Speculation about the financial position of the Sam Bankman-Fried backed companies FTX and Alameda Research has led to Binance dumping its FTT and shaken the value of the crypto tokens.

On November 7, Binance CEO Changpeng “CZ” Zhao tweeted that the company would liquidate the FTT it holds “due to recent revelations that have came to light…” and would aim to avoid impacting the market.

Those “revelations” arise from a recent report by CoinDesk that raised concerns about the ties between Sam Bankman-Fried’s two companies and how Alameda Research’s financials indicate its biggest asset is unlocked FTT.

FTX Financial Concerns “Unfounded”: SBF

CEO of trading firm Alameda Research, Caroline Ellison, claimed on Twitter that the balance sheet that sparked the concern was incomplete and did not reflect more than $10 billion of assets held by the company.

FTX founder and CEO of crypto exchange FTX, Sam Bankman-Fried took to Twitter to thank supporters and especially “those who stay level headed during crazy times” in light of what he describes as the “unfounded rumours” circulating.

In his tweet about liquidating Binance’s FTT tokens, CZ Zhao said Binance encouraged industry collaboration and had no intent to hurt users or other platforms, stating: “Regarding any speculation as to whether this is a move against a competitor, it is not.”

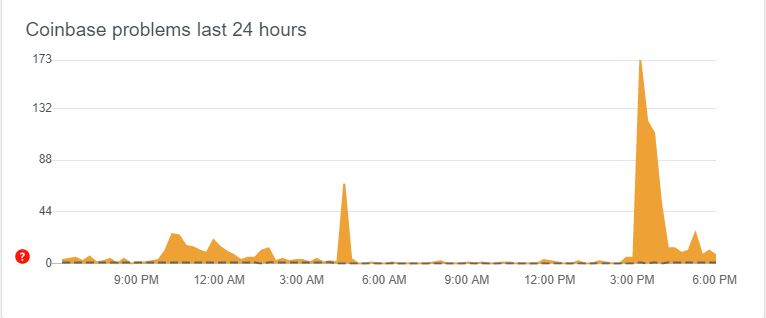

The taint of scandal has already had an impact, with FTT down more than 12 percent in the past seven days, currently trading at $22.35. Many social media users are wary of the token’s collapse.

Bankman-Fried said the exchange would keep going:

“And in the end you should do what you want, and trade where you want. We’re grateful to those who stay; and when this blows over we’ll welcome everyone else back.”

Sam Bankman-Fried, FTX CEO