It’s often been said that technical complexities remain one of the main obstacles hampering widespread Bitcoin adoption. In an attempt to provide retail investors exposure to bitcoin without the complexities, one Kiwi fund manager has just launched the country’s first bitcoin-only fund.

A First For New Zealand

The Vault International Bitcoin Fund (Fund) is the first of its type to be established in New Zealand and will be managed by Implemented Investment Solutions, an investment firm with over NZ$4 billion (A$3.8 billion) assets under management. The Fund has a market capitalisation of about NZ$1 million and would invest in international exchange-traded funds (ETFs) that hold positions in bitcoin.

One of the key motivations behind establishing the Fund was to take out the hassle and risk of direct ownership, including some of the tax complexities:

We see this as a great way for people to get that exposure without having to do all the more complicated and technical parts of it themselves.

Janine Grainger, co-founder, Vault Digital Funds

Vinnie Gardiner, Vault chief executive and co-founder, recognised that bitcoin was not necessarily suitable for all investors and recommended that they do their own research:

The reality has always been that if you own digital assets, you are the custodian of your own wallet, which introduces some real risk … Bitcoin isn’t appropriate for everyone. This is something people should not be taking lightly.

Vinnie Gardiner, co-founder and chief executive, Vault Digital Funds

‘Not Your Keys, Not Your Coins’

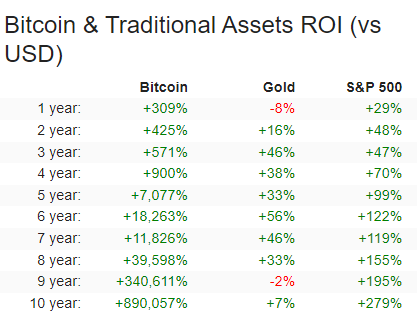

New Zealand institutions appear to be on the ball and this latest announcement is just another way for ordinary investors to gain exposure to bitcoin. In July, as reported by Crypto News Australia, the Kiwi Saver Pension Fund announced it had bought bitcoin in October 2020 to the tune of 5 percent of investable assets.

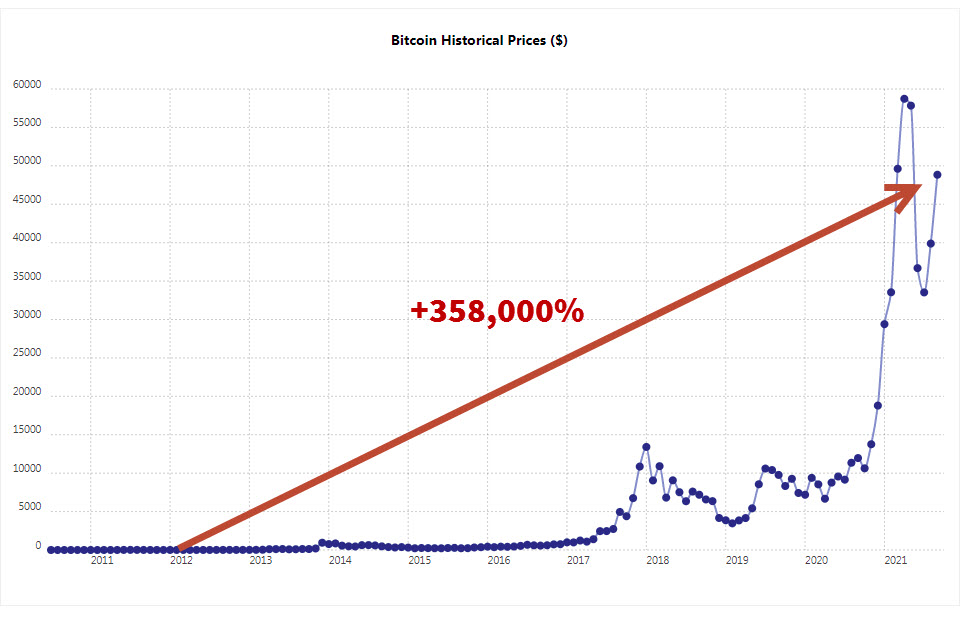

It’s no doubt bullish for bitcoin that more retail products are becoming available, making it easier and simpler to buy and hold bitcoin. The downside retail investors ought to be aware of is that ultimately, you are not in control over your bitcoin – “not your keys, not your coins”.

Some would argue that having a third party retain custody of your bitcoin negates bitcoin’s raison d’etre – namely that you can be self-sovereign and, ultimately, your own bank.

Of course, holding your own bitcoin comes with risks and it’s not for everyone. Each investor needs to determine their own risk appetite for self-custody and act accordingly.