With bitcoin mooning and surpassing all of its previously-set records, people worldwide are rushing to obtain profits. Miners are also keen on solving the proof-of-work problem in exchange for a chance to add the next block and reap their bitcoin reward. What if there was a better way to profit off bitcoin’s recent bull run?

Introducing Gamified Mining with Winz.io

Mining is complicated, but with Winz.io, it has never been easier! The casino has just announced the Winz.io Bitcoin Mining Adventure, where players can enjoy their favourite slots, level up, and obtain cash prizes for each of the levels they beat. That’s it. There are absolutely no restrictions concerning wagering limits, minimum bets, or maximum prizes. In fact, the first person to complete the 40 levels will not only obtain a prize for each level, but also the grand reward – one entire bitcoin! Each wager unlocks profit potential and puts users higher on the leveling leaderboard, so there’s nothing to lose. Profits are still paid out depending on the outcome of the slot roll.

The levels are open to all of Winz.io players, meaning that users can play up to wherever they feel most comfortable with their winnings.

Highlighting Winz’s Value Proposition as the World’s Top-Ranking Crypto Casino

Founded and licensed in early 2020, Winz.io has quickly established its title as one of the market’s best digital currency casinos, boasting not only great games, but also a plethora of payment methods and a tight-knit community.

With this being said, Winz.io collection of games includes highly-entertaining slot titles, such as jackpot slots, megaways slots, and buy bonus slots. Players can also find a formidable collection of table games and profitable lotteries. As expected, the casino features live games. Here, customers can interact with professional and engaging dealers, thereby accessing a superior experience that’s filled with authenticity and emotion. The Winz.io game catalogue is only provided by the industry’s finest developers. Winz.io therefore collaborates with the likes of Evolution Gaming, Amatic, iSoftBet, NETENT, Microgaming, and many others.

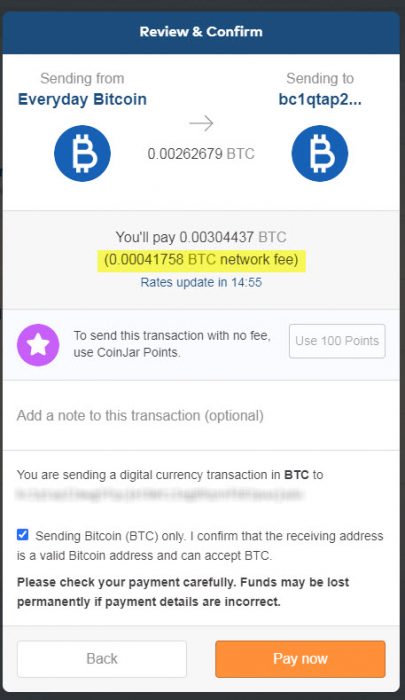

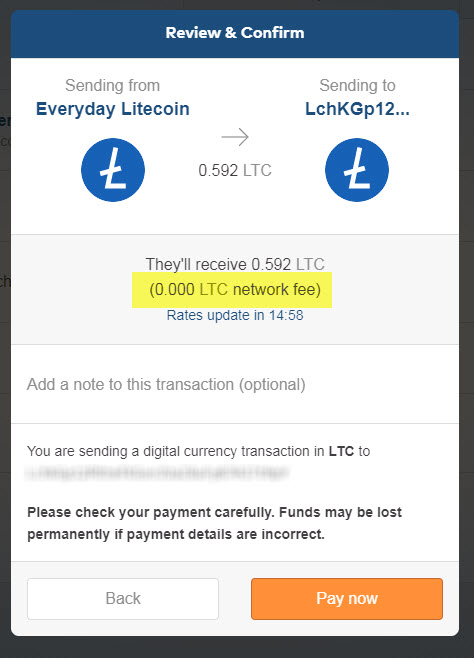

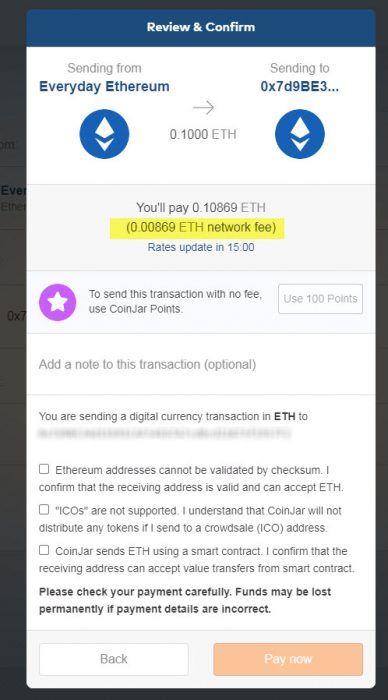

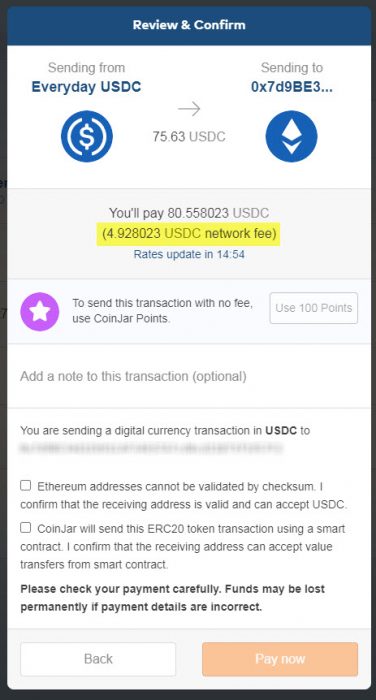

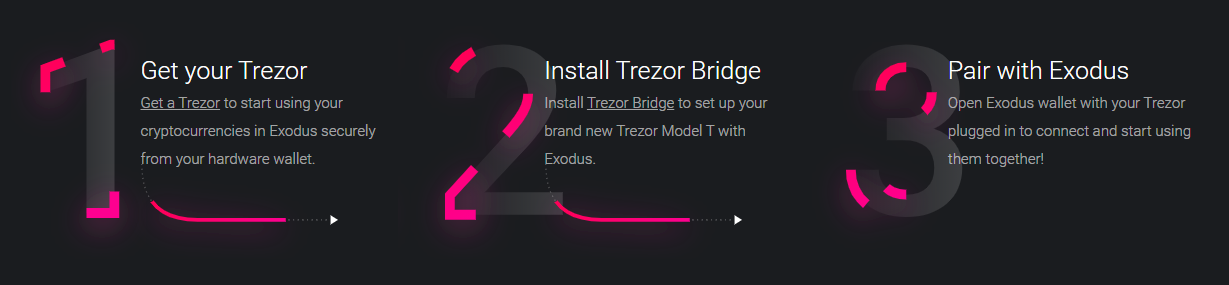

Winz.io is renowned for having one of the industry’s most future-thinking payment policies. As such, customers can deposit and withdraw their funds via cryptocurrencies, as well as fiat-based payment methods. Some of the main means of payment include debit cards, bank transfers, and support for e-money payment services. Thanks to a partnership with CoinsPaid, cryptocurrency enthusiasts can gamble using Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dogecoin, and Tether. Most deposits are confirmed within a few minutes, whereas withdrawals are processed instantly. Thus, users will no longer have to spend days waiting to cash in their winnings. This is especially the case with crypto-based withdrawals, which are lightning quick! Readers must also note that Winz facilitates crypto-to-fiat exchange: possibility for the instant exchange to FIAT on deposit and back to crypto on cashout.

Winz.io is thoroughly appreciated within the gambling reviews market. It’s been rated as ‘great’ by some of the most popular casino review websites, including Askgamblers.

Winz.io Optimal RTP policy

Return to Player (RTP) is a casino term describing percentage of any wagered money that slot machine games pays back to players over time

Most online casino operators have similar selection of slots, however, not all slot games are offered in the same way. This is due to many casino operators offering adjusted versions of popular games, often reducing Return to Player, sometimes up to five percentage points. We at Winz.io always keep original casino games settings ensuring more entertainment for the same money. Players can always check the game’s RTP tapping information icon of every slots game’s thumb.

Winz.io follows Optimal RTP Policy and chooses original slot games settings of return percentage in every situation.

Bottom Line

Thanks to Winz.io’slucrative bitcoin mining promotion, those who missed the bull run can certainly round up their profits. No other casino has ever put prizes as large as 1 BTC on the table, so it only makes sense that there’ll be a lot of competitive, but very entertaining gameplay! Winz.io – Every Bit of Fun!