Decentralized exchanges (DEXs) are on track to reaching another massive monthly trading volume, according to the latest market report by Messari, a cryptocurrency analytics platform. DEXs are one part of the decentralized finance (DeFi) industry that has gained immense growth in participation and market valuation since the past year, especially during the rush in DeFi.

Judging by the trading volume, the exchanges had an awakening moment in July where the volume began spiking consecutively to the all-time monthly high in September.

With 15 days left to conclude the month, DEXs could see a new ATH.

DEXs are Seeing High Trades in 2021

DEXs are seeing high market participation in January, as the monthly trading volume is already up to US$22 billion, which is about six percent below the $23.4 billion recorded in December. Recent reports had indicated that more coins, especially Ethereum (ETH), have been leaving centralized exchanges (CEXs) to other places that include DEXs. Notionally, this somewhat explains the increasing trading volume posted on these DeFi exchanges.

Meanwhile, DEXs are likely to surpass the September ATH of US$26.7 billion, following the current trading volume so far. Potentially, the crypto analytics platform noted that the trading volume could hit a milestone record of US$55 billion in January. Among all the available decentralized exchanges, Uniswap dominates the market with a current monthly trading volume of $9.7 billion. Other leading DEXs by trading volume include SushiSwap, Curve, Synthetix, Kyber, Balancer, and dYdX.

Total Assets Valuation in DEXs

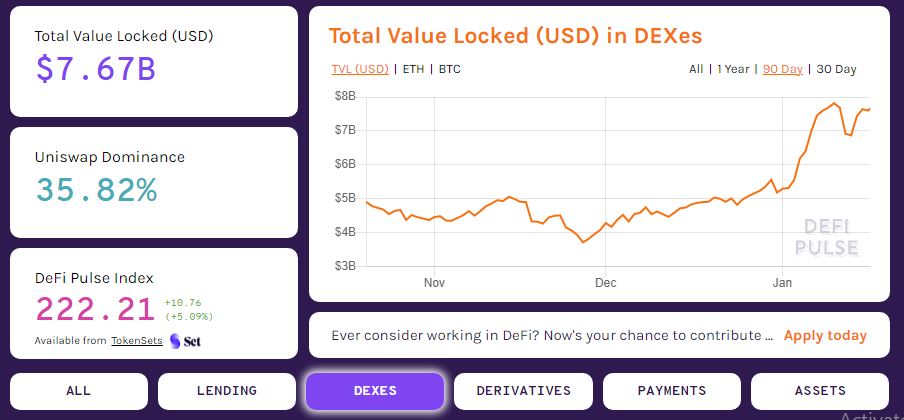

A glance at DeFi Pulse showed that DEXs are the second-largest set of DeFi protocols with about US$7.67 billion in assets locked – second to the Lending market, which has a total assets valuation of US$10.68 billion. The leading decentralized exchange, Uniswap, has more than US$2.7 billion assets locked, followed by Curve (US$1.9 billion), SushiSwap (US$1.83 billion), etc.