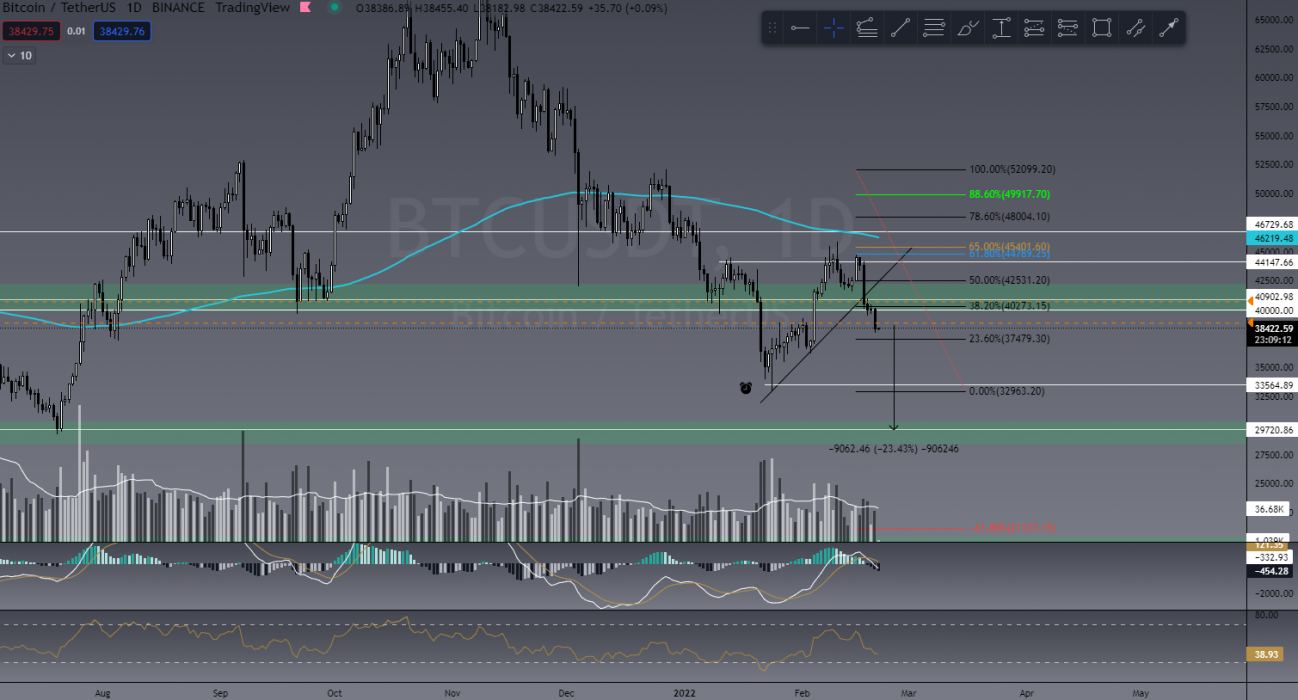

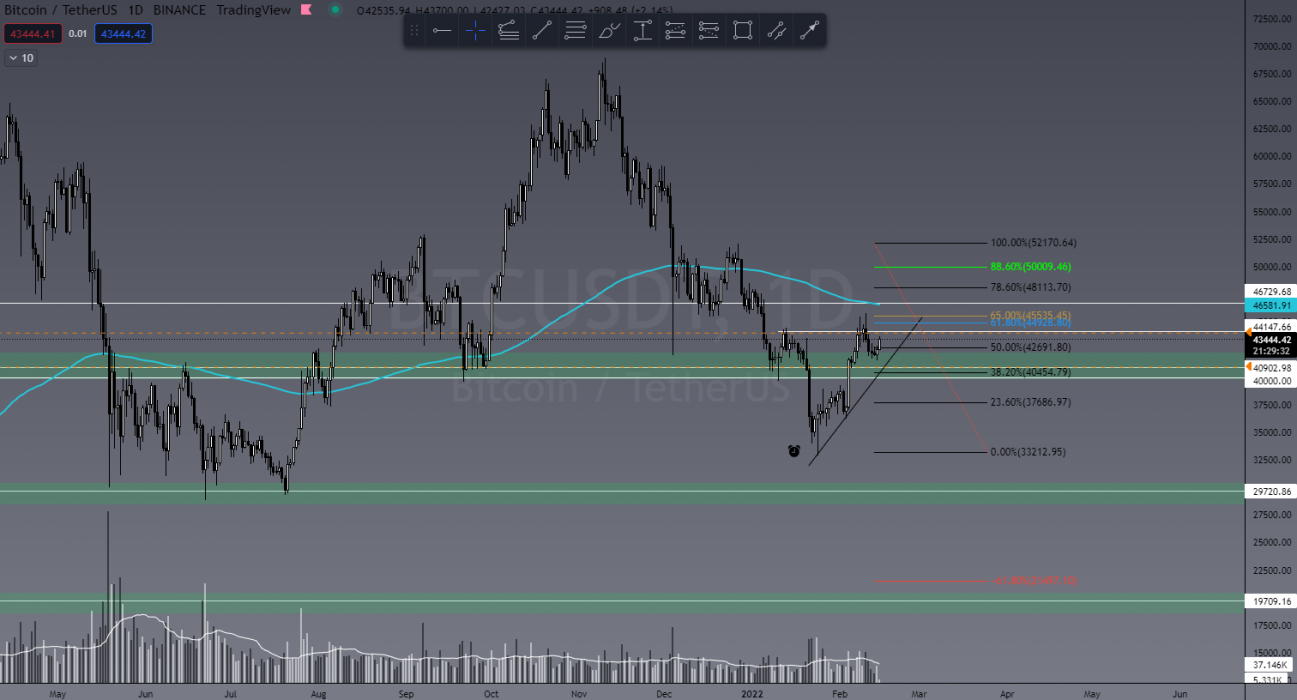

According to a global markets strategy PDF released by leading investment bank JPMorgan, the price of bitcoin (BTC) production has sunk to approximately US$13,000 from early June’s US$20,000.

This is reportedly the result of the bear market brought on by the crypto winter:

Bitcoin Miners: Crypto Winter Strikes Back

JPMorgan has found that the production cost to mine one Bitcoin has dropped from an estimated US$24,000 to a lowly $13,000, a 10-month low according to Bloomberg.

The bank’s strategists, led by Nikolaos Panigirtzoglou, have found that the recent plunge in BTC’s production costs resulted from the following combination of factors:

The decline in electricity use as proxied by the Cambridge Bitcoin Electricity Consumption Index, while the hash rate has been fluctuating in recent months with no clear downtrend.

Nikolaos Panigirtzoglou, strategist, JPMorgan

Despite improved profitability suggesting that pressure for miners to sell their bitcoin holdings for liquidity purposes could lessen, the decrease in costs is typically seen as a negative for the overall bitcoin price:

Although opinions vary, data from MacroMicro suggests that the production cost remains steady at approximately US$17,700. MacroMicro justifies this by explaining that the lower the mining costs, the more miners will join. However, when mining costs are higher than miners’ revenue, numbers will logically fall.

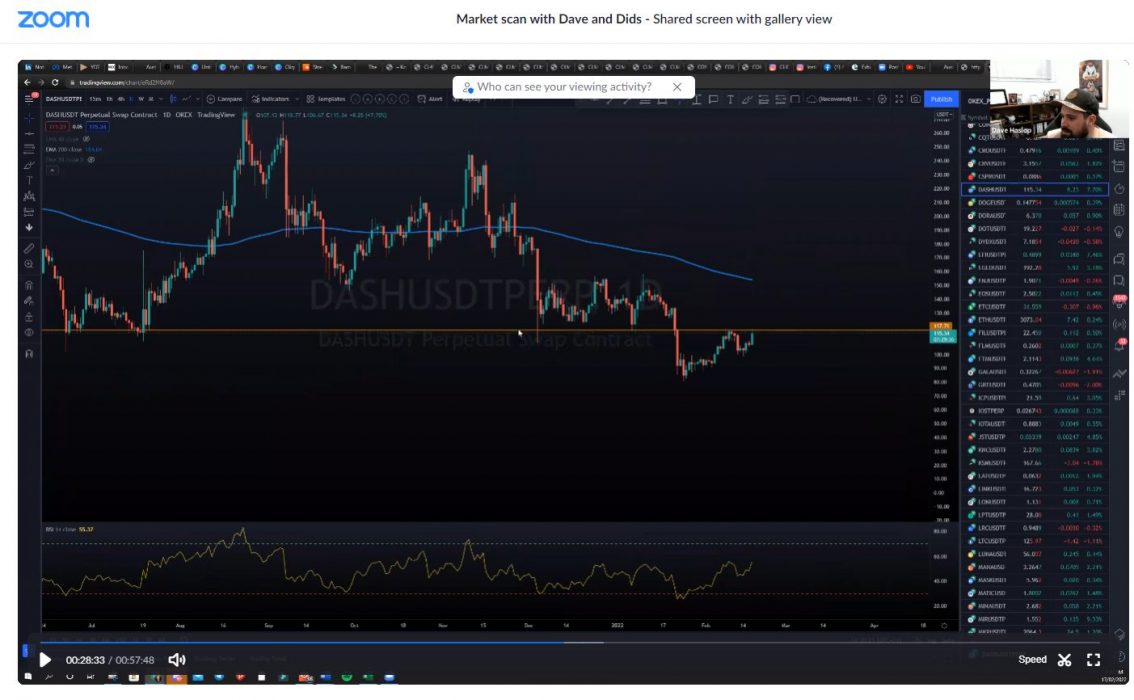

Funding a Mining Operation

The cost of bitcoin mining depends on several variables, chief among which is electricity costs incurred by miners for their required machinery. Providing bitcoin’s price exceeds maintenance costs, a mining operation will be profitable. However, mining operations must also consider infrastructure, labour and hardware costs for the maintenance of mining farms, all of which can vary. This crypto winter is also taking place while energy prices soar globally.

Bitcoin miners aren’t alone in their struggles, however. Miners of all sorts are facing pressure created by the damaging plunge of bitcoin. Among those experiencing exponential lows this year-to-date: Marathon Digital Holdings is down 73 percent, Riot Blockchain Inc has dropped 73 percent, and Core Scientific Inc is down a whopping 83 percent. Worse yet, there’s scope for these figures to continue falling.

Luckily, there is hope when it comes to infrastructure, with the Bloomberg report suggesting mining costs can be reduced via the deployment of more energy-efficient mining rigs, such as those becoming available thanks to Intel and Bitmain.

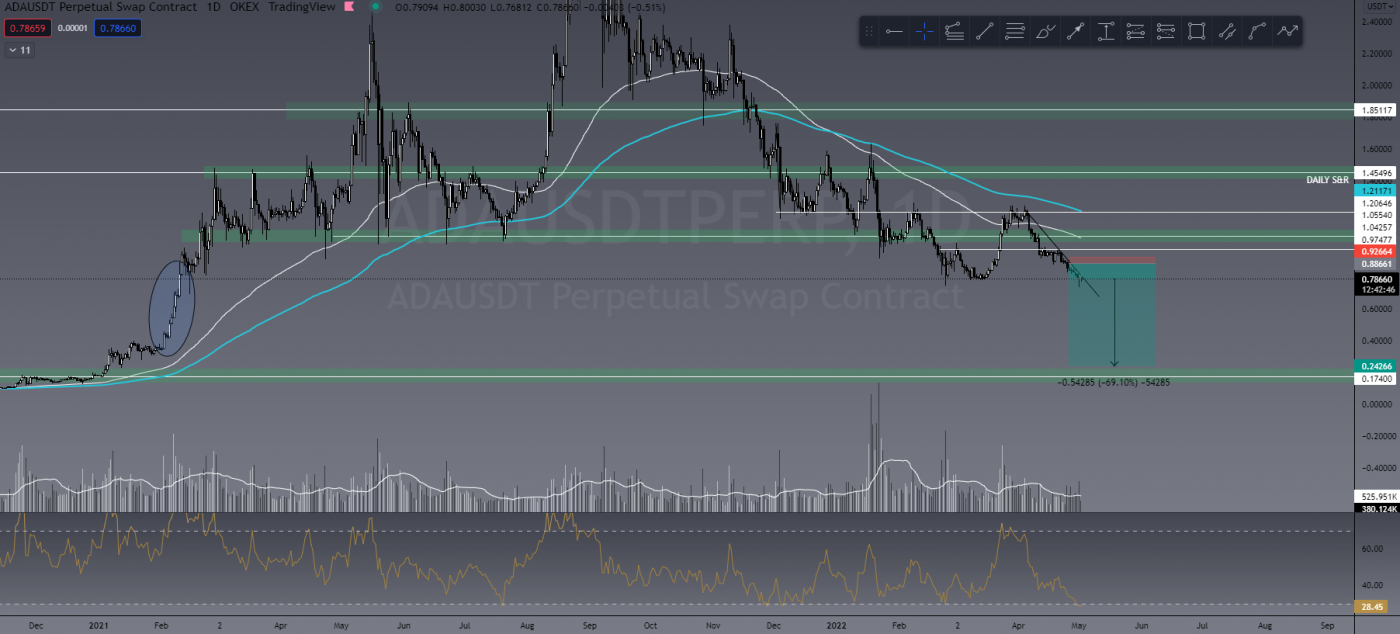

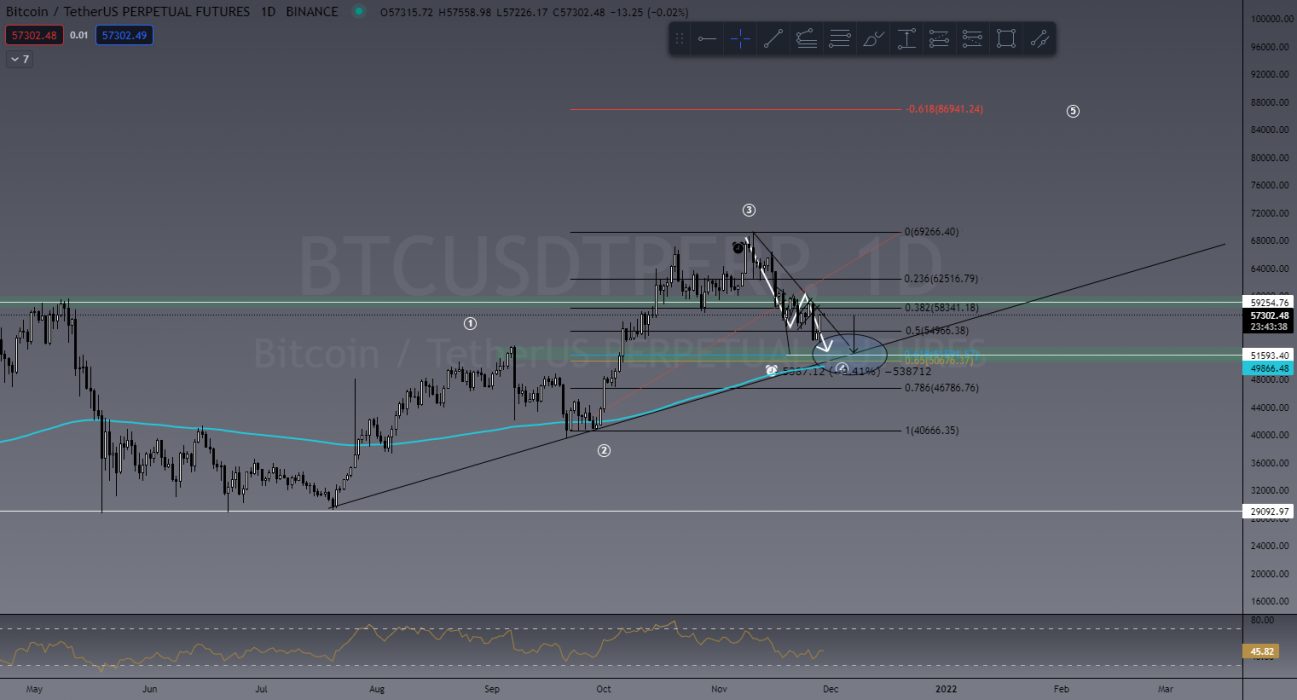

Bitcoin Falls on Rough Times

July has been somewhat of a nightmare month for bitcoin as it fell under US$19,000 following the US’s highest inflation print in 40 years. Economists had initially predicted an 8.8 percent June year-on-year inflation rate; however, the reality was 9.1 percent, which meant an immediate dip in BTC’s price.

To add further stress, Bitcoin has also had to address the strain placed on diamond hands, namely those investors who normally refrain from selling an investment despite downturns or losses. Glassnode, an on-chain analytics firm, discovered that while the total unique Bitcoin count had exceeded 1 billion, diamond hands were selling at an average loss of 33 percent.