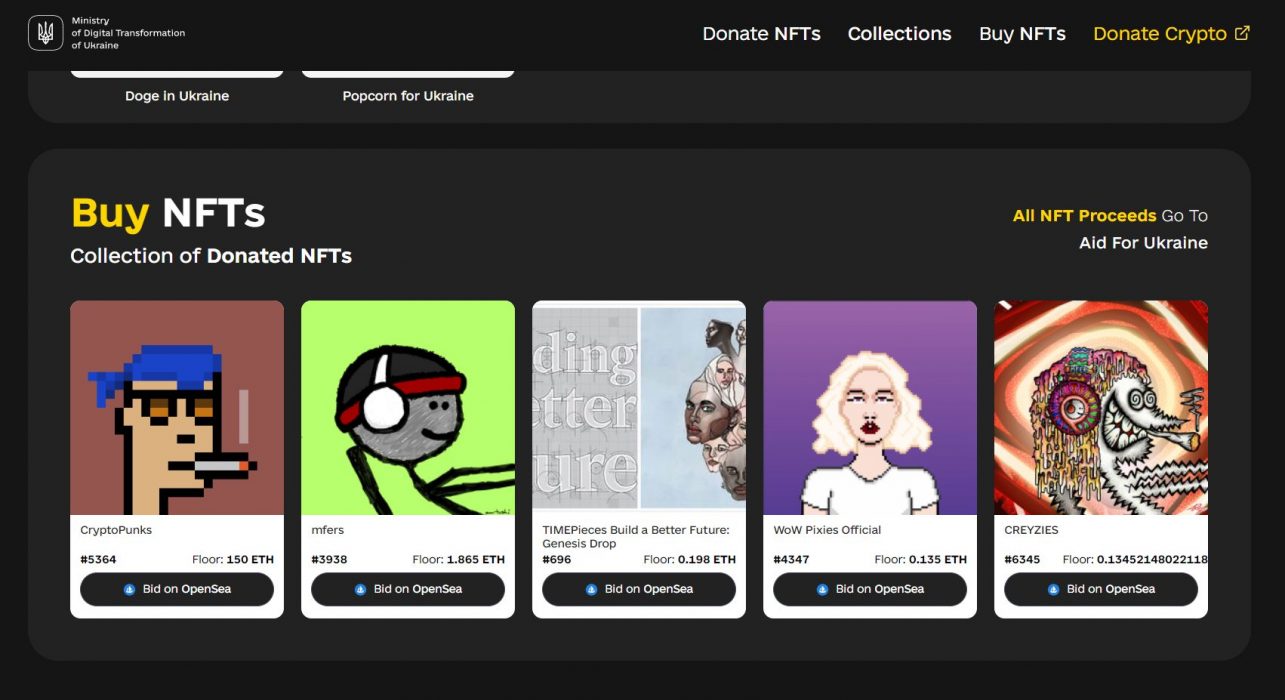

The Ukrainian government has launched a website for NFT (non-fungible token) donations in an attempt to raise funds to aid the country’s military forces in their ongoing conflict with Russia.

Supporting the Ukrainian Military With NFT Donations

The new marketplace, which comes with an ETH address for everyone wishing to donate, will host a wide range of NFTs, including the popular MoonCat collection and the Ethereum-based CryptoPunks.

So far, the Ukrainian government has received over US$100 million from crypto donations, an amount acquired shortly after digital assets exchange Kraken and the Bored Ape Yacht Club (BAYC) joined the charitable efforts last month.

The proceeds were largely used to buy the necessary equipment for Ukraine’s military arm, including bulletproof vests, medicine, and general supplies.

Blockchain, crypto and NFTs will not stop missiles, said Alex Bornyakov, the Deputy Minister of Digital Transformation of Ukraine, “but [they] do offer a way to protect our defenders and rebuild Ukraine as an innovation-friendly country”:

While the Ukrainian government is happy to attract crypto donations, recent news of its limiting crypto purchases has baffled the wider community. As Crypto News Australia reported last week, the National Bank of Ukraine has prohibited citizens from buying more than 100,000 UAH (approximately US$3,400) worth of crypto per month.