While Bitcoin was trading at $26,240 AUD price levels, we saw a mini Altcoins rally following Bitcoin & Ethereum. Unfortunately, BTC crashed before it was going to make a new ATH (All-Time High). This impacts Altcoins every time when a market crashes resulting the Altcoins in a bloodbath.

Where Blockstack STX was holding a tight position & bounced back from its support levels to continue the bullish trend. Let’s take a quick look at STX, price analysis, and possible reasons for the recent bounce back.

What is Blockstack?

Blockstack is a new decentralized internet where users own their data and apps run locally. A browser portal is all that’s needed to get started.

Blockstack Quick Stats

| SYMBOL: | STX |

| Global rank: | 75 |

| Market cap: | $221,315,337 AUD |

| Current price: | $0.3128 AUD |

| All time high price: | $0.5341 AUD |

| 1 day: | +2.36% |

| 7 day: | +6.69% |

| 1 year: | +112.58% |

Blockstack Price Analysis

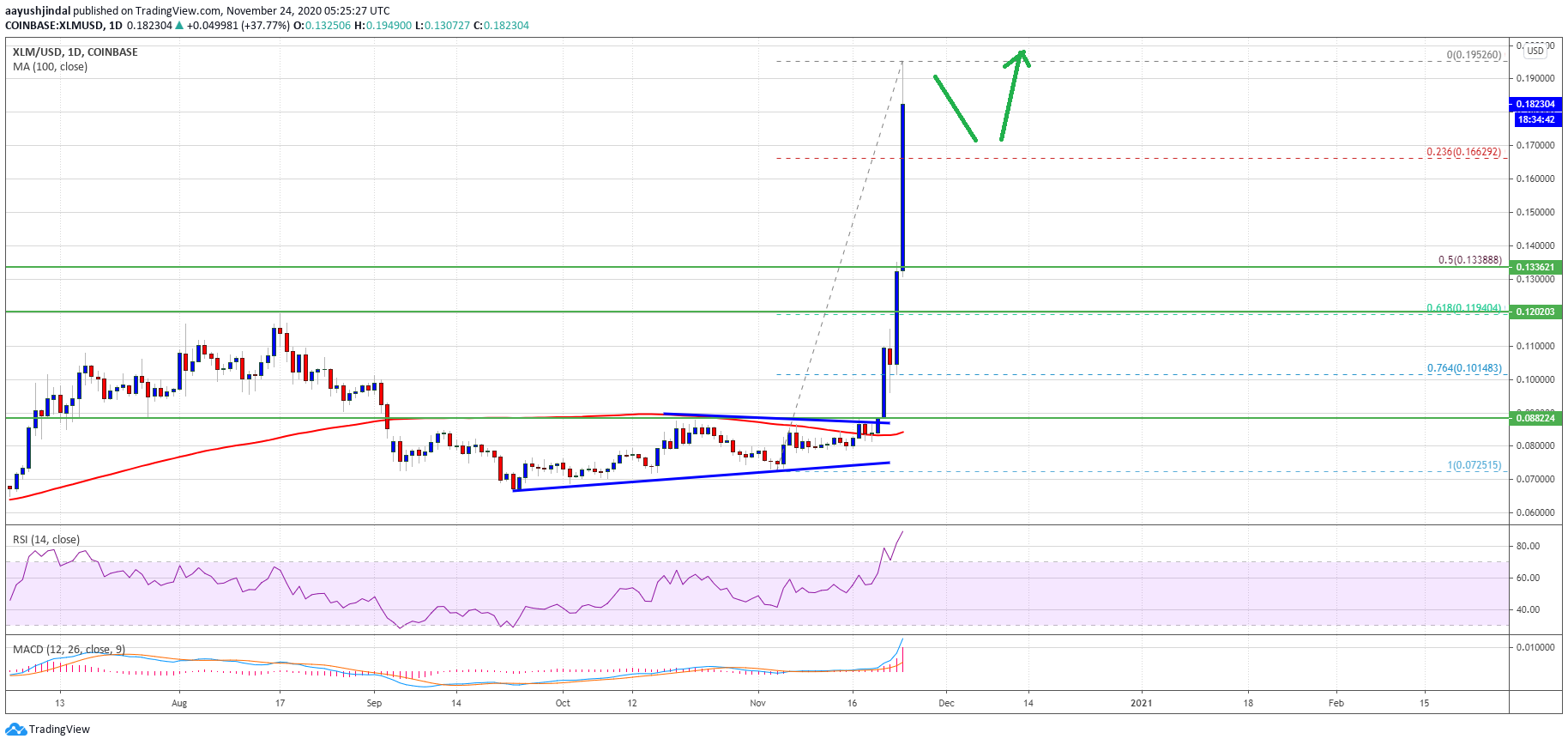

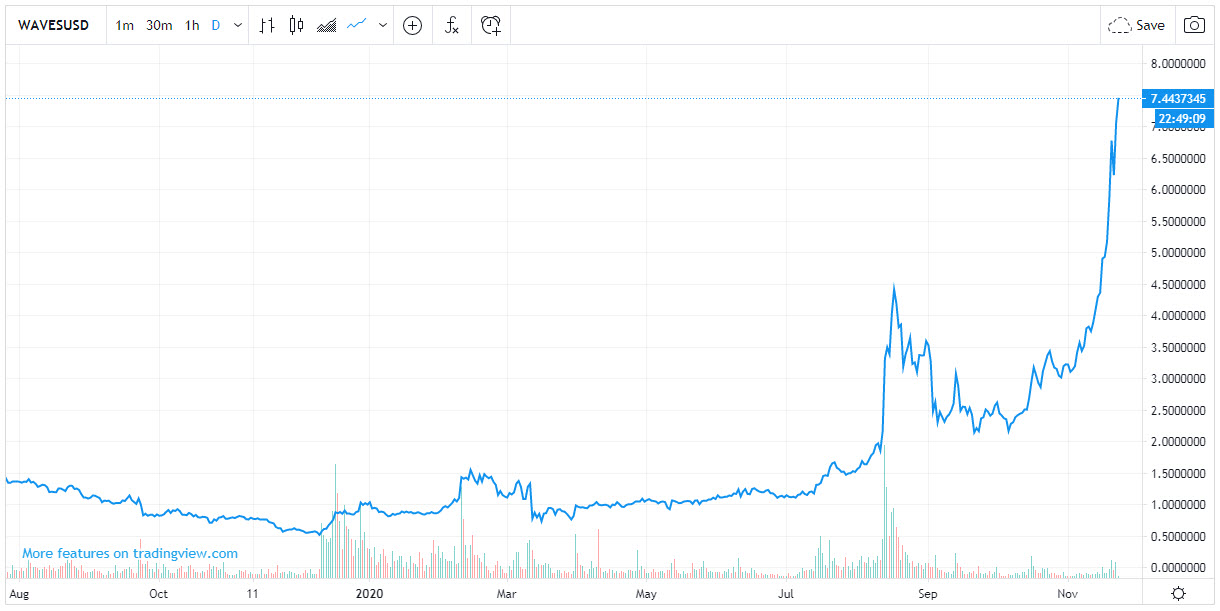

At the time of writing, STX is ranked 75th cryptocurrency globally and the current price is $0.3128 AUD. This is a +6.69% increase since 20 November 2020 (7 days ago) as shown in the chart below.

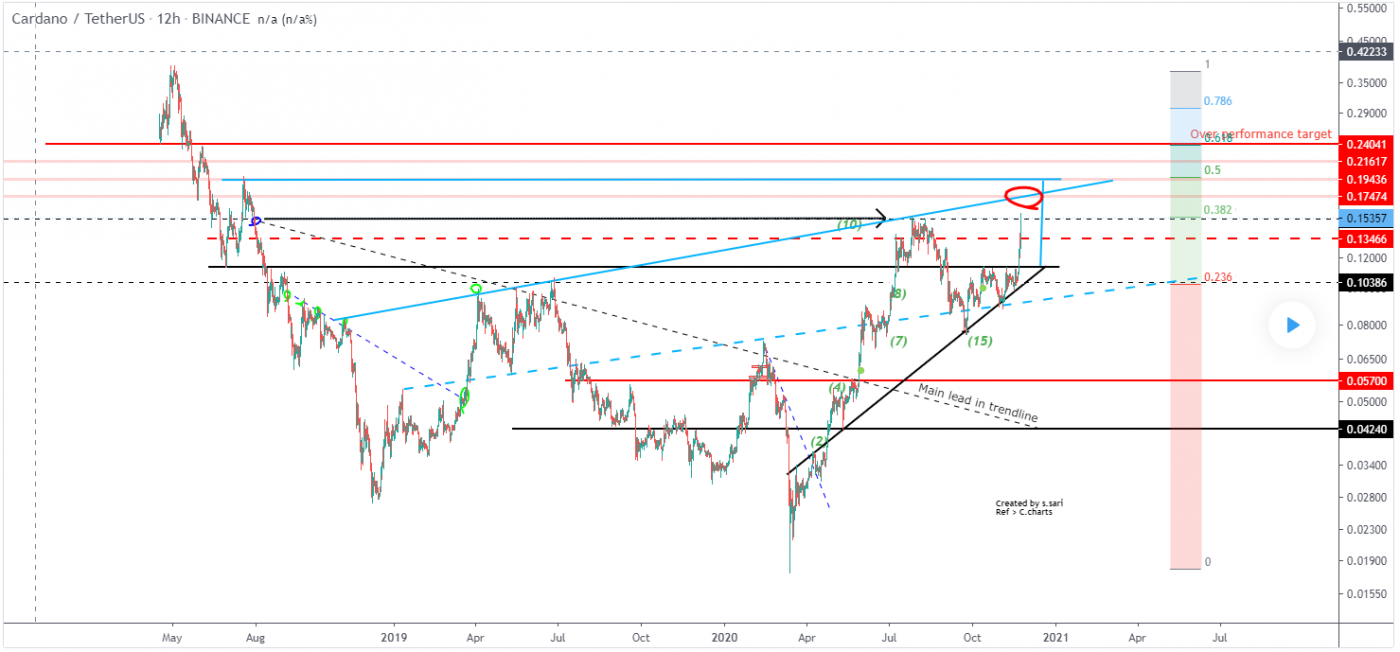

Blockstack STX moved up recently from its support level and challenged MA200, the black line on the chart. A rejection happened at this level which ended in a higher low. We are now seeing its price recovering, there might also be some additional growth to it.

“MA200 is the 200-day simple moving average (SMA) is considered a key indicator by traders and market analysts for determining overall long-term market trends. The 200-day SMA seems, at times, to serve as an uncanny support level when the price is above the moving average or a resistance level when the price is below it”

What do the Technical indicators say?

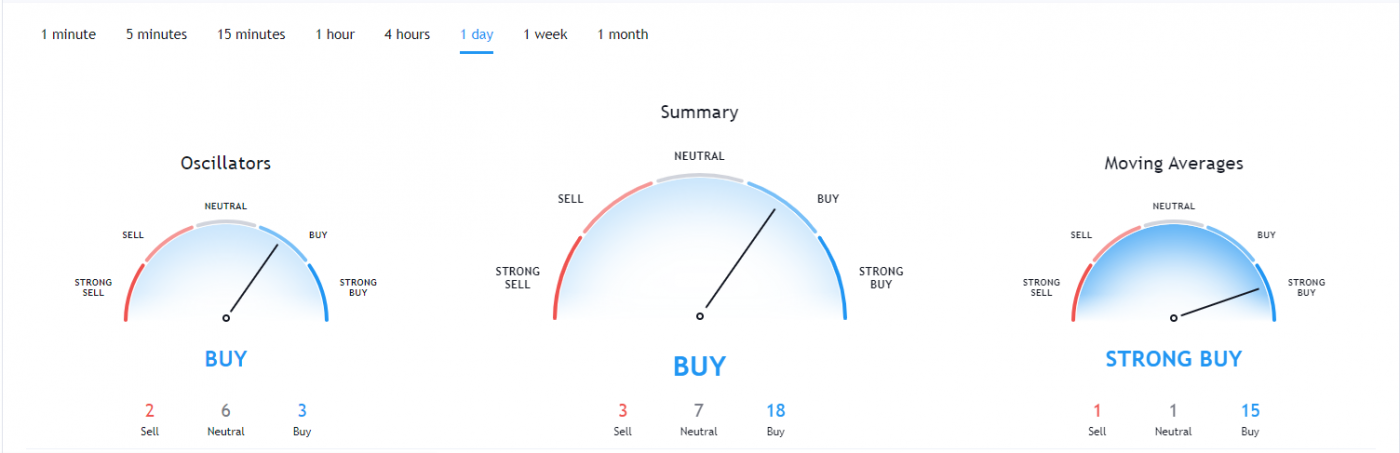

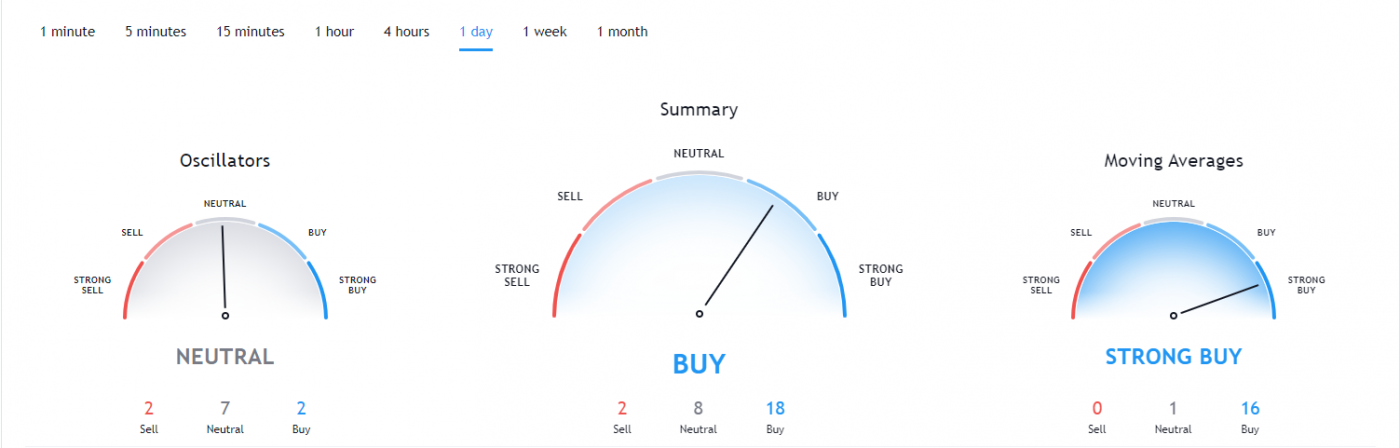

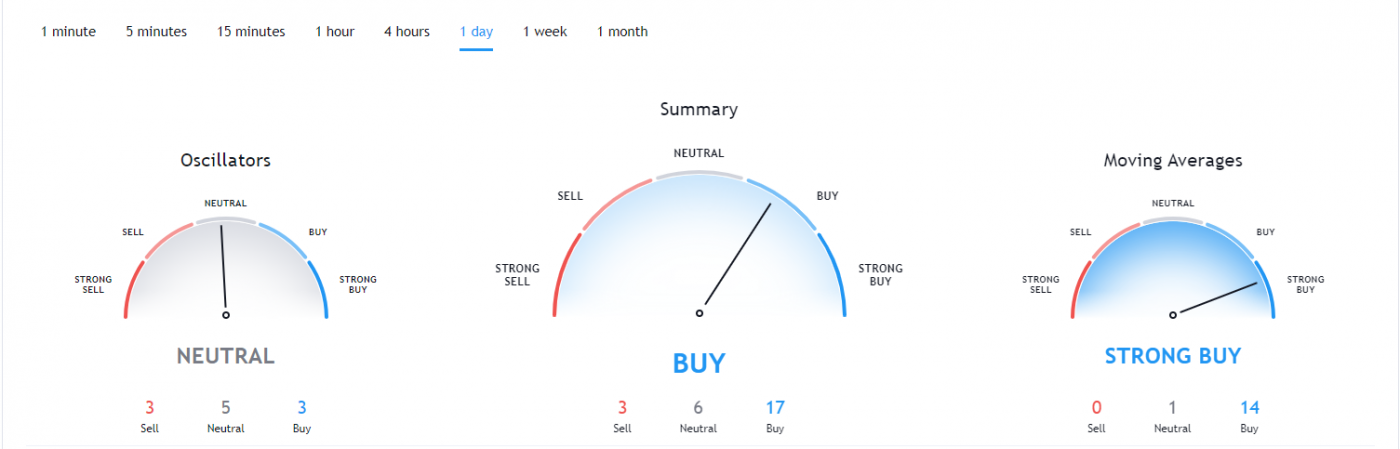

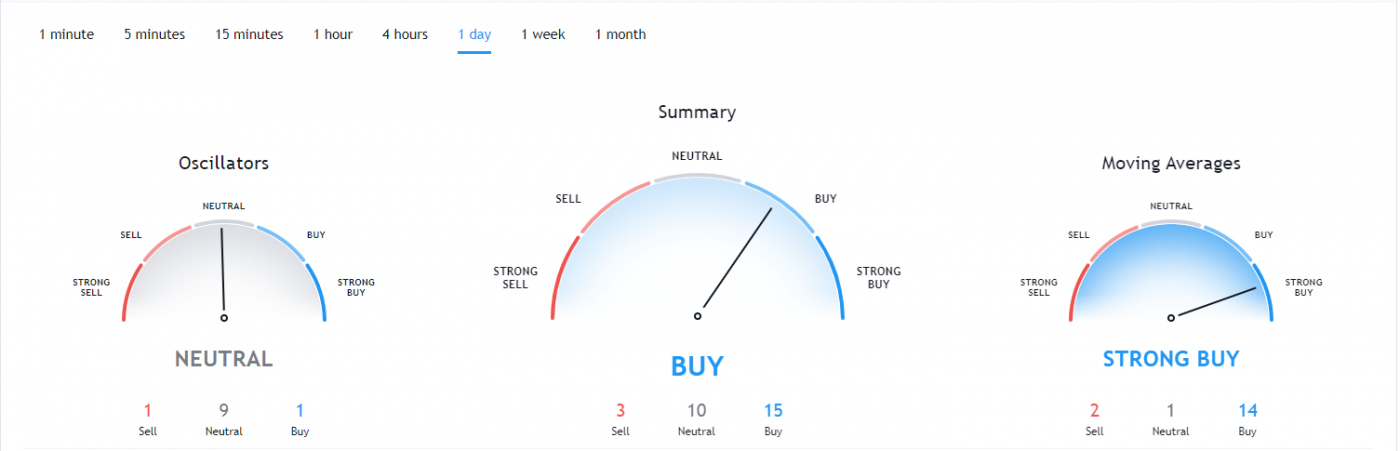

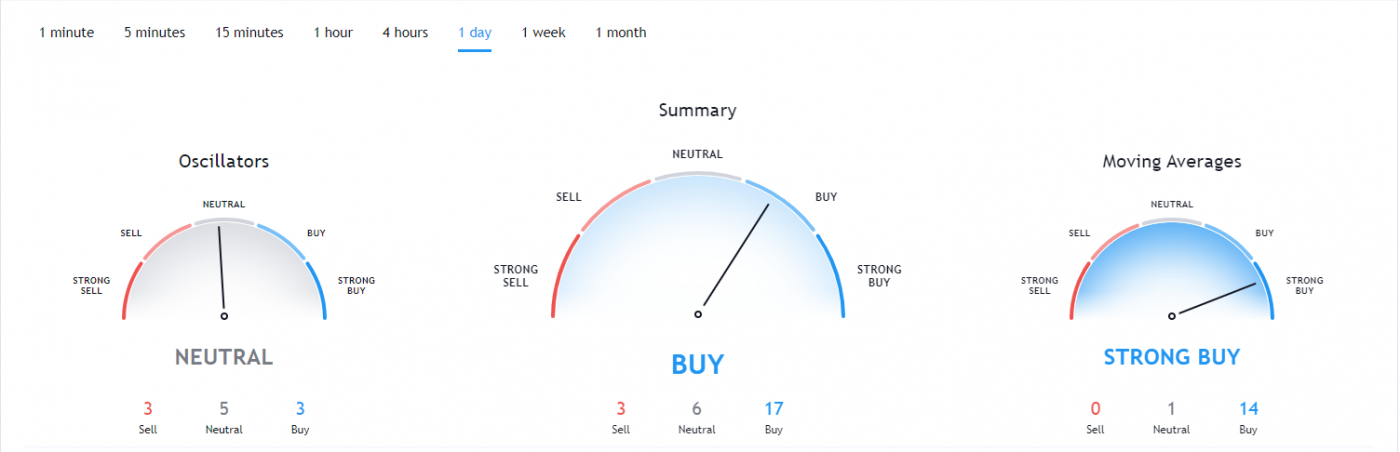

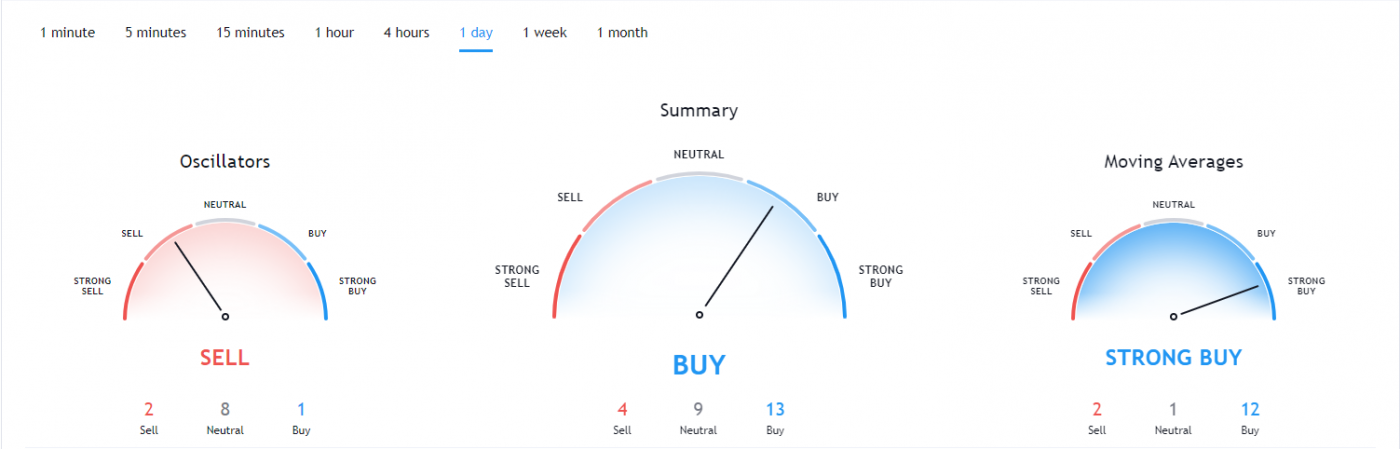

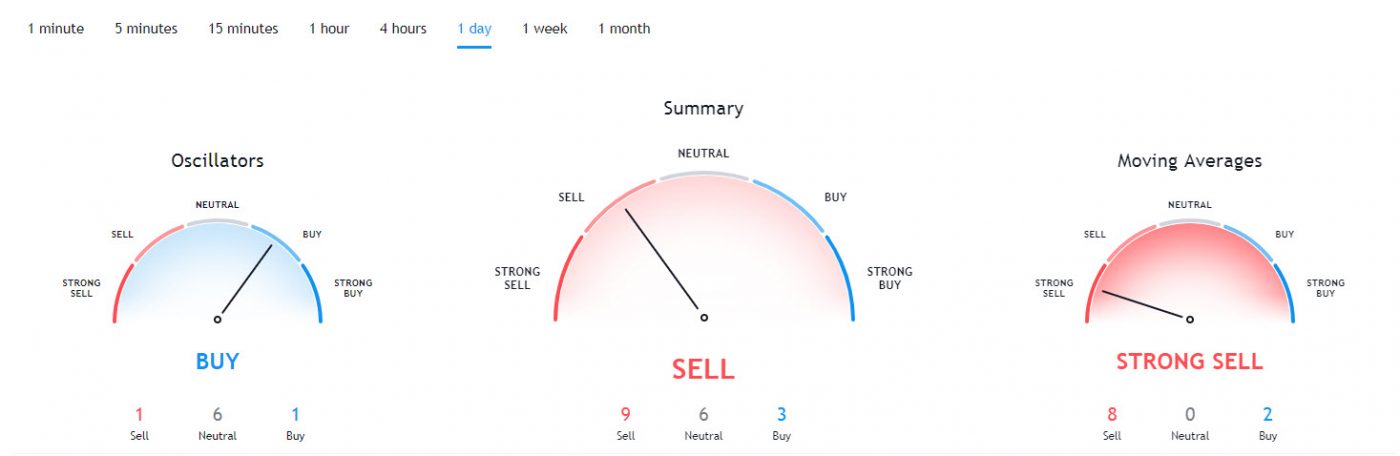

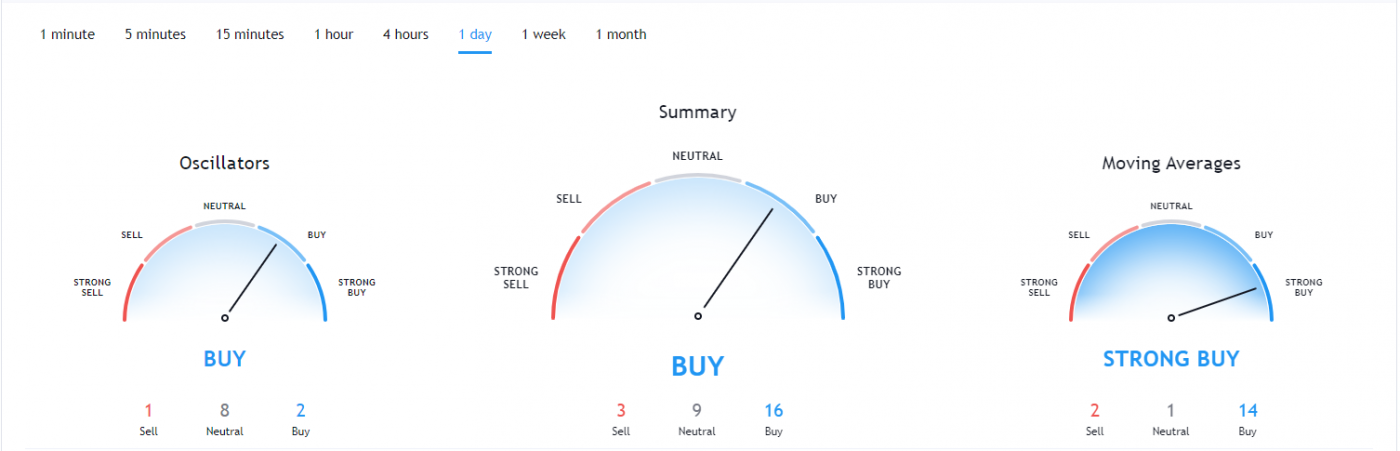

The STX TradingView indicators (on the 1 day) mainly indicate STX as a buy, except the Moving Averages which indicate STX as a strong buy.

So Why did STX Bounced Back?

Blockstack is a solid project with its clear vision, a new decentralized internet where users own their data and apps run locally & the recent rise in Bitcoin over 100% since the halving in May and then the suggested start of the Altcoin season could have contributed to the recent bounce back. It could also be contributed to some of the recent news for upcoming Nigeria: STX 2.0 Mainnet launch today.

Recent Blockstack News & Events:

- 17 November 2020 – STX2.0 Mainnet on Binance

- 18 November 2020 – SAU: STX 2.0 Mainnet AMA

- 24 November 2020 – Vietnam: Stacks 2.0 AMA

- 26 November 2020 – Nigeria: STX 2.0 Mainnet

- 15 December 2020 – Stacks 2.0

- 16 December 2020 – Stacks 2.0 Mainnet

Where to Buy or Trade Blockstack STX?

Blockstack has the highest liquidity on Binance Exchange so that would help for trading STX/USDT or STX/BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.