The US’ largest crypto exchange, Coinbase, has weighed in on the high-profile lawsuit brought against Ripple by the US Securities and Exchange Commission (SEC) by filing legal documents in support of Ripple.

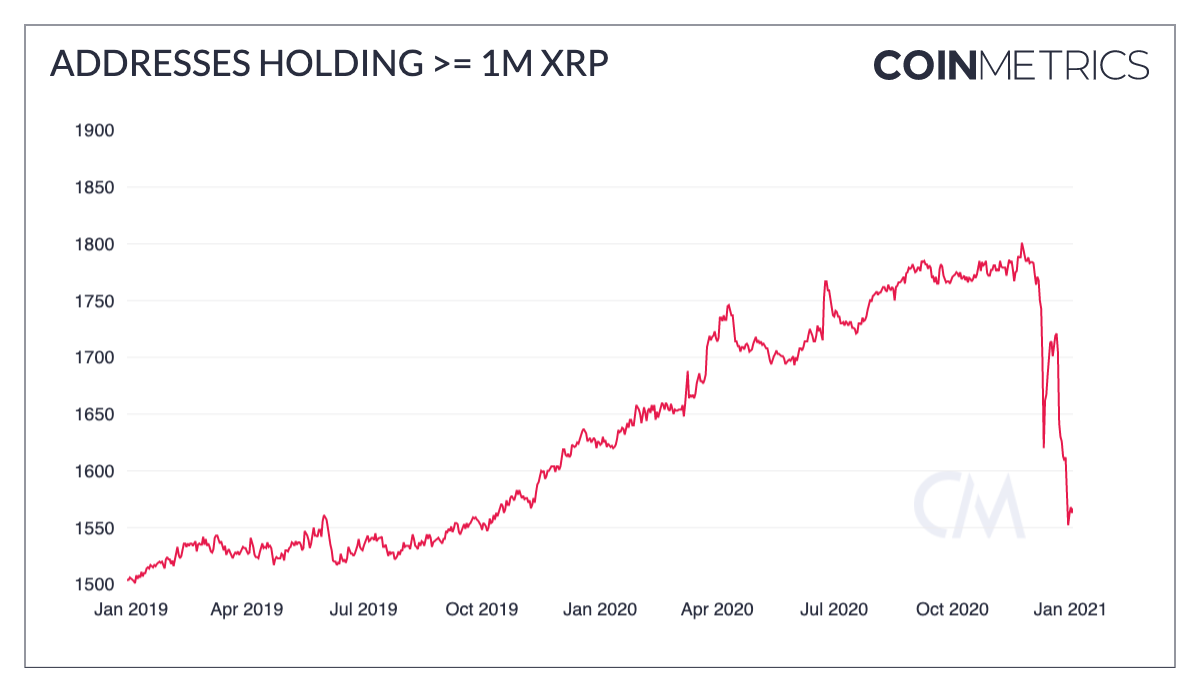

The amicus curiae brief submitted to the court by Coinbase argues that de-listing XRP from crypto exchanges in the wake of SEC’s legal action caused its market value to decline by US$15 billion, “resulting in significant losses to Coinbase’s customers.”

Coinbase’s brief pointed out it had previously urged the SEC to provide direction for the digital asset industry to provide certainty, and defended Ripple’s legal position:

“In the absence of a regulatory framework governing digital assets, Coinbase believes that parties like Ripple must be permitted to pursue fair notice defenses in matters where they are facing surprise enforcement actions like this one.”

Coinbase amicus brief in support of Ripple

Coinbase Support Strengthens XRP Position

Crypto payments network, Ripple, which has its own token called XRP, has been battling the SEC lawsuit since 2020 — disputing the regulator’s findings that Ripple conducted an illegal securities offering by selling XRP, which is the sixth largest crypto by market share.

Amicus briefs offer information or insights relevant to a case from an organisation not involved in the legal proceedings and are accepted at the discretion of the court.

In a Twitter thread about filing the brief, Coinbase Chief Legal Officer Paul Grewal said:

“One of the fundamental due process protections guaranteed by our Constitution is that government agencies cannot condemn conduct as a violation of law without providing fair notice that the conduct is illegal. By suing sellers of XRP tokens after making public statements signaling that those transactions were lawful, the SEC has lost sight of this bedrock principle.”

Coinbase Chief Legal Officer Paul Grewal

The lengthy legal battle has been closely watched due to its ramifications for the crypto industry. Ripple’s CEO has denounced the SEC for its “shameful” behaviour and at one point, Ripple accused the SEC of deleting material relevant to the case.

Support for Ripple by Coinbase and others including the Blockchain Association further strengthens the crypto firm’s position, and a number of legal experts have also speculated that the SEC is likely to lose.

Some in the crypto community called on Coinbase to go one step further in their support by re-listing XRP on the exchange: