Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Dash (DASH)

Dash is an open-source blockchain and cryptocurrency focused on offering a fast, cheap global payments network that is decentralised in nature. According to the project’s white paper, Dash seeks to improve on Bitcoin by providing stronger privacy and faster transactions. Dash’s governance system, or treasury, distributes 10% of the block rewards for the development of the project in a competitive and decentralised way.

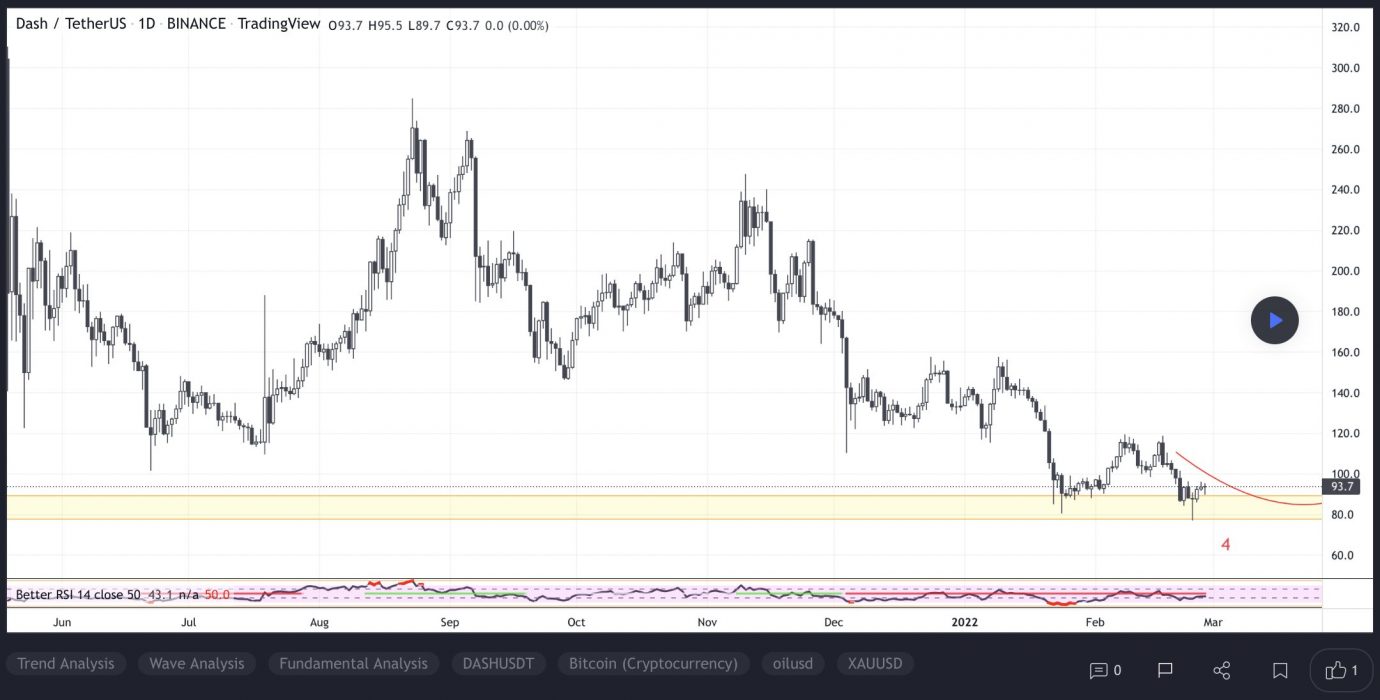

DASH Price Analysis

At the time of writing, DASH is ranked the 80th cryptocurrency globally and the current price is US$93.13. Let’s take a look at the chart below for price analysis:

During January, DASH retraced over 45% before finding support near $90.13 Consolidation above this level has created a series of relatively equal lows, which are likely to be swept before any longer-term bullish trend begins.

In the shorter term, the price might establish support near $92.50 before running the swing high at $106.88. If this bullish move occurs, the price could reach resistance near the weekly open around $115.43, and may even sweep the swing high near $123.22

Some support might exist at the daily gap near $87.12. A move this low would also fill the monthly gap and set the stage for a possible bullish reversal.

2. Enjin Coin (ENJ)

Enjin Coin ENJ is a project of Enjin, a company that provides an ecosystem of interconnected, blockchain-based gaming products. Enjin’s flagship offering is the Enjin Network, a social gaming platform through which users can create websites and clans, chat, and host virtual item stores. Enjin Coin is a digital store of value used to back the value of blockchain assets such as non-fungible tokens (NFTs).

ENJ Price Analysis

At the time of writing, ENJ is ranked the 67th cryptocurrency globally and the current price is US$1.45. Let’s take a look at the chart below for price analysis:

ENJ spent February ranging across the monthly open, reaching 30% over and 23% below. The price is currently consolidating between adjacent resistance and support at $1.45 with no clear higher-timeframe trend. A strong move over the monthly open could signal a run to resistance beginning near $1.95.

This move would likely target the swing high at $2.12 and relatively equal highs near $2.29. A sustained bullish trend could reach up to the monthly high near $2.35.

Bulls might see a sweep of the relatively equal lows near $1.42 as a chance to buy at a discount. If this level fails to hold, the next significant area for the price to find buyers is likely near the consolidation around $1.38 and $1.30.

3. Ankr (ANKR)

ANKR originates as a solution that utilises shared resources in order to provide easy and affordable blockchain node hosting solutions, it has since built a marketplace for container-based cloud services through the usage of shared resources. It is a platform that enables the sharing economy, where any customer can access resources at a more affordable rate, while also providing enterprises with the ability to monetise their spare computing power that is not being utilised. It is unique in the way that it is the first to use trusted hardware, and this ensures a high level of security.

ANKR Price Analysis

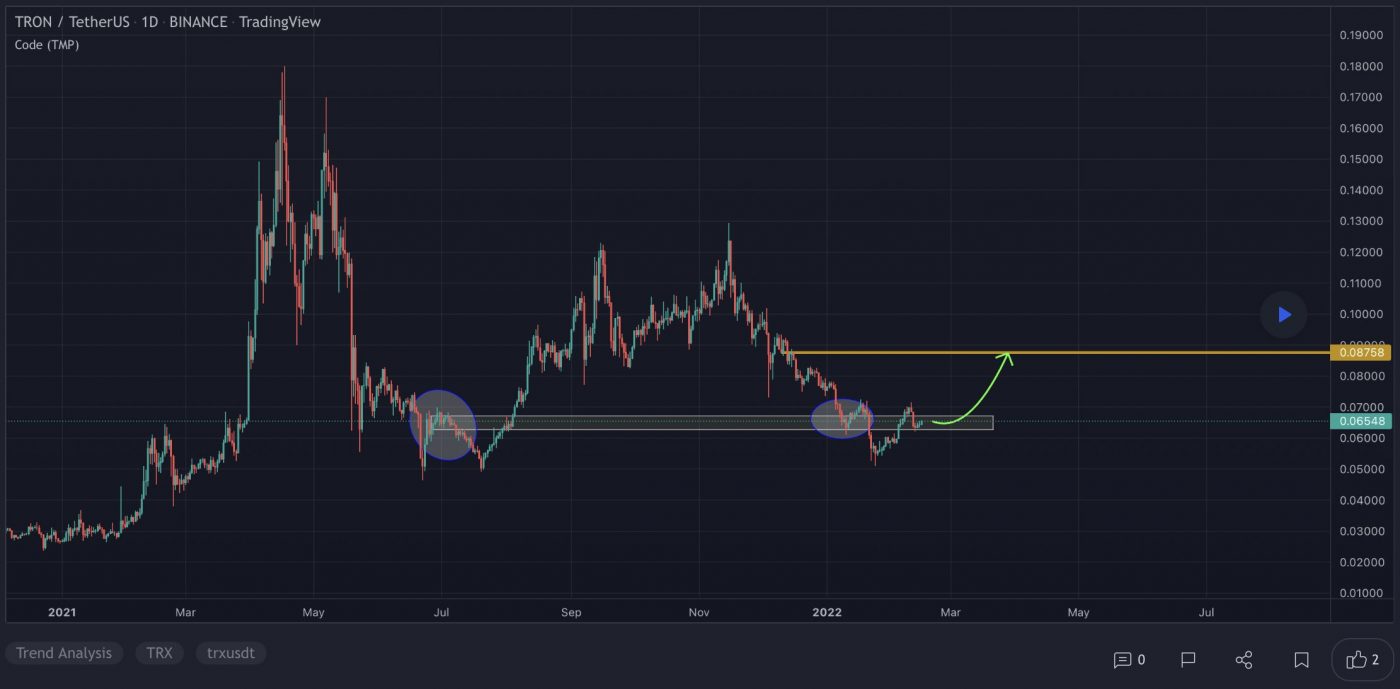

At the time of writing, ANKR is ranked the 107th cryptocurrency globally and the current price is US$0.06559. Let’s take a look at the chart below for price analysis:

ANKR continues to set monthly lows in its downward trend.

Support might be found in the daily gap above the monthly open near $0.06295. A deeper retracement is likely to target the relatively equal lows into support near $0.06125.

The daily gap near $0.05966 could also provide support. However, another gap inside the down candles, around $0.05732, provides the highest chances of solid support while offering a high risk-reward entry.

There is currently no resistance overhead since the price is in discovery. Extensions hint at the areas around $0.06895 and $0.07244 as reasonable take-profit zones.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.