A cashed-up Bored Ape Yacht Club (BAYC) enthusiast has just paid a huge 777 ETH (US$1.5 million) for a single Ape, defying the current market downturn.

Crypto millionaire and BAYC superfan Vis.eth purchased Bored Ape #5383 for its gold fur, after already spending millions on Otherdeeds:

Median Price Hits Two-Month High

The Ape purchased this week by Vis.eth is the 285th rarest in the BAYC collection, notable for its gold fur and red checked shirt. The purchase pumped the median price for the collection, pushing it to a new two-month high of 441 ETH.

Vis.eth’s purchase of Ape #5383 netted a 500 percent profit for its previous owner, who originally bought it for 95 ETH. The “metaverse mogul” is no stranger to these purchases, having already spent millions on Otherdeeds from Yuga Labs’ Otherside project, and some CryptoPunks:

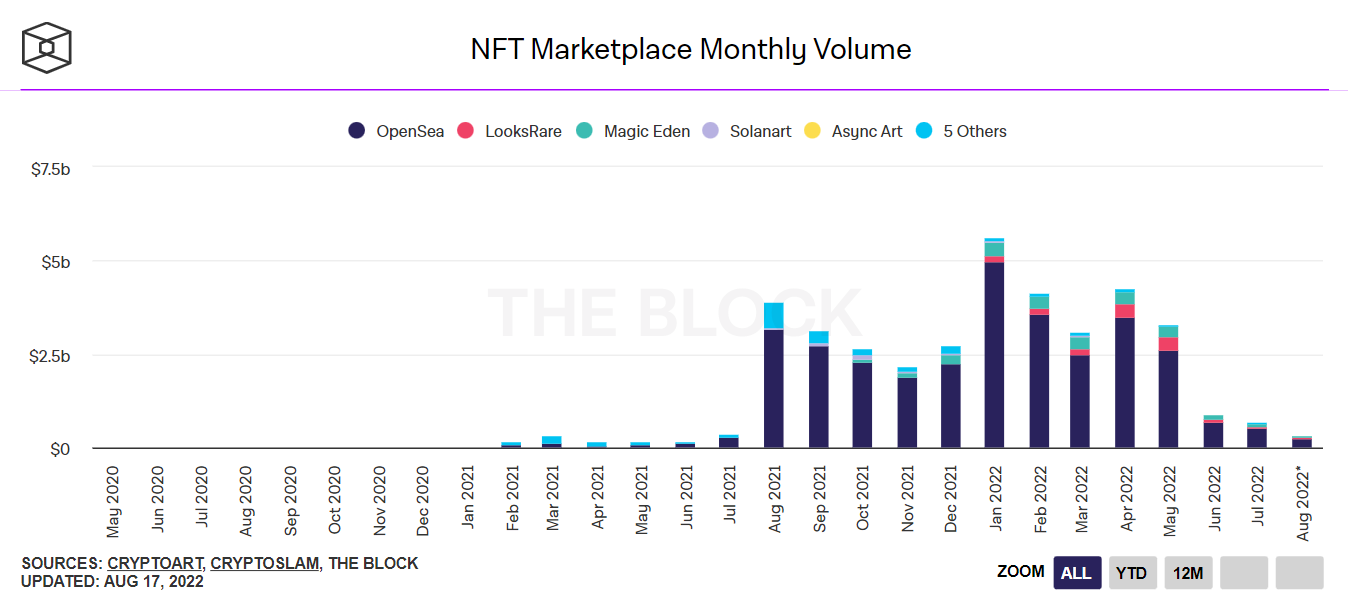

The monthly volume for the NFT marketplace has been at abysmally low levels during the crypto winter. Total sales for July were a meagre US$675.53 million in comparison to January’s US$5.63 billion:

Eventful Year for Yuga Labs

Yuga Labs has been stuck between a rock and a hard place of late, with both the media and the courts snapping at its heels. In late July, a class-action lawsuit was filed by international law firm Scott+Scott over allegations that it falsely promoted Bored Ape NFTs and ApeCoins as securities with guaranteed returns, despite their value actually plummeting in the subsequent three months.

Prior to the lawsuit, Yuga Labs faced damning allegations of racism which rocked the industry. Philip Rusnack, aka Philion, posted a lengthy YouTube video identifying supposed alt-right connotations among the memes, language and symbols used in Bored Ape Yacht Club (BAYC) collections. This led to the trending ‘BURNBAYC’ hashtag, which was circulating on Twitter at the time.