At last, progress towards tokenised asset trading by the Australian Securities Exchange (ASX) has taken a step forward rather than a step back. A test pilot has been successfully completed with the help of Zerocap, demonstrating how ASX-listed companies could store and trade on the exchange:

It’s Getting Closer

Thanks to Zerocap and its Synfini settlement project, the ASX was able to bridge its custody infrastructure to the platform for trial purposes. Doing so permits the trading and clearing of Ethereum-based tokenised assets.

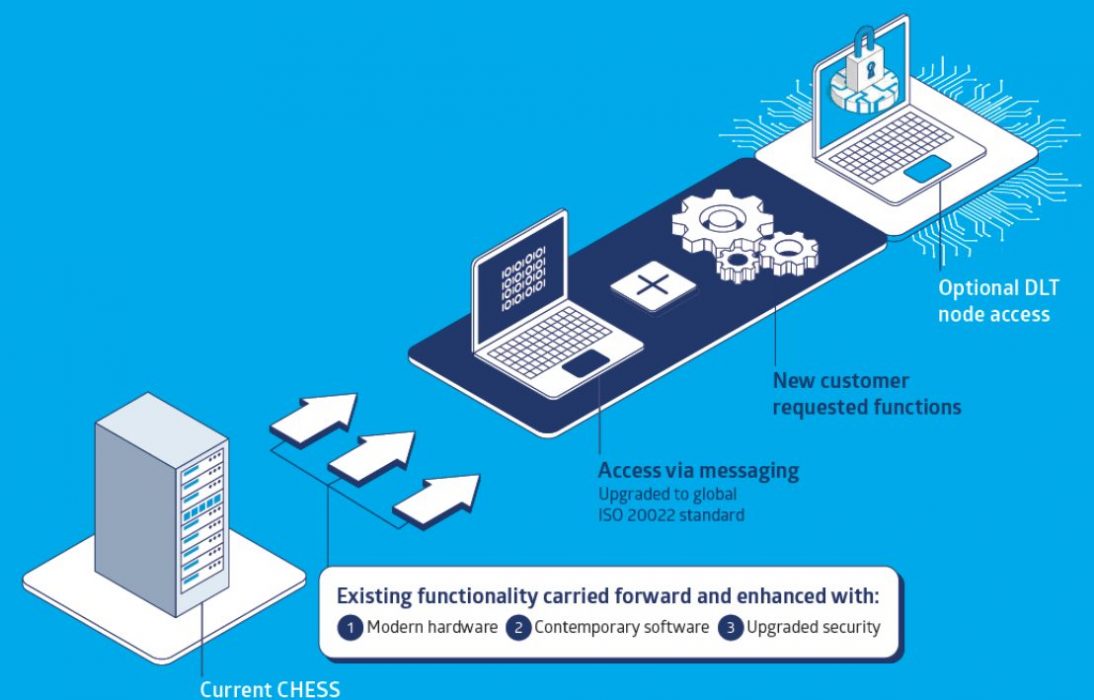

This recent test pilot is only one part of ASX’s distributed ledger technology (DLT)-based settlement project. Synfini launched in November as a separate initiative from the blockchain-based CHESS (Clearing House Electronic Subregister System) replacement, an upgrade that has been the bane of the project’s existence for some time. The platform allows users access to DLT infrastructure, ledger services and data hosting, while also permitting them to build blockchain applications from it:

According to Zerocap CEO Ryan McCall, final legal approval has been given to launch Synfini asset tokenisation and trading services. He believes there is high interest from organisations who wish to explore tokenisation, along with trade bonds, carbon credits and funds.

Thinking beyond Bitcoin, Ethereum and other crypto assets, the tokenisation of bonds, equities, property, carbon credits, private equity, and anything that’s essentially illiquid, there’s a strong value proposition here that we can essentially tokenise any asset and bridge that into the ASX ecosystem.

Ryan McCall, co-founder and CEO, Zerocap

McCall also has faith that Synfini will be a popular tool among a wide range of firms due to the platform’s user-friendly interface and refined variables.

Plagued by Delays

The ASX’s immersion with blockchain has previously been delayed a whopping five times. The most recent of these delays was blamed on issues with blockchain replacement for the clearing system CHESS, and was awaiting an independent review. A spokesperson for ASX stated that “more development is required than previously anticipated to meet ASX’s scalability and resilience requirements for the application”.

The delay to CHESS prior to this was blamed on the firm building the software. At that stage, the project was believed to have already cost ASX A$187 million.