Coinbase’s Super Bowl ad, basically a US$15 million QR code, saw its platform crash within a minute during the February 14 NFL final playoff. The simplistic, but initially successful, marketing technique drew thousands of Super Bowl spectators to the site, which was ill-equipped to handle the influx:

The ad itself was simply a colourful QR code bouncing around the screen, akin to the ‘DVD video’ logo. Scanning the code took new users to a platform where they could sign up for US$5 worth of free bitcoin – with the deal available until the following day. Not every viewer was able to get that far, however:

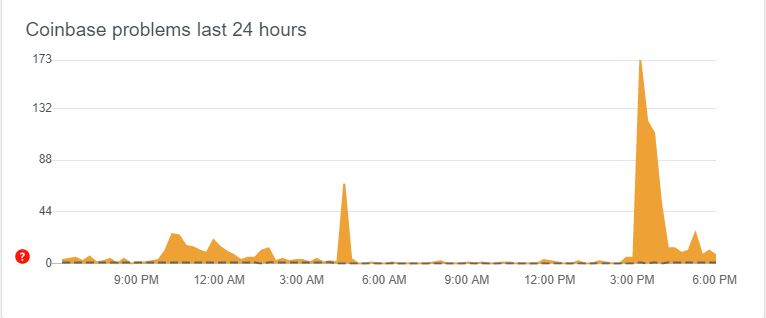

Coinbase’s chief product officer Surojit Chatterjee took to Twitter to explain that the platform “saw more traffic than [it had] ever encountered” and that the issue had since been rectified. The crash lasted no longer than an hour; long enough, however, for Coinbase’s exposure to backfire. Coinbase shares took a 5 percent dive as many expressed their frustrations across social media.

The US$15 million ad was live only for a single minute timeslot.

Previous Coinbase Troubles

While Coinbase’s Super Bowl outage was the result of positive consumer interaction, the exchange has suffered previous negative performance issues. In late 2021, hackers stole crypto from 6,000 of the exchange’s users. It was suggested that the hackers had managed to gain access to personal user information in the lead-up, likely from external sources. However, a bug in the exchange’s multi-factor authentication was the cause.

Earlier last year, Coinbase had another significant crash that prevented investor attempts to purchase. Bitcoin and Ethereum had dipped in value, which saw a sudden rise in buyer interest. The platform’s inability to handle the response saw its stock price dip accordingly.

By Lauren Claxton, Crypto News Guest Author