A man from Germany has fallen victim to a Bitcoin scam, losing over AU$700,000 to a fake Elon Musk giveaway.

Sebastian (not his real name) said that Elon Musk, CEO of Tesla, tweeted, “Dojo 4 Doge” and was curious about what he meant as Musk often tweets about crypto. Apparently, under the tweet, there was a link to an event that was giving away Bitcoin, which Sebastian clicked on.

Seemingly run by Musk’s Tesla team, the so-called giveaway invited people to send anything from 0.1 Bitcoin (AU$7,700) to 20 Bitcoin (AU$1.5 million) with the promise of sending back double the amount, reports the UK’s BBC News. A common impersonation scam which we’ve covered in our Bitcoin Scams Guide.

“It Was a Big Fake”

Believing he was on to a good thing, Sebastian sent 10 Bitcoin, amounting to over AU$700,000. For the next 20 minutes, Sebastian waited for his Bitcoin wallet’s value to increase.

It was only after the countdown ended that Sebastian realized he’d been scammed. He said:

I realized then that it was a big fake. I threw my head on to the sofa cushions and my heart was beating so hard. I thought I’d just thrown away the gamechanger for my family, my early retirement fund and all the upcoming holidays with my kids.

Even though he tried to get his money back, he finally accepted he wasn’t going to see it again.

Crypto Scams Soar

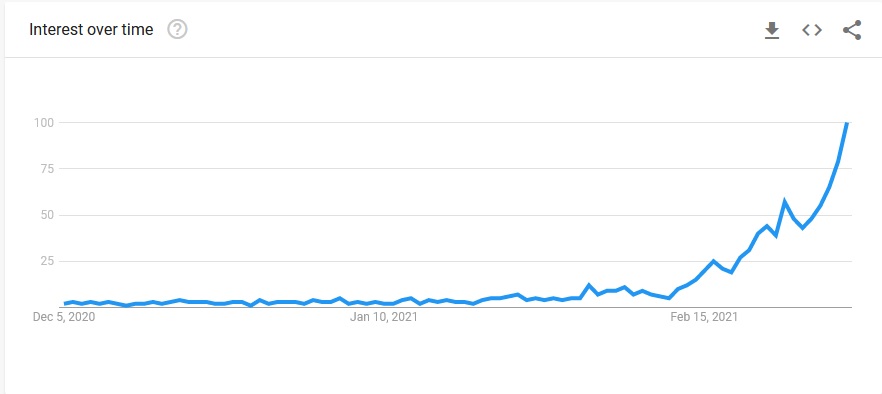

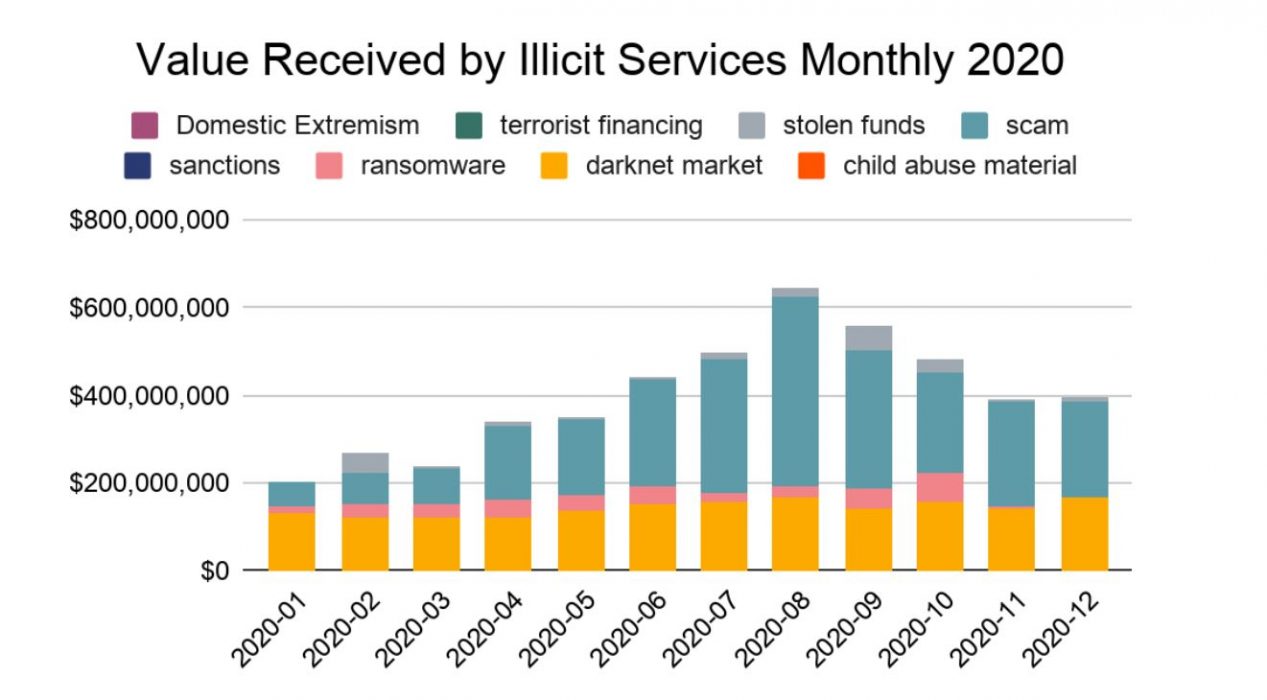

In recent years, crypto scams have risen targeting unsuspecting people with false promises that they can earn more if they just give a little. According to data from Chainalysis, scams made up the majority of all crypto-related criminal activity at 54%, in 2020, representing AU$3.35 billion.

Fake crypto giveaways are also gaining traction and often target high-profile pages in the hopes that they will trick people into thinking it’s real. They either achieve this by disguising the account to look like the real one or hacking into the account. Musk is one figure who has been used before.

However, it was in 2020 when hackers managed to steal AU$153,000 after a short-lived hack enabled them to tweet from celebrity accounts, including Bill Gates and Kim Kardashian-West.

Unfortunately, with interest in crypto continuing to rise amid increasing prices, crypto scams are going to remain. Speaking on this, Whale Alert founder Frank van Weert, said:

When the Bitcoin price goes up, people go crazy and a lot of them are new to the market and they want this idea of quick money.