Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Ethereum Classic (ETC)

Ethereum Classic ETC is a hard fork of Ethereum that launched in July 2016. Its main function is as a smart contract network, with the ability to host and support decentralised applications (DApps). Its native token is ETC. Since its launch, Ethereum Classic has sought to differentiate itself from Ethereum, with the two networks’ technical roadmaps diverging further and further from each other with time. Ethereum Classic first set out to preserve the integrity of the existing Ethereum blockchain after a major hacking event led to the theft of 3.6 million ETH.

ETC Price Analysis

At the time of writing, ETC is ranked the 29th cryptocurrency globally and the current price is A$70.88. Let’s take a look at the chart below for price analysis:

During August, ETC broke several swing highs that could be the signal for a new bullish trend.

Last week’s break of the most recent swing low could suggest some downside in the short term. It formed probable resistance near A$78.46 and may target the swing low and possible support near A$68.22.

The swing low and possible support near A$66.82 could be the second bearish target if the move down continues. The relatively equal lows near A$65.30 and possible support underneath near A$63.54 could provide more substantial support.

The last swing high near A$80.44 gives a near-term target if bullish continuation continues. However, resistance beginning around A$82.69 could cap this move. A break of this resistance might continue to probable resistance near A$86.27 and reach above the cluster of relatively equal highs near A$92.15.

2. Polygon (MATIC)

Polygon MATIC is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications. The MATIC token will continue to exist and will play an increasingly important role, securing the system and enabling governance.

MATIC Price Analysis

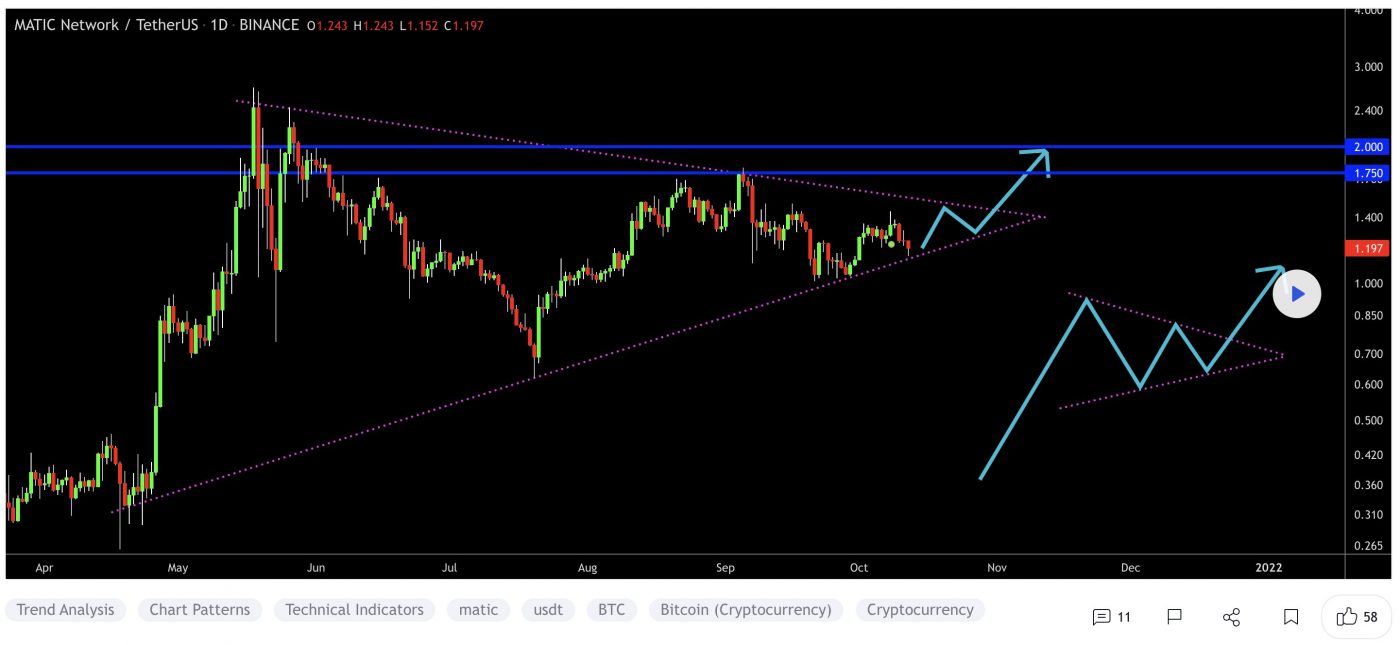

At the time of writing, MATIC is ranked the 22nd cryptocurrency globally and the current price is A$1.64. Let’s take a look at the chart below for price analysis:

August marked a turning point for MATIC, with the price rocketing up almost 85% from its lows to probable resistance beginning near A$2.35.

The price is currently struggling with the area between A$1.75 and A$1.41. This region could provide support after a close above – or resistance after a close below.

A retracement could reach into the daily gap and possible support around A$1.60. A more bearish shift in the marketplace will likely aim for the relatively equal lows near A$1.55, and the potential support just below that begins around A$1.49.

Continuation to the upside will likely target the monthly high near A$1.77. However, probable resistance beginning at A$1.84 and A$1.90 could cap or slow down this move.

3. Internet Computer (ICP)

The Internet Computer ICP is the world’s first blockchain that runs at web speed with unbounded capacity. It also represents the third major blockchain innovation, alongside Bitcoin and Ethereum – a blockchain computer that scales smart contract computation and data, runs them at web speed, processes and stores data efficiently, and provides powerful software frameworks to developers. By making this possible, the Internet Computer enables the complete reimagination of software, providing a revolutionary new way to build tokenised internet services, pan-industry platforms, decentralised financial systems, and even traditional enterprise systems and websites.

ICP Price Analysis

At the time of writing, ICP is ranked the 27th cryptocurrency globally and the current price is A$56.97. Let’s take a look at the chart below for price analysis:

In mid-August, ICP also turned the corner, breaking a key swing high in early September. This move could suggest a longer-term bullish trend.

The swing high near A$74.24 stands out as a bullish target and marks an area of probable resistance. Further continuation could reach into possible resistance starting near A$80.35.

Even if the bullish trend continues, a stop run at the recent swing low near A$54.30 into possible support beginning near A$50.87 is reasonable. If the price reaches further down, the swing low and possible support near A$48.27 might provide another downside target.

The area near A$46.75 could also provide support. However, a drop this far could suggest a stop run below the higher-timeframe relatively equal lows near A$42.18 into possible support beginning around A$40.73.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.