A world-first Australian blockchain pilot could be the answer to Australia’s lost excise tax revenue issue. The collaboration between the federal government and consulting company Convergence.Tech will mark the first radical tax system overhaul in a century, addressing the hundreds of millions of dollars lost in uncollected excise each year.

Alcohol on the Blockchain

The pilot targets one of Australia’s significantly haemorrhaging industries: alcohol. According to Australian Taxation Office (ATO) estimates, alcohol excise duty should bring in A$6.5 billion annually for the government. However, the ATO estimates that 9 percent of this figure currently cannot be collected – equating to A$582 million in lost revenue.

The Pilot Grants Program has tasked Convergence.Tech with leading exploration into reducing regulatory compliance burdens for businesses via blockchain tech, according to Australia’s new National Blockchain Roadmap.

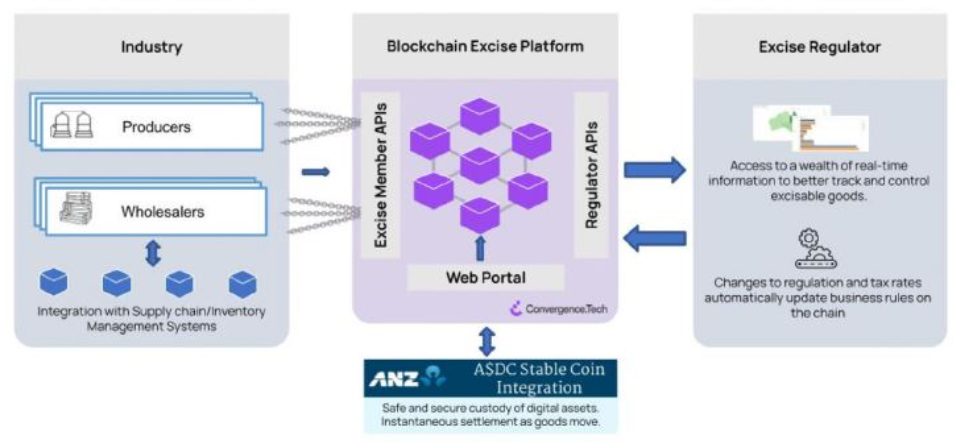

The resulting pilot Blockchain Excise Program can track excisable goods from production through the supply chain to their eventual sale. The platform will use a private blockchain to allow the industry to provide a real-time ledger of alcohol transactions directly to the regulator.

This type of technology … allows us to focus our efforts, have a differentiated approach and hopefully reduce compliance costs for the legitimate operators.

Anthony Barnard, director, Excise Centre, ATO

According to analysis by KPMG, this tax system overhaul could potentially recover A$45 million in lost excise revenue each year. Anthony Barnard, director of the ATO’s Excise Centre, says that the “prospect of being able to trace goods through the supply chain is very exciting for the ATO”.

A$DC Powers the Pilot

However, a relationship with fiat currency must be established prior to the implementation of any of this technology. Thus Convergence.Tech and the Australia and New Zealand Banking Group (ANZ) have been working together to integrate the platform with A$DC – ANZ’s Australian dollar stablecoin. Doing so will provide digital assets with financial liquidity and enable automatically triggered remittance of the excise duty liability to the regulator as alcohol moves through the supply chain:

ANZ will also be able to offer wholesalers and distillers digitised inventory via custodian services, alongside remittance and refunds through highly secure digital wallets and immediate transfers.

The pilot is currently trialling this innovation with spirits; however, it could be extended to beer and ultimately real estate, hydrogen, fuel and tobacco, thereby reaping larger benefits for the relevant industries, taxpayers and regulators alike.

Blockchain and the Aussie Government

In July 2021, the Australian government’s Blockchain Grants Program allocated A$5.6 million towards supply chain pilots. The goal was to explore how blockchain could positively influence Aussie supply chains by aiding companies to navigate regulatory hurdles. Everledger, a digital transparency company, received A$3 million, and Convergence.Tech A$2.6 million.

In additional positive news, the federal government included blockchain in its co-called ‘Blueprint for Critical Technologies’ in November 2021. The blueprint is a strategy to both protect and promote essential technology, and the inclusion of blockchain has signposted the government’s position on the matter.