MetaMask is one of the most popular crypto wallets at the moment as it’s active monthly users reaches a massive 5 million milestone.

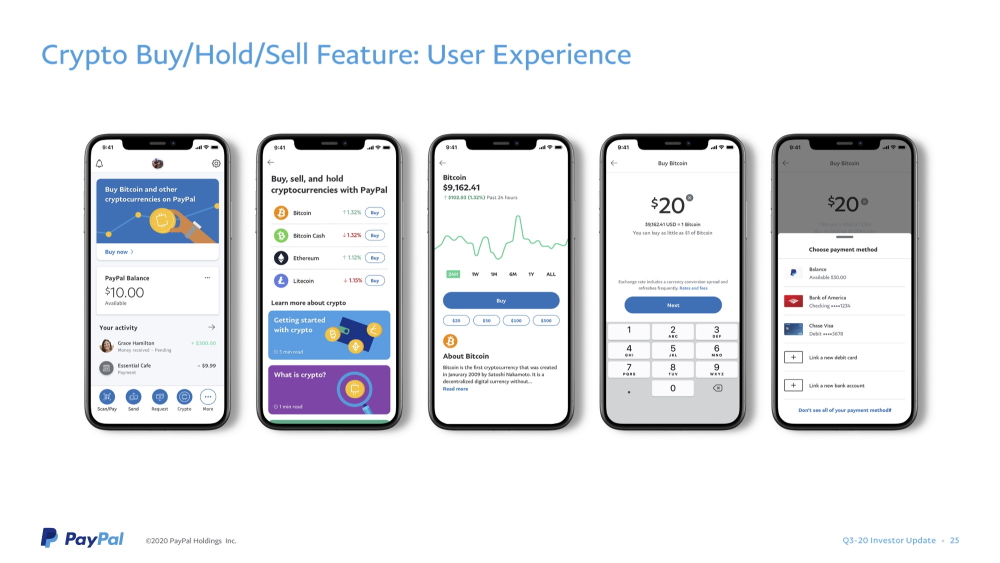

Powered by the Ethereum blockchain, MetaMask sports a flashy yet welcoming user interface which provides easy access to cryptocurrencies and tokens, especially DeFi and NFTs.

In a recent blog post, the team announced that MetaMask had reached a total number of 5 million active users – and reiterated their commitment to keeping the internet accessible to all.

“We cannot express how honoured we are to continue democratizing access to Web 3.0, and we look forward to serving the millions more users that are joining the decentralized web. This growth opens the possibility of a more ethical internet where people control their own data and identities, can build communities, and freely associate with one another through interactions that are empowering and based on consent.”

Metamask

Could DeFi Compete With The Banks?

One of the main vectors identified in the post for the growth of Metamask’s user base is the adoption of DeFi – specifically by those in countries where banks and financial services are lacklustre – if they exist at all.

Although in places such as Australia, China, the USA and the EU a bank account is more or less a necessity in this day and age, things are somewhat different elsewhere. For instance, 54% of people living in South America do not have access to bank accounts. This is not only due to denial of service by banks – many simply do not trust either their national banks or private banks operating locally.

As a result, many of these citizens have turned to cryptocurrency and DeFi as a way to store their assets, make investments, and take care of their daily expenses.

Following a rise in popularity that brought MetaMask to 1 million users by October 2020, their userbase has continued to grow exponentially – leading to the current figure of 5 million monthly users, carrying out transactions worth $2 billion within the past 6 months.