Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Polygon (MATIC)

Polygon Network MATIC is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications. MATIC, the native token of Polygon, is an ERC-20 token running on the Ethereum blockchain. The tokens are used for payment services on Polygon and as a settlement currency between users who operate within the Polygon ecosystem. The transaction fees on Polygon sidechains are also paid in MATIC tokens.

MATIC Price Analysis

At the time of writing, MATIC is ranked the 19th cryptocurrency globally and the current price is A$1.78. Let’s take a look at the chart below for price analysis:

After retracing nearly 80% from its highs, MATIC wicked into the monthly gap beginning near A$1.20. This wick formed the bottom of the current range.

The price shows no apparent signs of a longer-term reversal, which may mean that the closest resistance near A$1.89 will continue to suppress the price. However, some support could be found near the monthly open, possibly giving bulls footing for a stop run through the swing high at A$1.93.

This move could continue into resistance near A$1.98 and spike through the relatively equal highs near A$2.07. A break of the next swing high near A$2.19 is likely to find resistance once it reaches A$2.25. If this move occurs, it may suggest a longer-term reversal.

A retest of possible support near A$1.67 could provide an entry for a short-term trade. However, there is a higher probability for more substantial support near A$1.62 after a run on the lows at A$1.55 and A$1.49.

2. Compound (COMP)

Compound COMP is a DeFi lending protocol that allows users to earn interest on their cryptocurrencies by depositing them into one of several pools supported by the platform. When a user deposits tokens to a Compound pool, they receive cTokens in return. These cTokens represent the individual’s stake in the pool and can be used to redeem the underlying cryptocurrency initially deposited into the pool at any time.

COMP Price Analysis

At the time of writing, COMP is ranked the 57th cryptocurrency globally and the current price is A$561.29. Let’s take a look at the chart below for price analysis:

COMP has dropped nearly 82% from its highs, with the current low’s wick in June taking stops below two major swing lows.

The resulting bounce found resistance near A$548.36, which could continue to cap upward movement. If the price finds support in the current region near A$570.29, it could continue to resistance just above the relatively equal highs near A$589.72. A more substantial move might run stops above the swing high near A$597.11 into resistance near A$612.83.

A break below the monthly open is likely to target buy stops near A$550.28, an area that could provide some support. A move below this level could target below the swing low at A$529.06, possibly reaching the gap beginning near A$508.33.

3. Omg Network (OMG)

Omg Network OMG, formerly known as OmiseGo, is a non-custodial, layer-2 scaling solution built for the Ethereum blockchain. As an Ethereum scaling solution, OMG Network is designed to allow users to transfer ETH and ERC20 tokens significantly faster and cheaper than when transacting directly on the Ethereum network. The network is powered by the OMG utility token, which can be used as one of the payment methods for fees on the OMG Network, and will eventually be stackable – helping to secure the network in return for rewards.

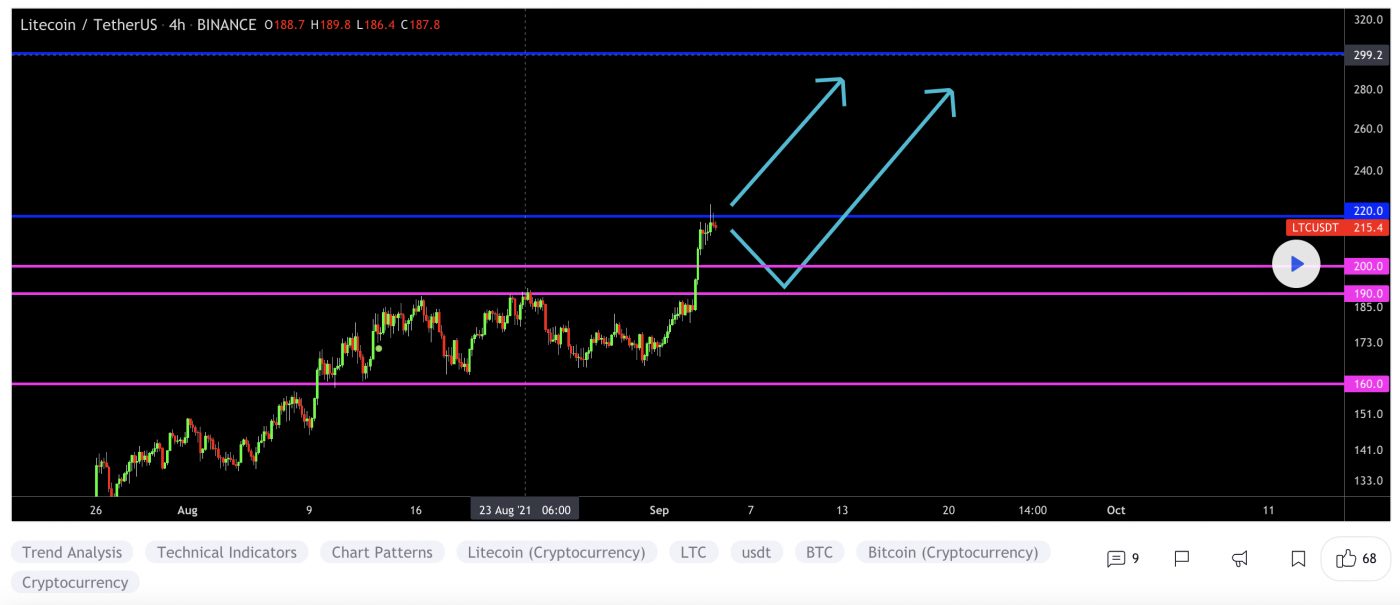

OMG Price Analysis

At the time of writing, OMG is ranked the 91st cryptocurrency globally and the current price is A$10.55. Let’s take a look at the chart below for price analysis:

OMG‘s 77% drop has filled the June monthly gap twice as the price consolidated between A$6.25 and A$6.87.

The price’s current region, between A$9.36 and $10.97 and just under the monthly open, could continue to give support. If this area continues to hold, the cluster of relatively equal range highs up to A$11.28 is a likely target.

An animated move through these highs could reach up to the daily gap beginning at A$11.49. The area between A$11.83 and A$12.17 provides a likely cap for a move into this zone.

A drop lower could be a run-on stop under A$9.66 and find support near A$9.30. If this level is lost, the swing low at A$8.92 is a likely target, with A$8.69 possibly giving support.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.