Despite a short-lived rally mid-week, crypto markets have tumbled over the past few days as they follow the lead of the US stock market, which on May 5 recorded its single worst day of trade since March 2020.

According to data from CoinMarketCap, at the time of writing Bitcoin was trading at US$36,421, a 24-hour loss of 8.07 percent, while the overall crypto market cap was down 7.65 percent.

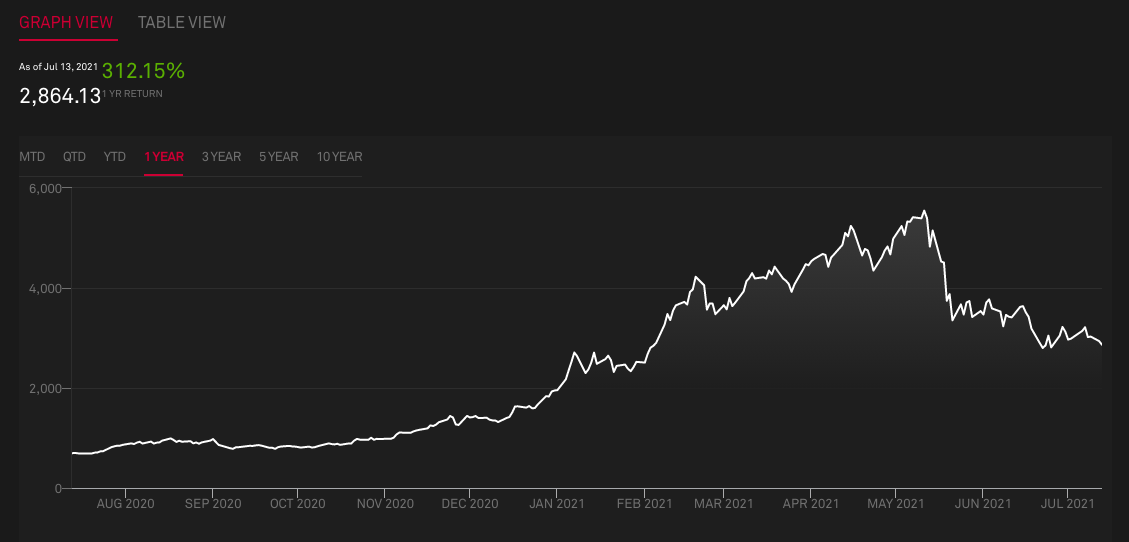

7-Day Total Cryptocurrency Market Cap. Source: CoinMarketCap

Financial Markets Plunge in Response to Rate Rise

The falls on the stock market that sparked the crypto losses were triggered by the US Federal Reserve’s decision to raise interest rates by 50 basis points.

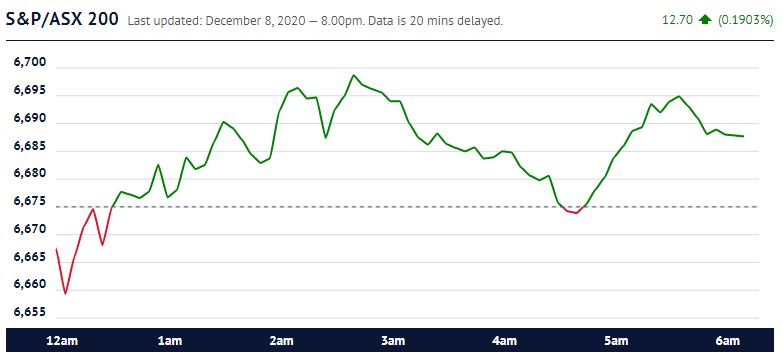

On May 4 the news was initially welcomed by markets, as it was in line with what many expected, spurring the S&P 500 to its biggest daily rally in two years. The following day, however, traders reconsidered the implications of the rise and the market dumped: the S&P fell 3.56 percent, the Dow Jones was down 3.12 percent and Nasdaq plunged 5.06 percent – its largest single-day percentage drop since 2020.

Crypto Down Across the Board

In line with the traditional financial markets, crypto was down virtually across the board. In addition to Bitcoin’s almost 8 percent drop on May 5, most top 10 coins saw substantial losses: Ethereum fell 6.78 percent, Solana was down 10.75 percent and Cardano lost 12.09 percent.

Given the changed broader economic conditions, Bitcoin and the wider crypto market face an increasingly uncertain period. Rekt Capital suggested on Twitter that US$38,400 may mark the new line of short-term resistance, and the popular crypto market analyst believes that BTC will need to close the month above that figure to have much chance of a rally in the medium term:

So far, 2022 has been an unhappy year for crypto generally – this latest downturn, in addition to several other sharp declines, including major losses in January and again in April, have left the crypto market cap down over 20 percent since January 1.