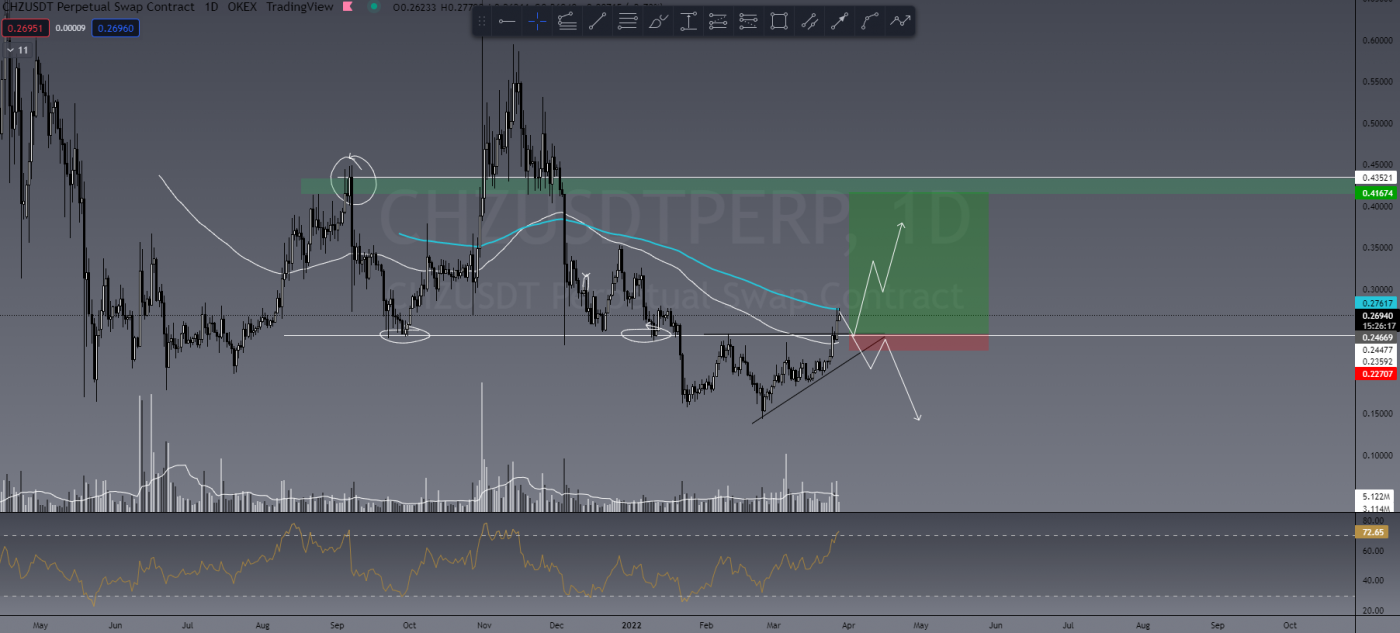

DORA/USDT

DORA is also coming into daily resistance after some pump days and is currently showing some indecision on low timeframes. This could remain a big daily wick and present a short opportunity below the 100 EMA.

Something to keep in mind is that BTC dominance (BTC.D) is dropping. This usually occurs when the market is scaling into ALTs or hedging into USDT/USD coins. Keep a close eye on these ALT movements because there’s a good chance some fake-outs will happen!

The Australian Crypto Convention

Myself and The Crypto Den team will be at the Australian Crypto Convention on the Gold Coast in September. We will be running workshops on how to read and trade these markets. Would love to see you there!

You can get discounted tickets using this CNA code: CRYPTONEWS

Introducing TCD’s New Social Platform

The Crypto Den now has a FREE purpose-built social platform to share investment ideas, trade chat, connect with like-minded people, share info and more, without the censorship of Facebook. The platform is designed for those more focused on the investment/profitable side of the crypto world.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom, you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!