With the ATO set to target Aussie crypto investors it is important that you understand that you need to declare your crypto in your tax returns.

To help you get ready for tax time in Australia, we’ve taken the main things you need to consider when declaring your cryptocurrencies.

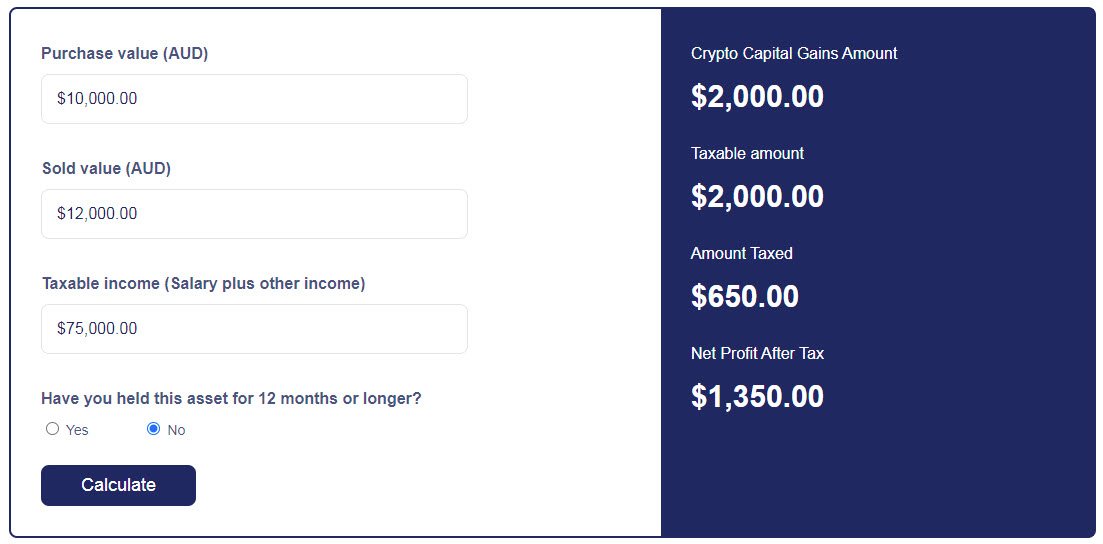

You can check out the full guide, written by Australian crypto exchange Swyftx. They have also created a crypto tax calculator which you can use to get an estimate on your tax payable.

Everyone has different tax situations so please clarify your personal circumstances with your accountant.

1. Investor vs Trader

First up, the Australian Tax Office (ATO) does not view crypto as money. Instead, crypto is seen as property, subjecting it to the Capital Gains Tax (CGT). This classification means that you should update your info every time you buy, sell or gift crypto. Keep in mind that HODLing for 12 months or more will bring with it a 50% CGT discount.

Going further, if you can classify yourself as a trader, your income might instead be taxed as business proceeds.

Here’s how to tell which category you fall into.

Investor: If you’re using crypto mostly as a personal investment and earning most of your profits by making long-term investments, you would be classified as an investor.

Trader: If, on the other hand, you are running a business involving cryptocurrency, you could be classified as a trader. For instance, if you buy crypto in order to turn a profit for clients from whom you receive a commission, you could be classified as a trader.

Keep in mind that the ATO has to agree with you on this – so make sure you keep accounting records, follow a business plan, and stick to your planned business model.

2. Capital Losses and Total Assessable Income

While the CGT will deduct from your crypto profits, the reverse is also true – if you’ve lost money trading on one trade while making money on another, the financial hit you’ve taken on the negative trade can help offset the CGT owed from the positive trade.

Furthermore, your income tax and CGT tax are paid together – this is called Total Assessable Income. Make sure to combine your incomes from all taxable sources in order to figure out which tax bracket you fall into.

What Information Does The ATO Collect? The ATO can collect personal information – including your ABN – from Designated Service Providers (DSPs) in order to ensure accurate income reporting.

When is CGT applied? CGT is applied whenever you dispose of your crypto, whether by giving it away, trading it or selling it. So if you bought Bitcoin five years ago but haven’t touched your stash yet, you’re good to go.

Personal Use Assets: Although CGT can be charged in some cases when crypto is used in order to buy goods and services, it may be classified as a Personal Use Asset, and therefore exempt from CGT.

Fred is buying a new laptop from his favourite online retailer. They offer discounts on purchases made in cryptocurrency, so Fred uses Australian dollars to purchase cryptocurrency, and on the same day purchase his laptop. In this instance, cryptocurrency would be constituted as a personal use asset.

3. Getting Paid In Crypto

If you work for a crypto-related business, you’re probably getting at least a part of your pay cheque in crypto. In this case, crypto would be classified as personal income tax, not as a capital gain.

Although crypto taxes can be confusing to deal with at first, Swyftx exchange does all it can to help by partnering with developers that provide accurate reporting tools – and by keeping easy-to-understand records of your activity.

If you need help with your crypto tax, check out our Top 10 Crypto Tax Accountants in Australia.