Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

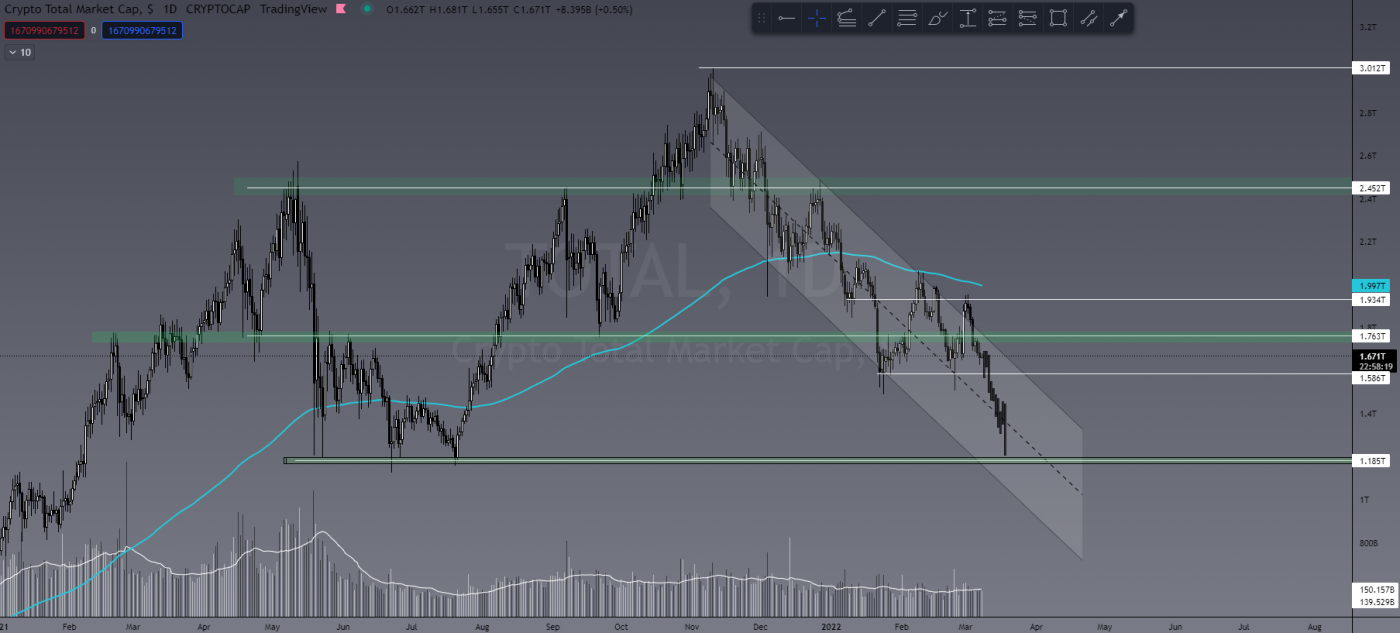

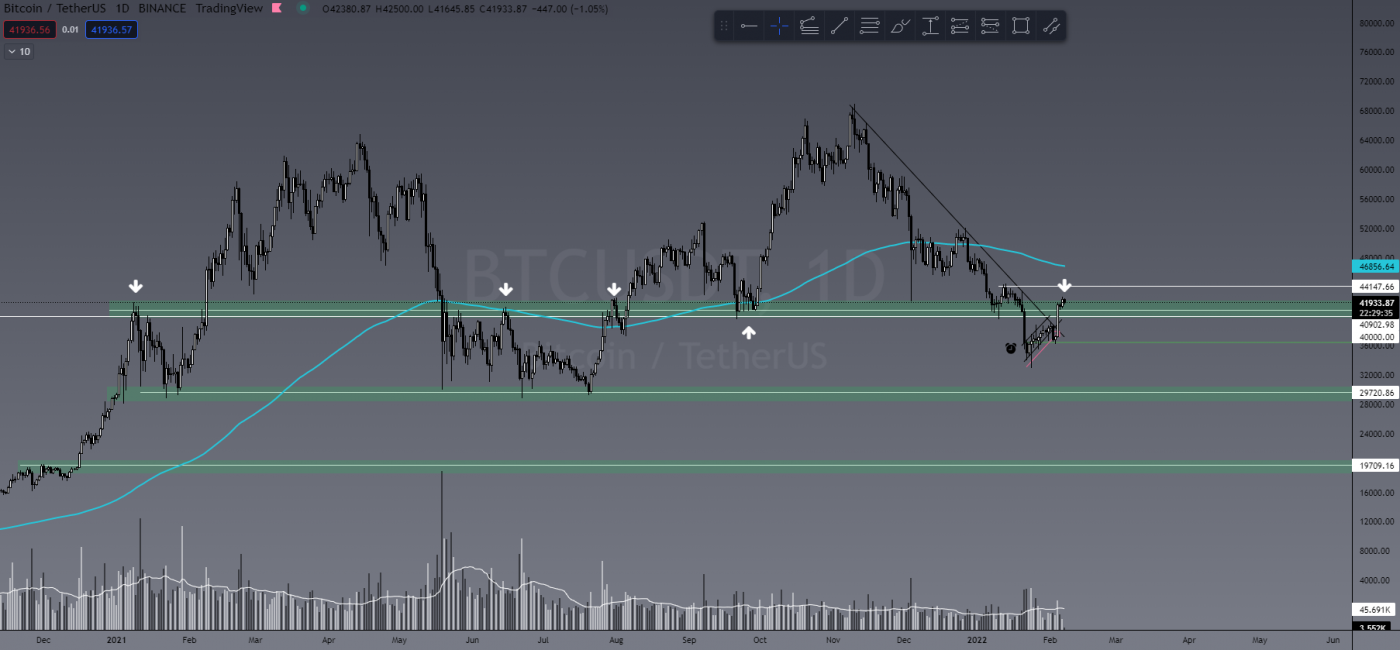

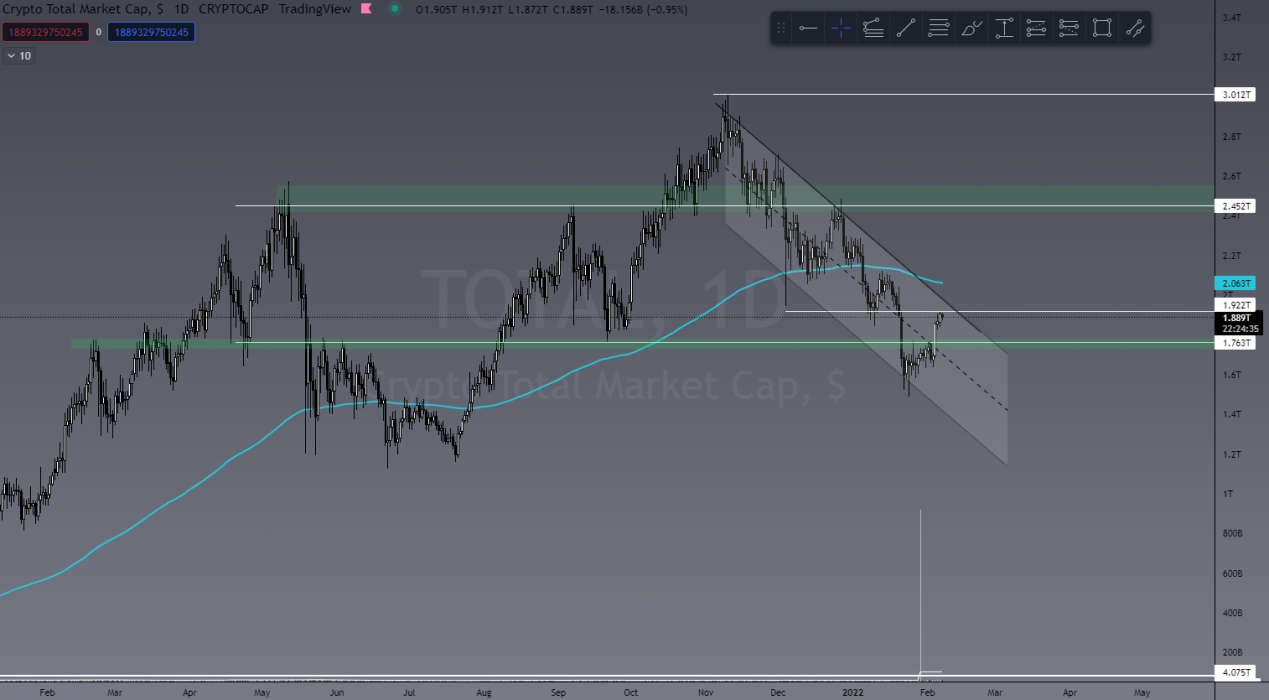

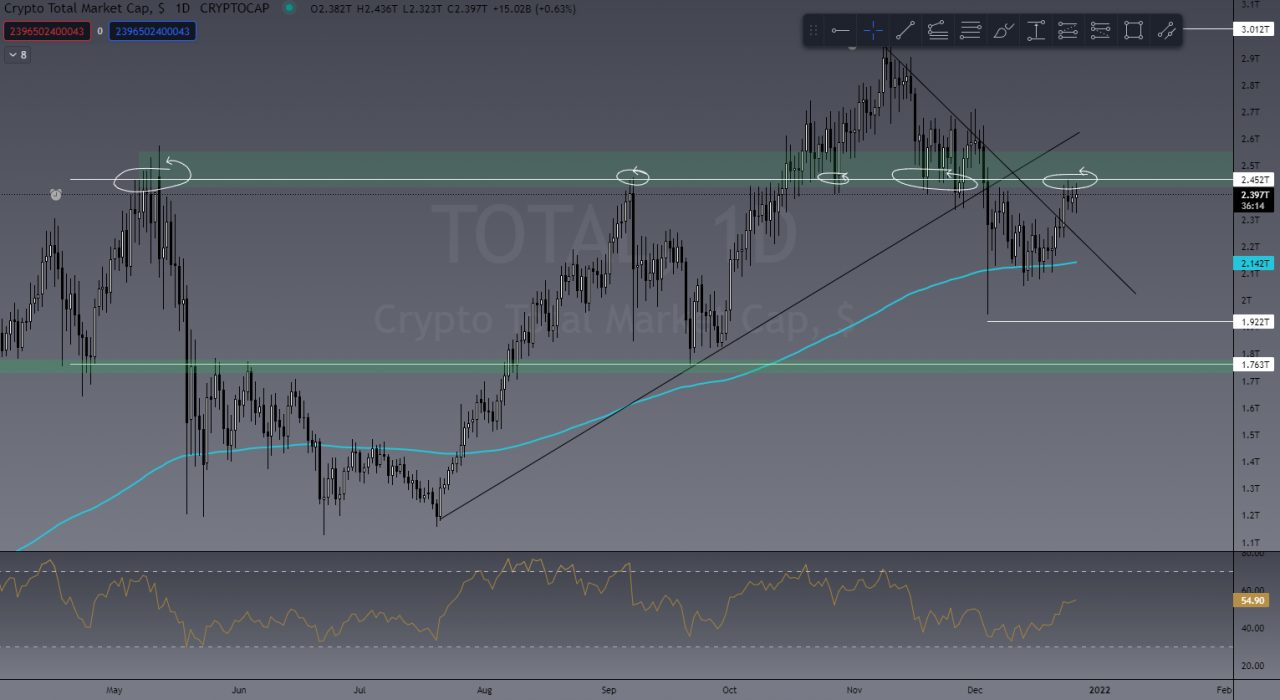

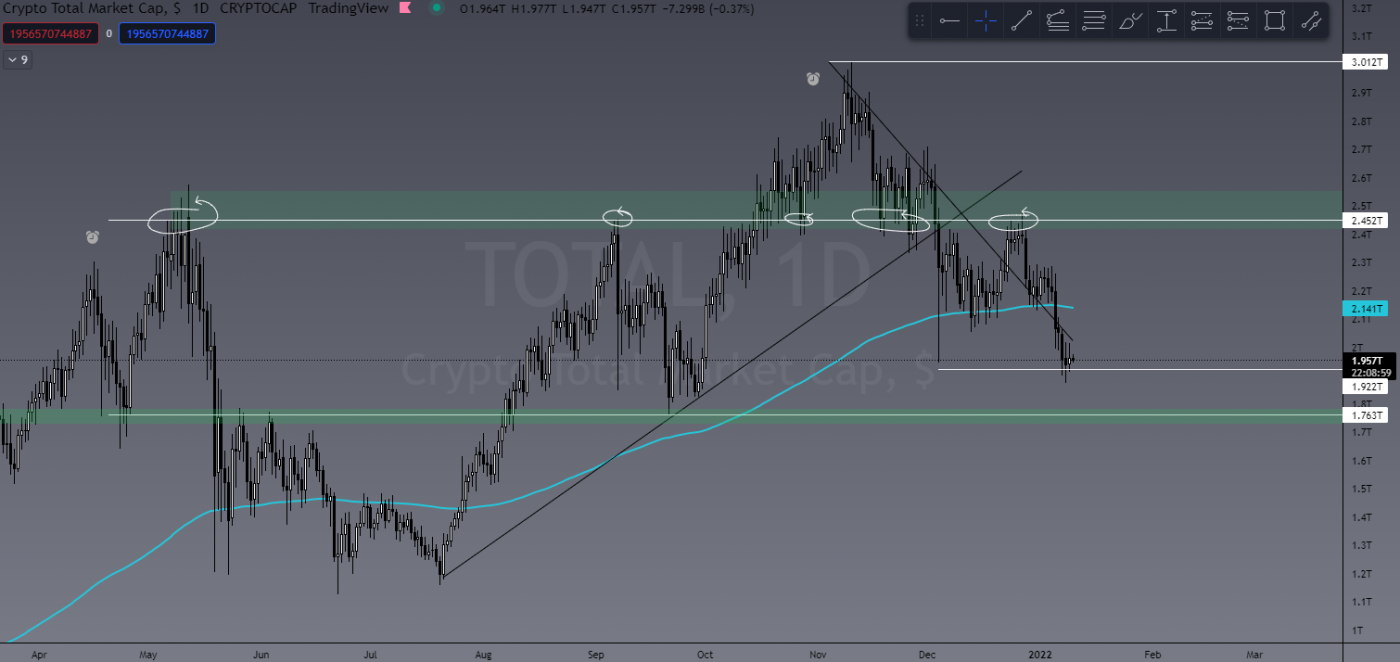

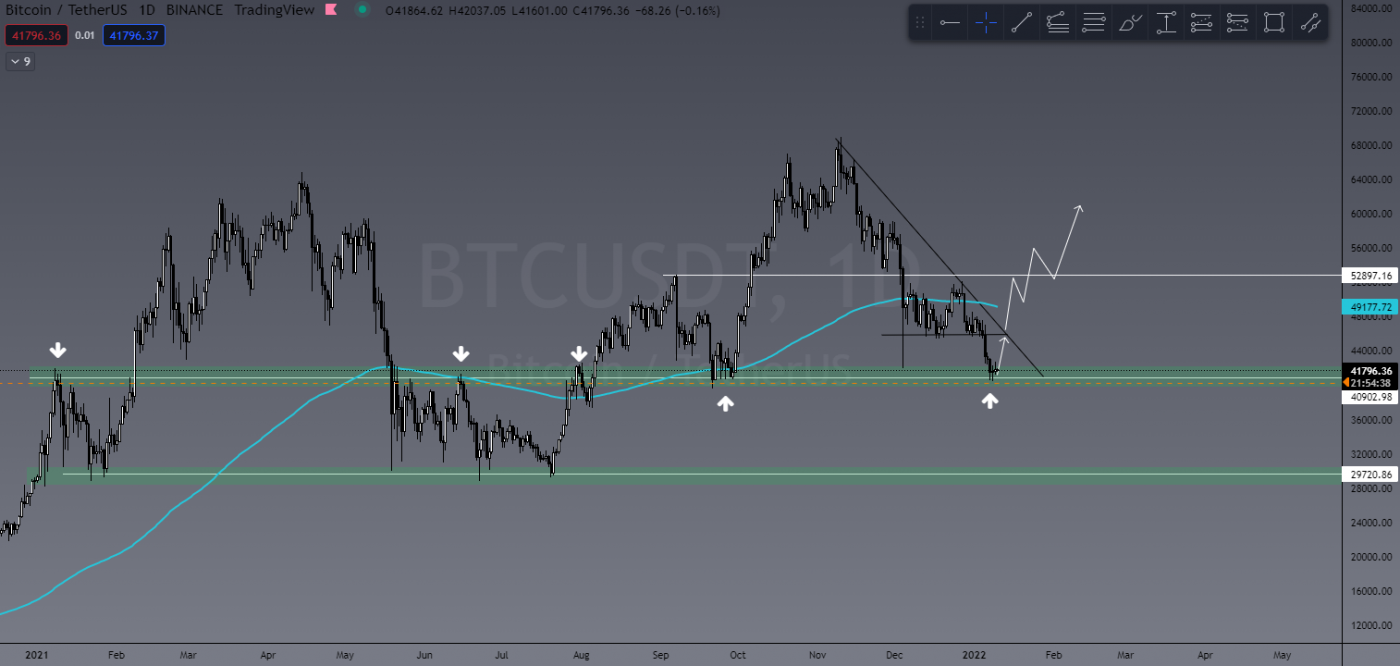

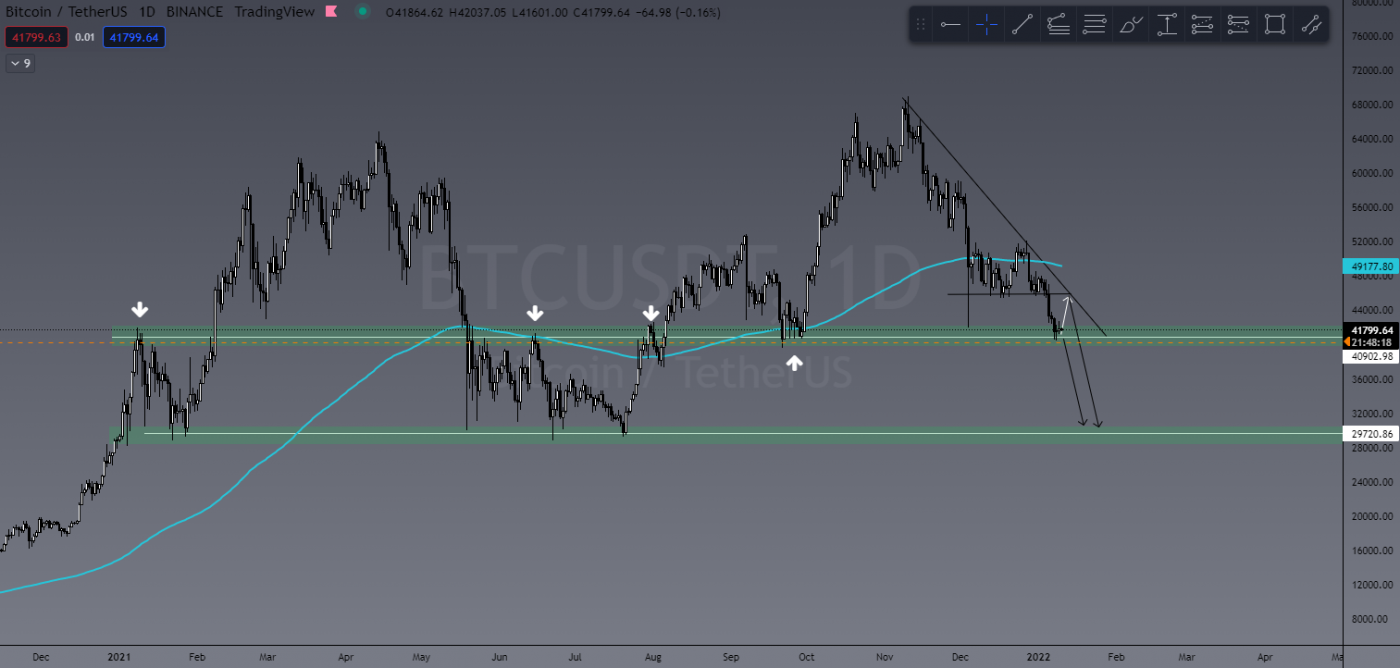

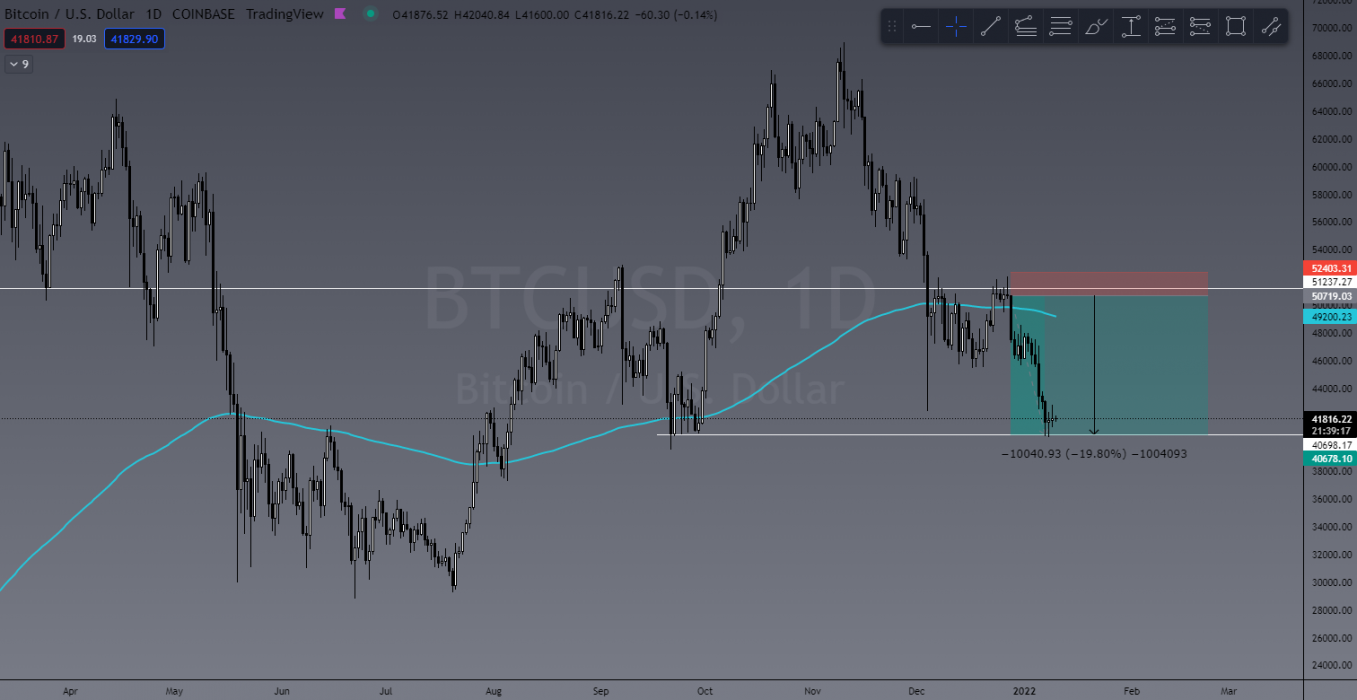

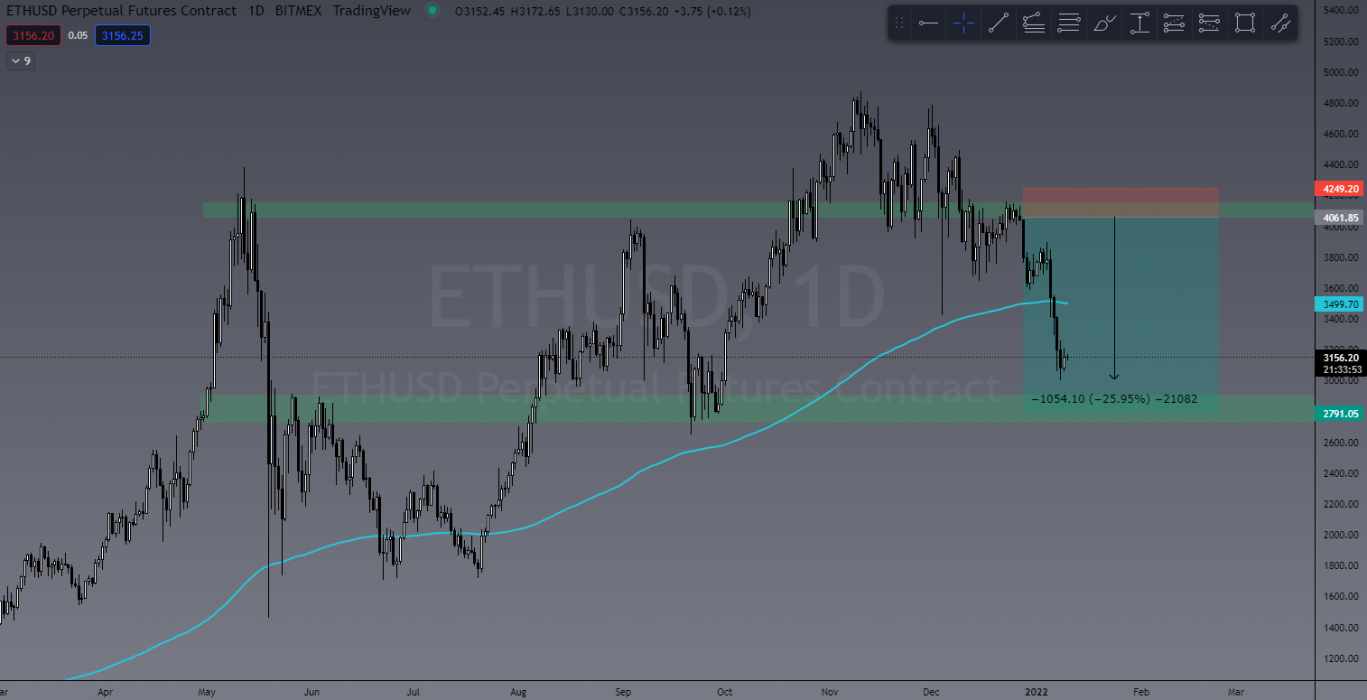

Well, I’ll keep it short this week because not much has changed since last week. The TOTAL market cap is still ranging in what we call a Symmetrical Triangle. This pattern is generally a continuation pattern with a 72% success rate. This indicates that should the pattern play out, there’s a 72% chance it will see more downside. My target from last week of US$1.18 trillion still stands.

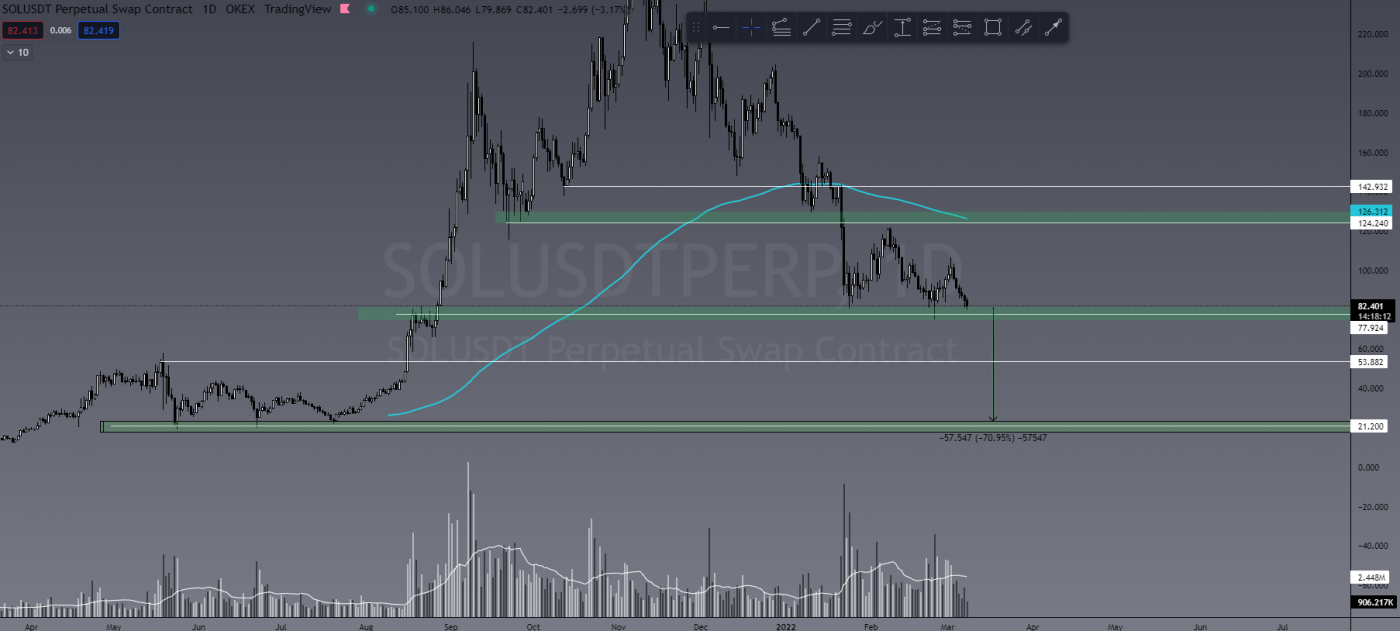

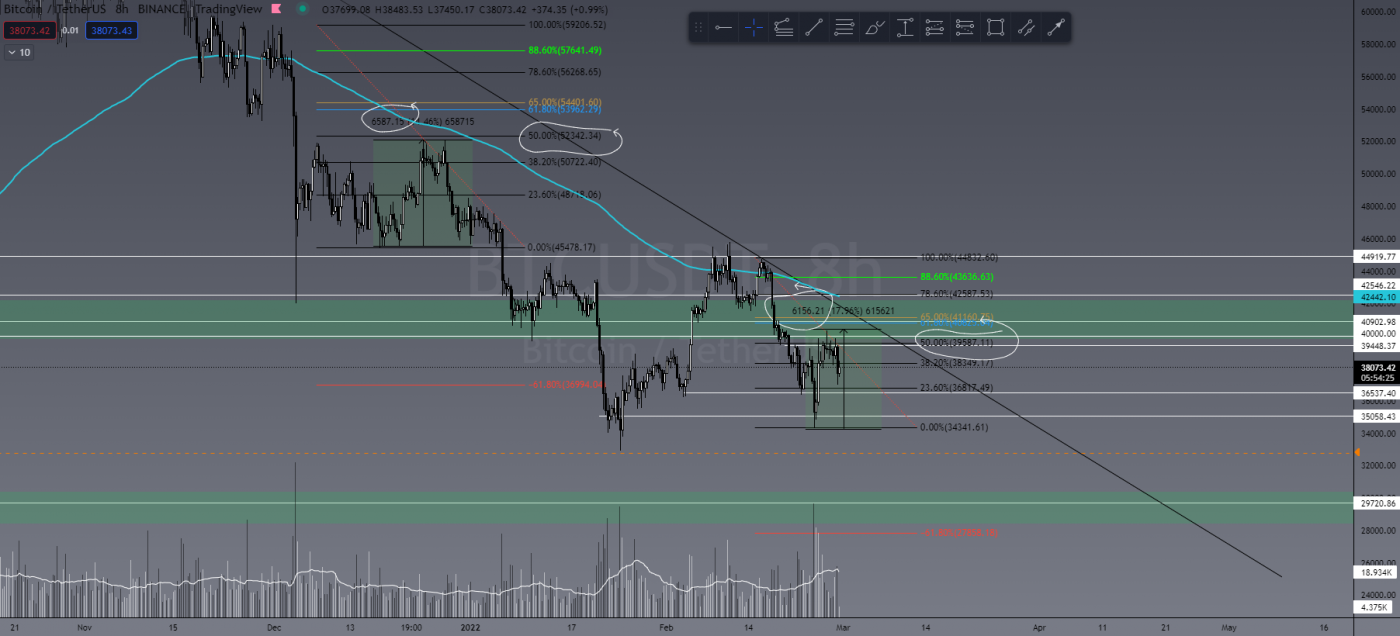

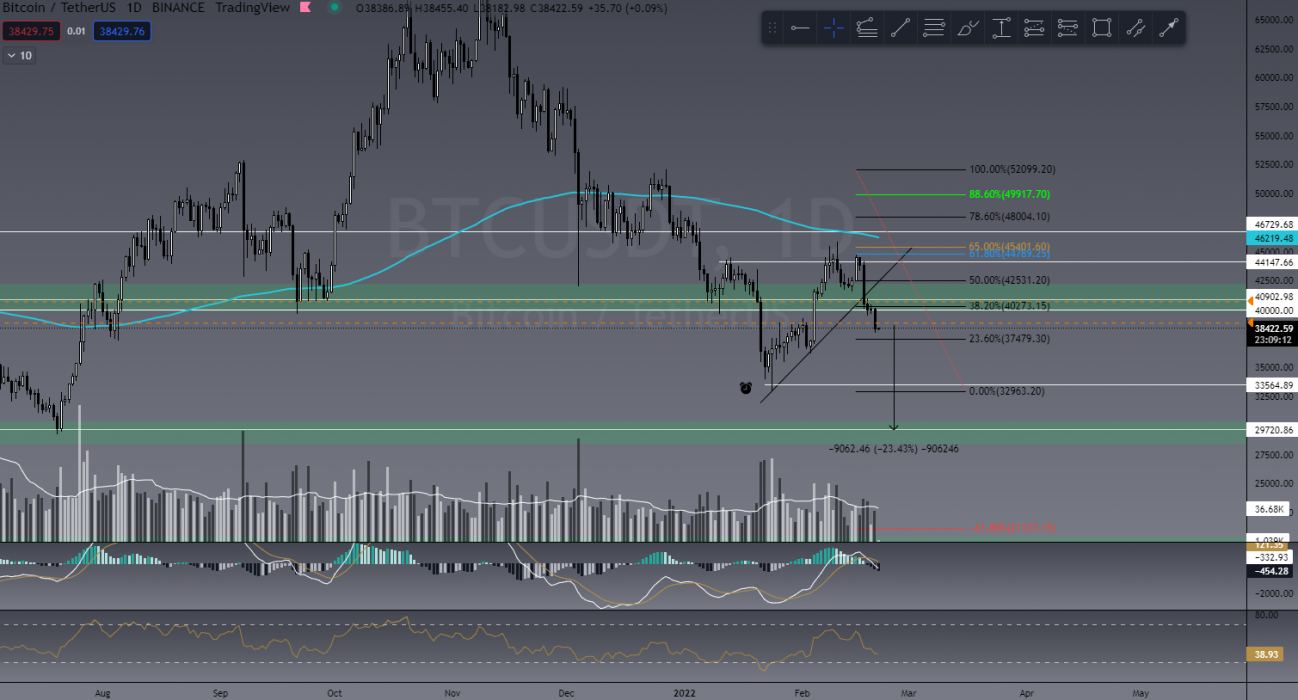

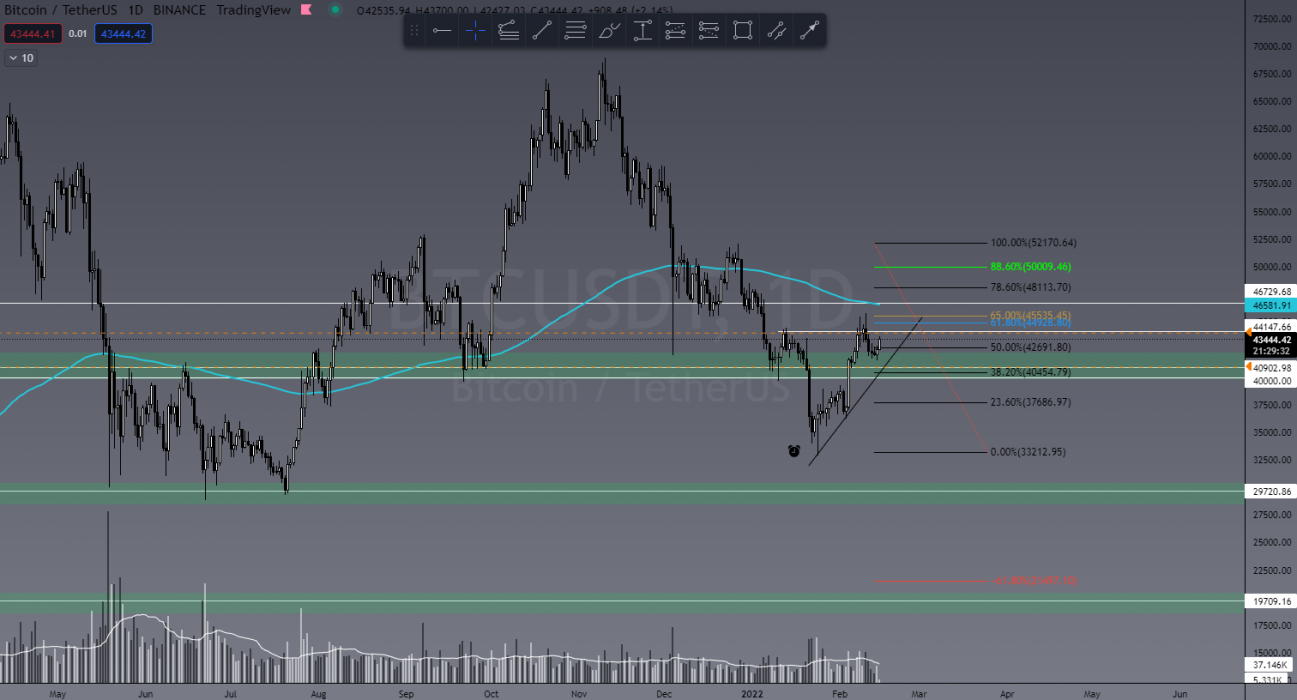

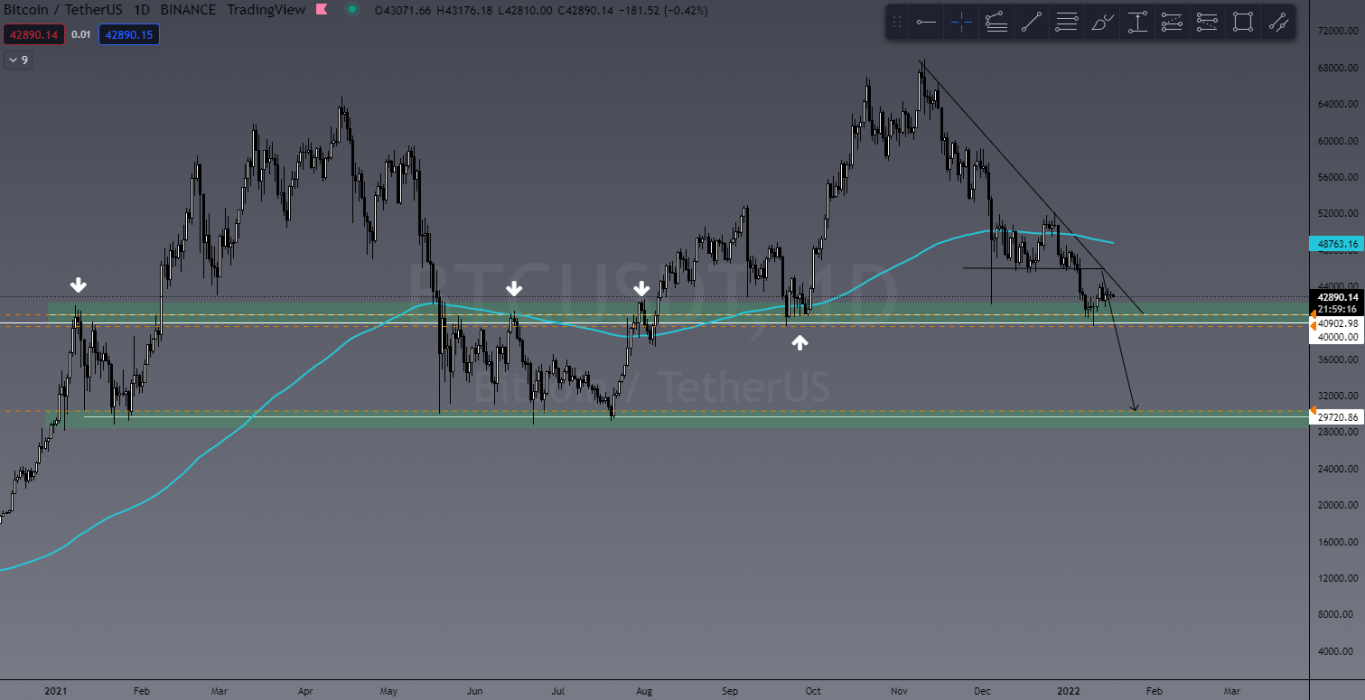

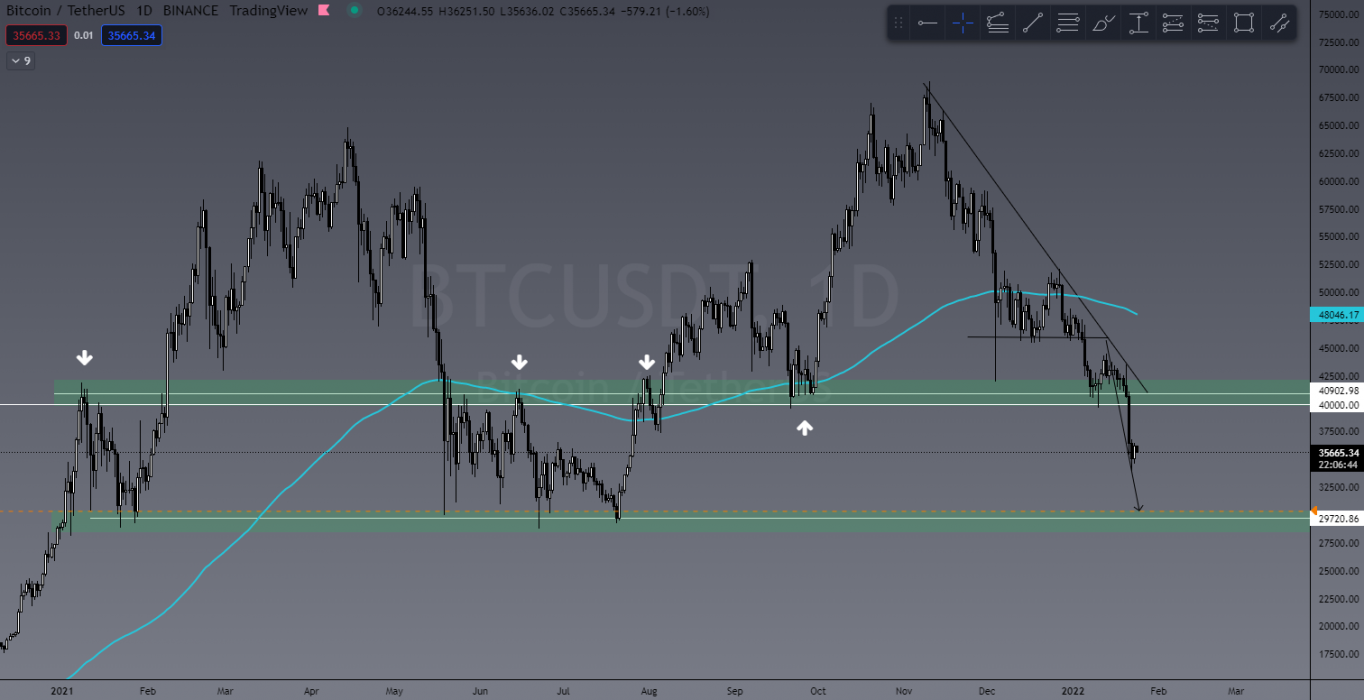

BTC has formed the same pattern and if we were to overlay Elliott Wave Theory, then there’s the possibility we’ll see another small move up before we see price action tank to the downside. If this pattern does play out, I’m seeing the US$20,000 level being tested.

As I pointed out in my last article, the DXY (US Dollar Currency Index) is on a bull run, which generally does the opposite of BTC, and GOLD has just tested its ATH. Meaning the flow of global capital seems to be seeking a hedge during the geopolitical unrest, and as I’ve stated before I don’t believe BTC is mature enough yet to be such a hedge.

Last Week’s Performance

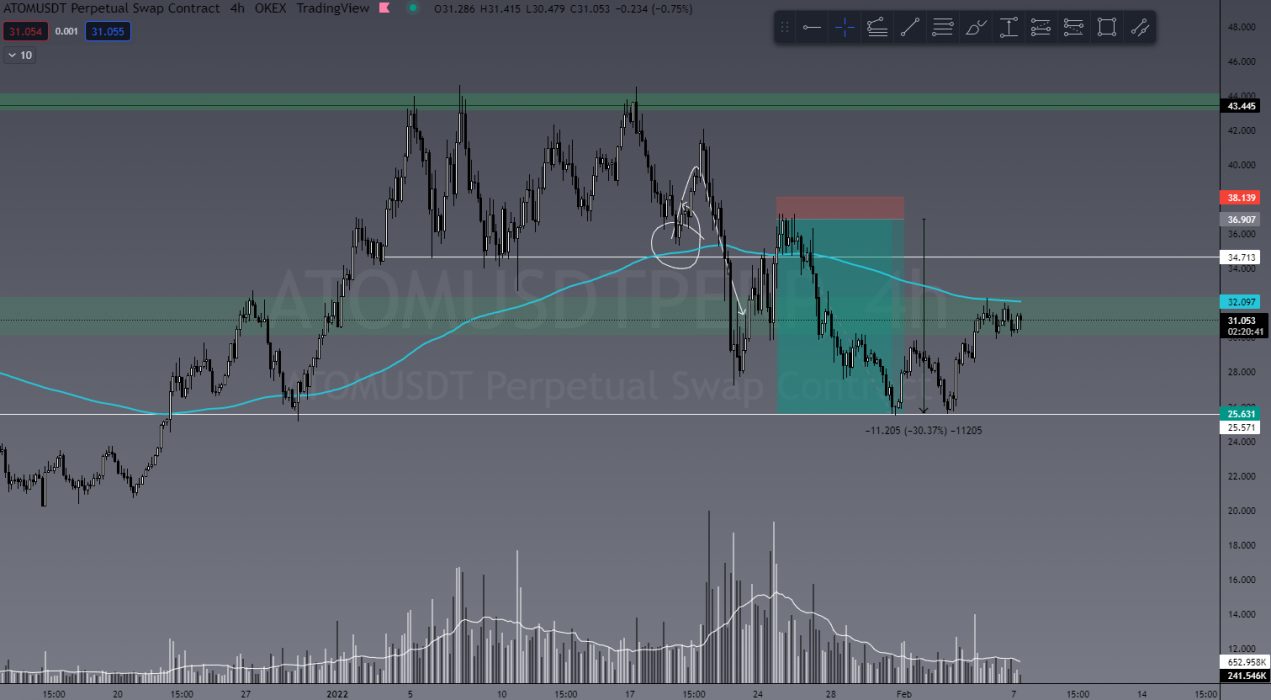

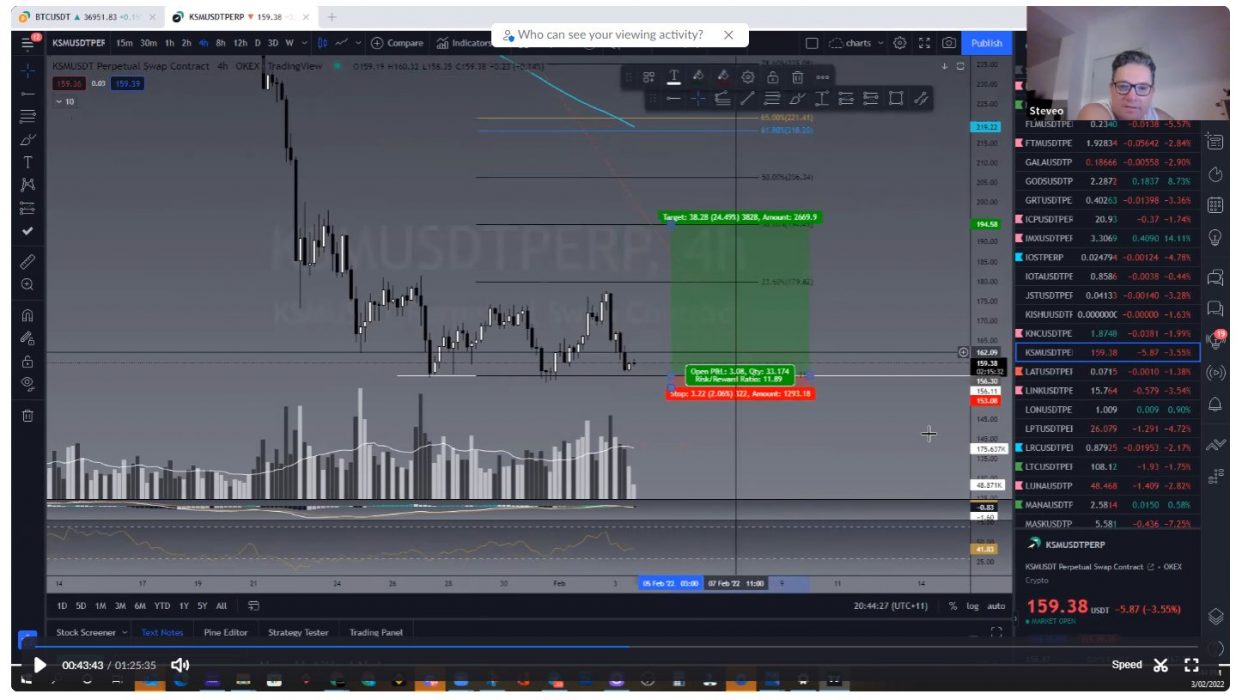

I personally didn’t enter any new positions last week as the market hasn’t really given any opportunity because nothing has really changed yet. I’m still in 11 open short positions that I’ve openly shared in our Facebook Group if you’d like to check these out.

UMA/USDT

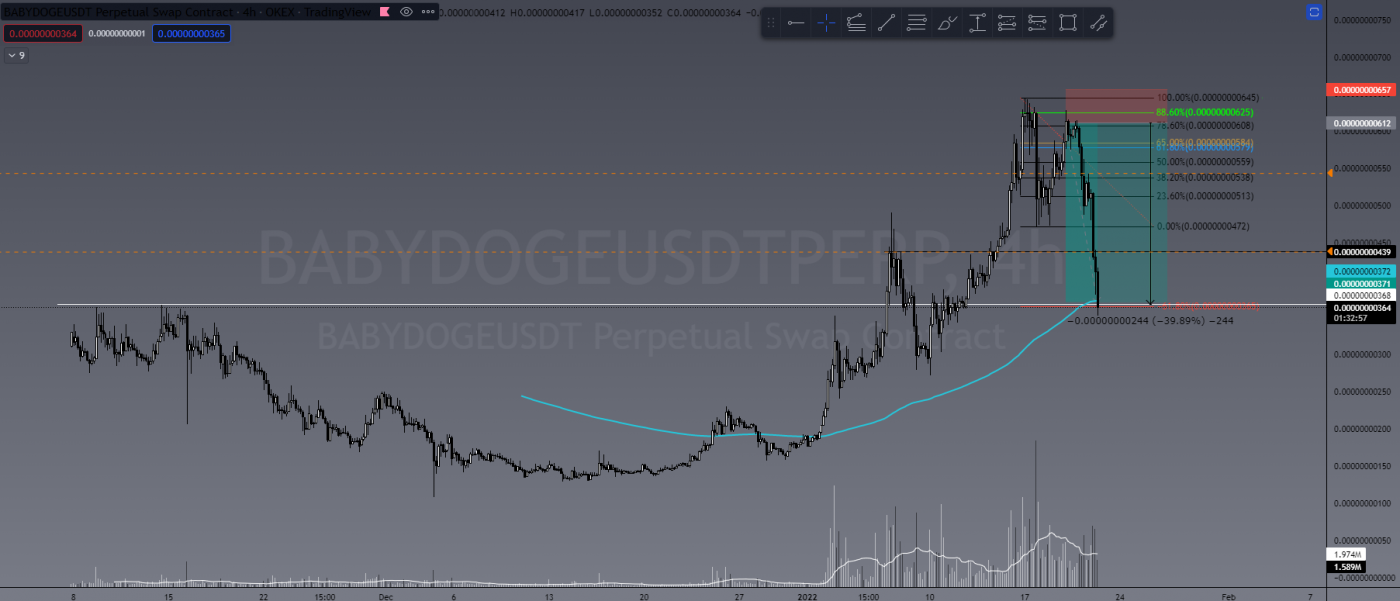

A quick 200%+ trade here shared by “bking43” in the TradeRoom shows really good confluence of the falling wedge pattern, landing in the golden pocket Fibonacci level and finding dynamic support on the 200 EMA. Looking for these confluent reasons to get into a trade is a prime example of what we teach in TCD. In, out, Profit locked in. Nice trade, bking!

This Week’s Trades

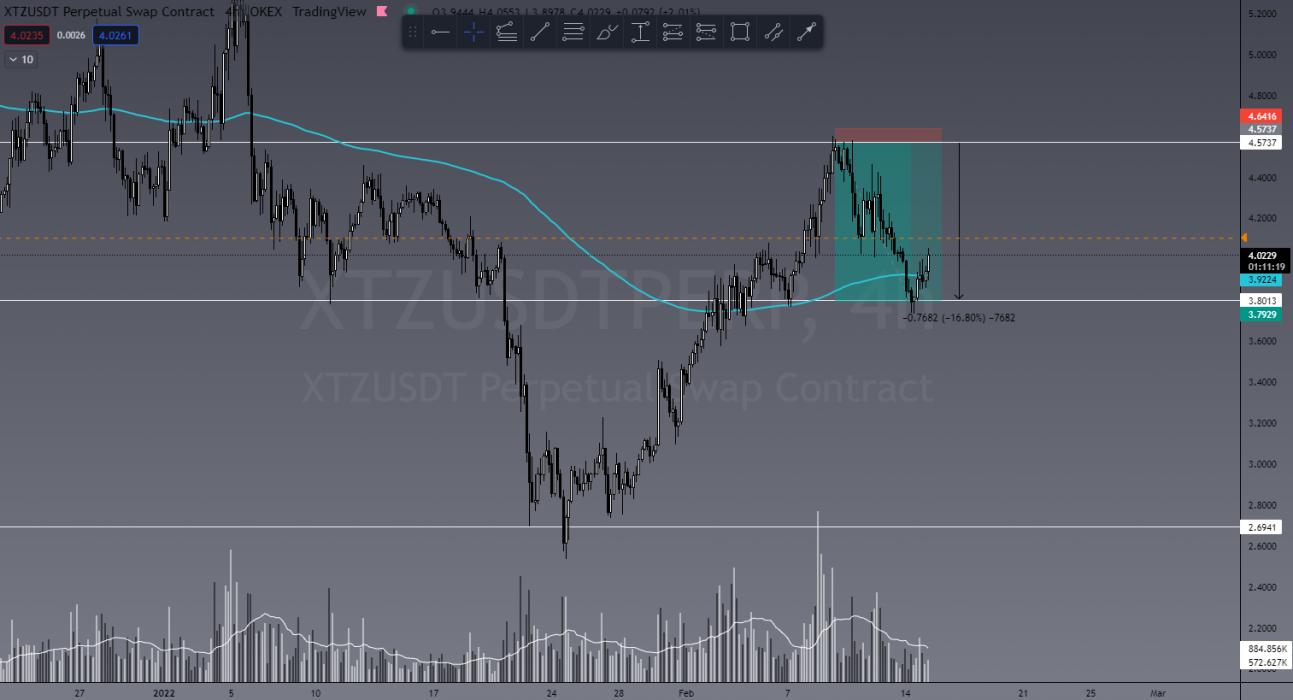

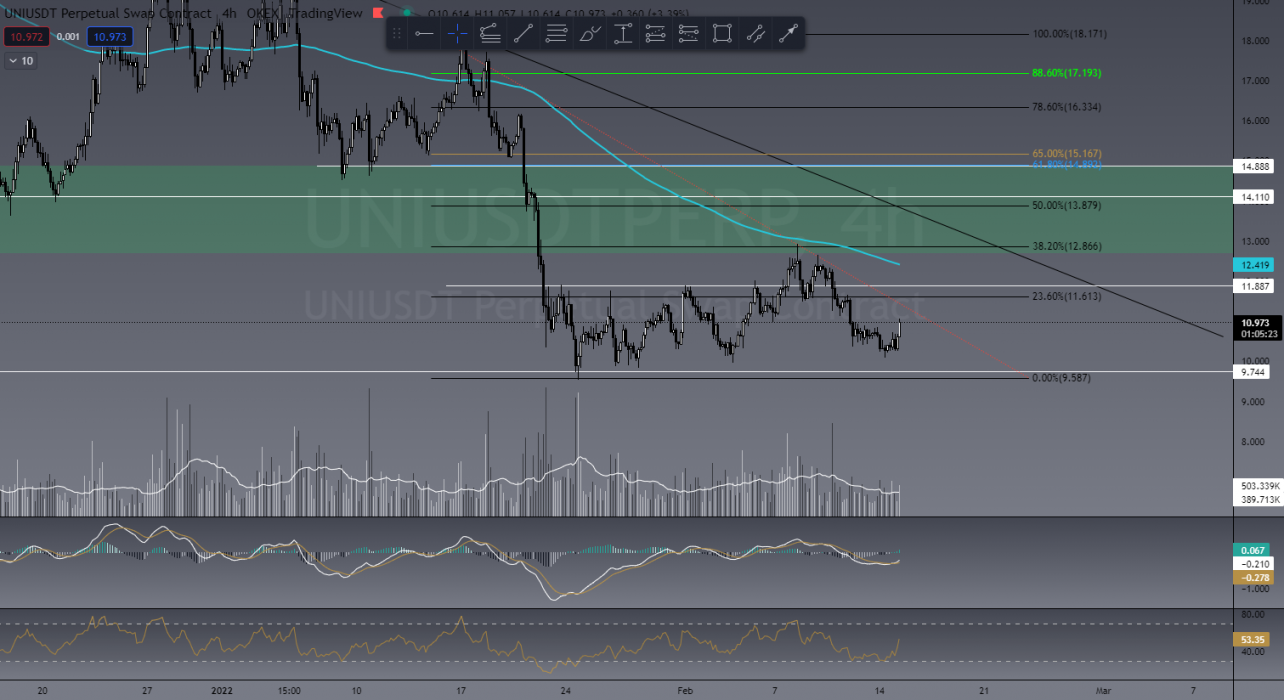

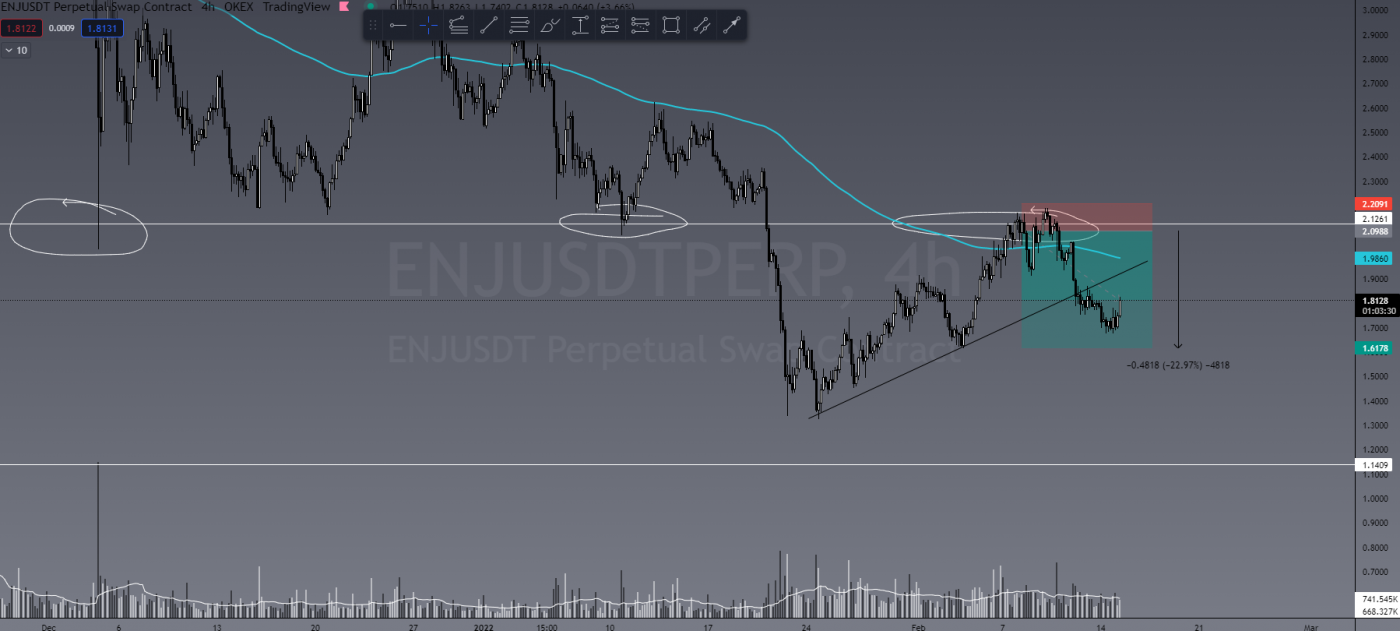

This is where I’d normally share trades I’m looking to enter this week, however I feel we are currently in what we call the “wait trade”.

This is simply waiting for the market to present us with safe entries, and at this moment I see none I’m confident in sharing.

Patience is key here! Some people struggle NOT being in the market and sometimes a bit of patience is all you need!

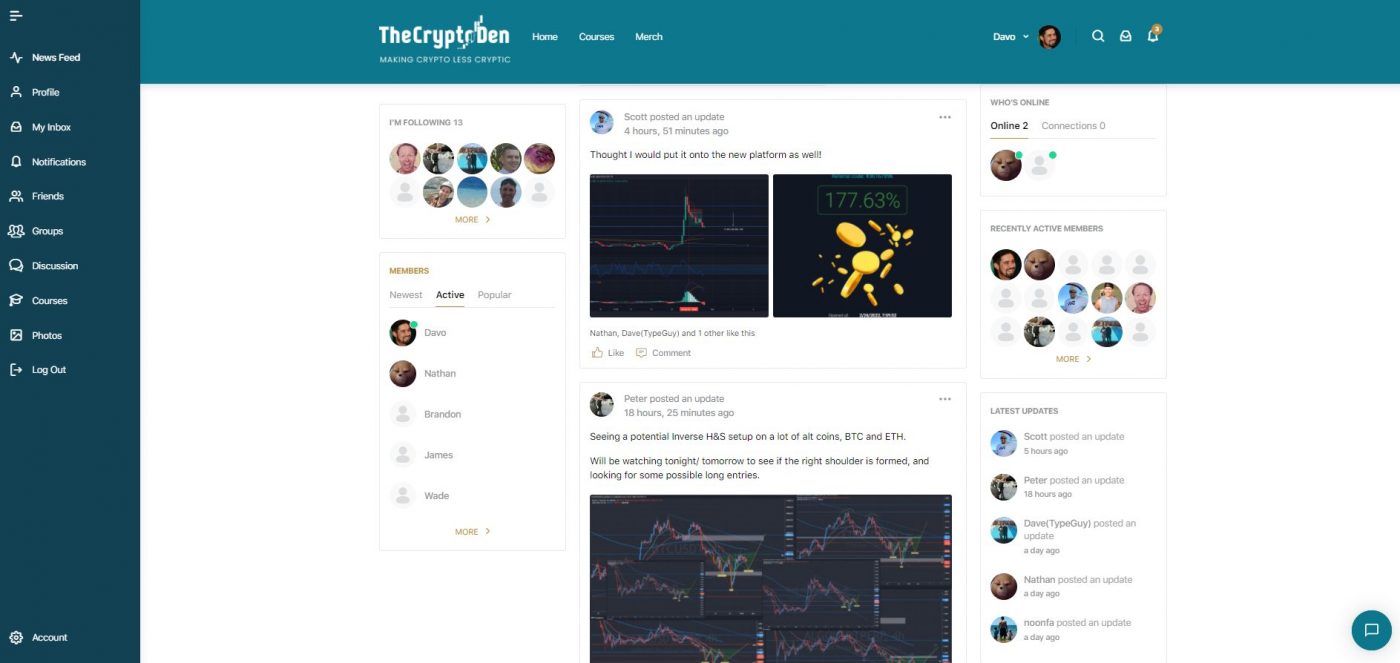

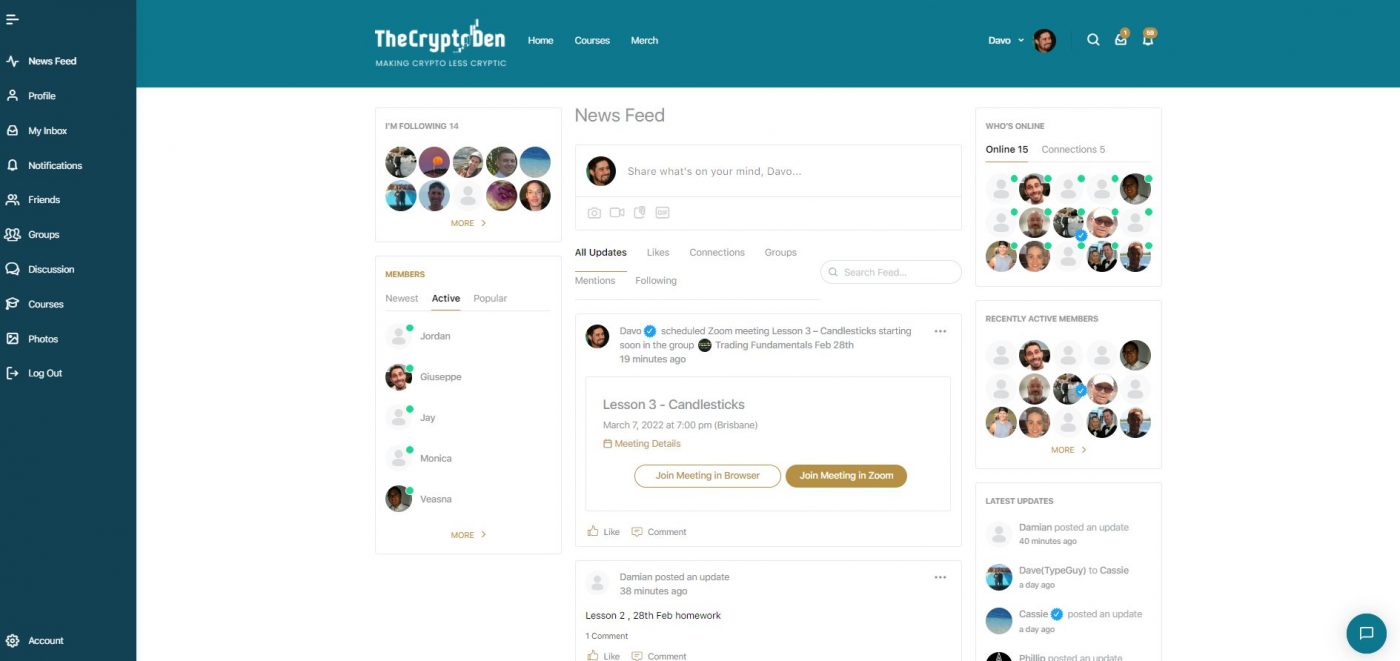

Introducing TCD’s New Social Platform

The Crypto Den now has a FREE purpose-built social platform to share investment ideas, trading chat, connect to like-minded people, share info and more, without the censorship of Facebook. The platform is designed for those more focused on the investment/profitable side of the crypto world.

Are You a Trader?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!