Hardware wallet maker Ledger is launching the Crypto Life card, a debit card that allows its users to spend crypto on goods and services or use it as collateral for cash purchases.

The ‘Crypto Life’ is Set for 2022

The new debit card was announced on December 9 during Op3n, Ledger’s biannual conference, and it’s set to debut in early 2022 for users in the UK, Germany and France, but those in the US will have to wait until the second quarter.

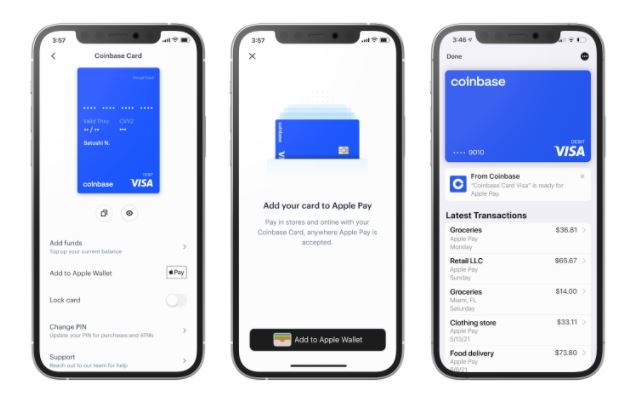

The Crypto Life (CL) card will carry out transactions using the Visa network. Users will be able to buy goods and services using the card, which is linked to Ledger Live, the desktop and mobile app that enables users to trade cryptocurrencies.

Funding the card is straightforward – users can top it up from the Ledger live app using a handful of coins such as BTC, ETH, USDT, and more. When it’s time to make a purchase, the funds are instantly converted to the fiat amount. Additionally, users can receive their paycheques using the card account and convert a percentage into BTC or ETH.

Users can also open a line of credit to spend on their card using crypto as collateral with rates going as low as zero percent. However, this feature depends on the region. US citizens won’t be able to take crypto loans due to regulatory issues in the country regarding crypto loans and transactions.

Moving to a Wider Audience

Ledger’s move comes as part of its plans to reach a wider audience. Rather than stick to making hardware wallets, it’s now following in the wake of Coinbase and other crypto companies by providing traditional banking services.

In August, Crypto News Australia reported that Ledger had enabled ETH staking directly form the Ledger Live wallet, thanks to a partnership with Lido, an ETH 2.0 liquid staking platform.