Stablecoins are a class of cryptocurrency developed to solve the problem of price stability as they are pegged to a reserve asset such as the US dollar. They provide price stability and liquidity to markets that operate on the blockchain.

The first fiat-backed coin was introduced in July 2014. Called Tether (TUSD), it is backed 1:1 by the USD. Since then there have been many more stablecoins emerging to help provide liquidity to crypto investors and traders while also supporting various networks to provide compatibility conversions for decentralised finance.

Blockchain-powered stablecoins have provided the world with global liquidity, instant processing of cryptocurrency payments, volatility-free stable valuations of fiat currencies, and interest-bearing liquidity providers. Let’s take a look at the different types of stablecoins and the best stablecoins to use in Australia.

Types of Stablecoins

There are essentially three types of stablecoins:

- Fiat-backed – these are backed off-chain by fiat currency such as USD.

- Crypto-backed – these are backed on-chain by cryptocurrencies such as BTC.

- Commodity-backed – these are backed by physical assets such as gold and silver.

Stablecoin Comparison Table

| Stablecoin Name | Symbol | Issued by | Type | Pegged | Marketcap | Features |

| Tether | USDT | Tether Limited, Hong Kong | Fiat-Collateralized | USD 1:1 | $62,485,619,423* | High liquidity |

| USD Coin | USDC | Circle, USA | Fiat-Collateralized | USD 1:1 | $27,716,248,195* | ERC-20 Support |

| Wrapped Bitcoin | WBTC | Bitgo, USA | Crypto-Collateralized | BTC 1:1 | $8,452,503,642* | ERC-20 Support, DeFi |

| Binance USD | BUSD | Binance, USA | Fiat-Collateralized | USD 1:1 | $12,316,647,148* | ERC-20 Support |

| Maker Dai | DAI | MakerDAO, Denmark | Crypto-Collateralized | USD 1:1 | $5,793,513,856* | Soft-pegged, DAO company |

| Terra USD | UST | Terra, Korea | Crypto-Collateralized | USD 1:1, WON 1:1 | $2,069,164,210 | South-Korea support, LUNA |

| True USD | TUSD | Trust Token, USA | Fiat-Collateralized | USD 1:1 | $1,257,312,669 | TrustToken support, ERC-20, BSC |

| Paxos Standard | PAX | Paxos Trust Company, USA | Fiat-Collateralized | USD 1:1 | $928,027,288 | ERC-20 support |

| HUSD | HUSD | Huobi, China | Fiat-Collateralized | USD 1:1 | $492,682,951 | ERC-20 Support |

| Synthetic USD | sUSD | Synthetix, Australia | Crypto-Collateralized | USD 1:1 | $274,386,960 | DeFi |

*marketcap displayed in Australian Dollars as at August 9, 2021

Tether (USDT)

Tether (USDT) is the first and one of the most popular stablecoins on the market with a market capitalisation of over US$62 billion. The premise of Tether’s appeal came from its value being pegged to the US dollar. Each Tether issued into circulation was said to be backed by a one-to-one ratio. Although 1 USDT tries to be worth 1 USD, it does fluctuate between $0.9992 and $1.0024 micro values, as seen in the graph below.

USDT Stablecoin Price Fluctuations

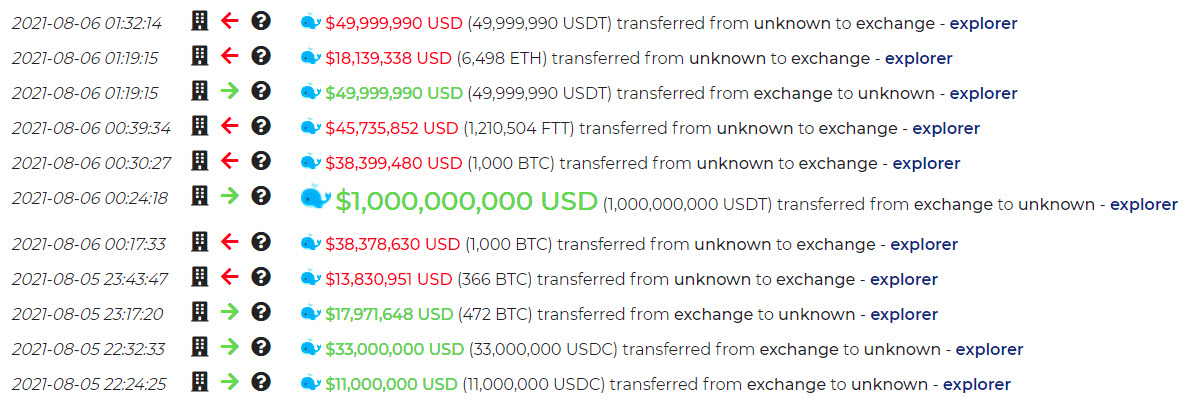

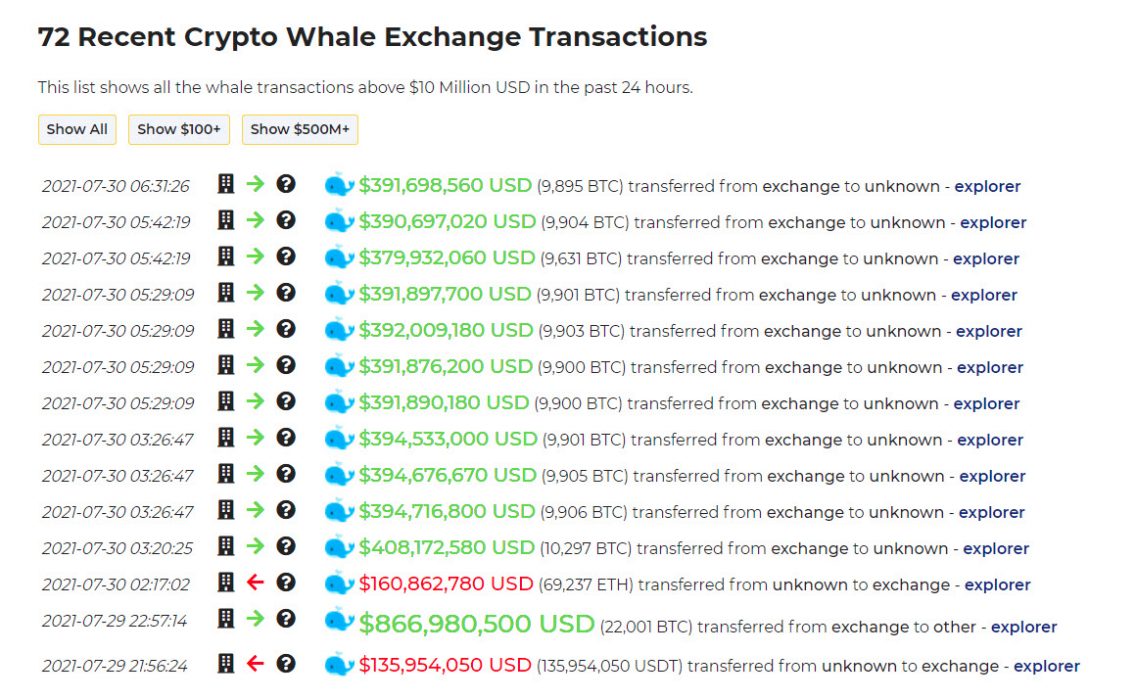

Tether has also come under scrutiny with claims that USDT is not backed by an equal amount of USD fiat currency, as its market cap grows by large $2 billion amounts minted on the blockchain. The company has since altered its claim from being backed by cash reserves to now being backed by “reserves”, of which fiat cash is just a small portion. Tether insists that the value of its assets equals the number of Tethers in circulation, although this claim has been consistently challenged.

USD Coin (USDC)

USD Coin (USDC) is a fully collateralised digital stablecoin that is pegged to the USD and runs on multiple blockchains including Ethereum, Stellar, Algorand and Solana, and also works on the Hedera Hashgraph system. The USDC coin was created by Circle and Coinbase, and reserves of the US dollar for this stablecoin are audited by Grant Thornton LLP.

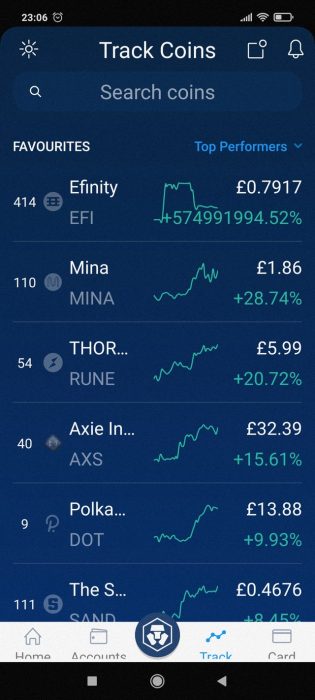

USDC has recorded growth of over 450 percent since the beginning of 2021. Investors can also use stablecoins such as USDC to earn yield on holdings, attracting interest rates as high as 11% by staking USDC coins on Zipmex.

Wrapped Bitcoin (wBTC)

Wrapped Bitcoin (wBTC) are crypto-backed stablecoins in the form of an ERC-20 token. The stablecoin operates on the Ethereum blockchain and represents the exact price of Bitcoin. The goal of wBTC is to bring Bitcoin’s price value into play and combine it with Ethereum’s programmability.

Each wBTC is backed 1:1 with BTC, as a wrapped token allows for bitcoin transfers to be conducted faster on the Ethereum blockchain and opens up the possibility for BTC to be used from within the Ethereum ecosystem.

Bitcoin is held in custody by the centralised custodian, BitGo, who provide the converted wrapped and unwrapped Bitcoins between parties using smart contracts.

Binance USD (BUSD)

Binance USD (BUSD) is a stablecoin created by Binance exchange, which is 1:1 USD-backed and approved by the New York State Department of Financial Services (NYDFS), issued in partnership with Paxos.

You can use BUSD for storing funds and transacting across the Binance platforms, including direct trading pairs and converting to other stablecoins with zero transaction fees. You can also earn yield when staking your BUSD coins with Binance.com Lending.

Maker Dai (DAI)

Maker Dai (DAI) is the native stablecoin for the Maker protocol and the world’s first crypto-collateralised and decentralised stablecoin. The value of DAI is soft pegged to the USD, which means it is backed by a diversified portfolio of collateral crypto assets instead of fiat currency with institutions.

DAI is a decentralised stablecoin with MKR token holders governing the decisions around the Maker Protocol as to which DAI is used. There are some common myths about DAI which you can read to find out more.

Reserve Rights (RSR)

Reserve Rights (RSR) is the governance token for the Reserve Project, which aims to create a censorship-resistant stable crypto that countries with high inflation can use for decentralised fiat on/off ramps.

Ultimately, Reserve’s goal is to create a universal store of value, particularly in regions with unreliable banking infrastructure and where hyperinflation is an issue.

Standard (PAX)

Paxos Standard (PAX) is backed one-to-one by USD deposits available to buy from New York-based blockchain company Paxos. On redemption, PAX tokens are immediately removed from the supply to keep the supply elastic based on demand fluctuations.

PAX claims to be the most liquid regulated stablecoin in the world, with the fastest USD conversions. The ERC-20 PAX token is listed on over 150 crypto exchanges, making it one of the most widely available stable cryptos for use for trading. There is also a token called Pax Gold (PAXG), which is an asset-backed token where one token represents one fine troy ounce of a London Good Delivery gold bar, stored in professional vault facilities.

Huobi USD (HUSD)

Huobi USD (HUSD) is another ERC-20 token pegged 1:1 to the USD created for Huobi crypto market. This was done to allow multiple stablecoins such as PAX, USDC, TUSD and GUSD to be deposited and automatically converted into HUSD for easy display and use within the Huobi platforms.

True USD (TUSD)

TrueUSD (TUSD) is yet another ERC-20 based stablecoin pegged to the USD. There are versions of True for other fiat currencies including:

- TUSD – pegged to the US dollar USD

- TGBP – pegged to the British pound GBP

- TAUD – pegged to the Australian dollar AUD

- TCAD – pegged to the Canadian dollar CAD

- THKD – pegged to the Hong Kong dollar HKD

These digital asset tokens are built on the TrustToken platform where they can be staked to earn staking rewards.

Synthetix (sUSD)

Synthetix (sUSD), previously known as Havven, is a crypto-collateralised network enabling the creation of on-chain synthetic assets on the Ethereum blockchain. These assets are over-collateralised to provide sufficient liquidity for users to redeem collateral at face value.

Beyond sUSD, Synthetix plans to offer stablecoins for other legal tenders such as the euro, yen and the Korean won, to drive the DeFi ecosystem liquidity and utility to new levels.