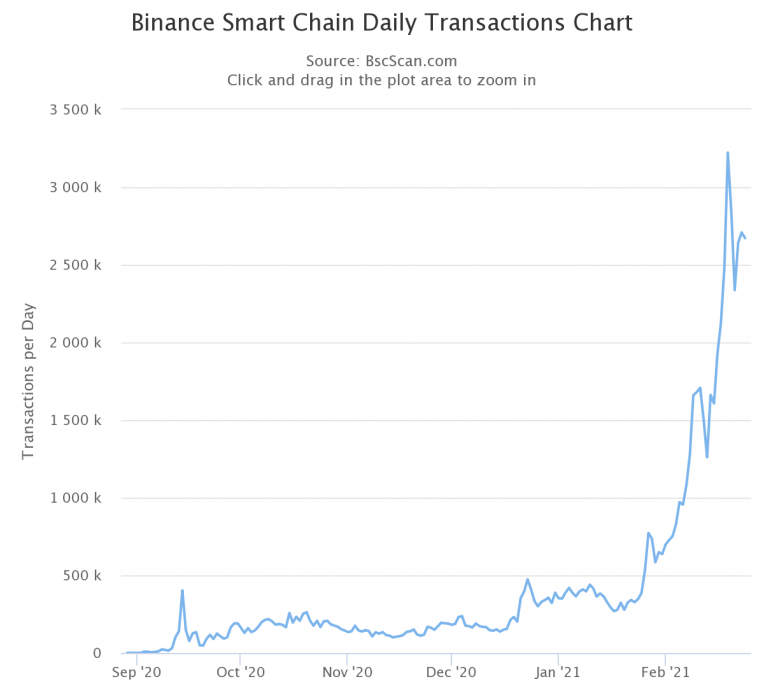

The largest cryptocurrency exchange, Binance, is allegedly under investigation by the United States Commodity Futures Trading Commission (CFTC), according to a Friday report by Bloomberg, which cited anonymous sources familiar with the matter. The Binance Coin (BNB) has been struck by news, as it’s down by 12 percent, with a market price around US$269, during press time.

However, the CEO of Binance, Changpeng Zhao, has shrugged off the news as FUD (Fear, Uncertainty, and Doubt).

CFTC probes Binance over trading activities

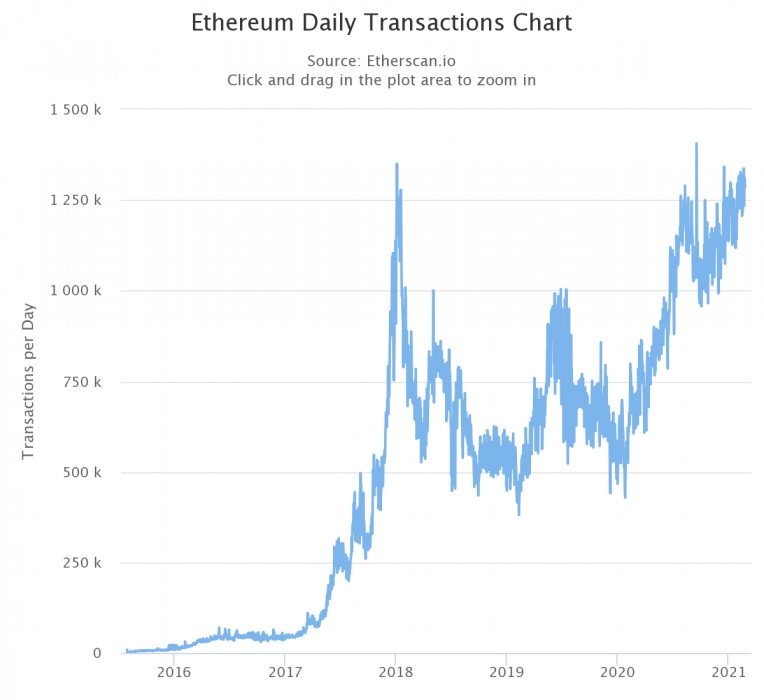

As Bloomberg reported, the US regulator is investigating Binance to know whether the exchange allowed residents from the country to trade derivative products on its platform. Note-worthily, the cryptocurrency exchange isn’t registered with the US authorities, and so, it’s not permitted for US investors and traders to buy and sell derivative products related to digital currencies.

The CFTC, in particular, considers cryptocurrencies like Bitcoin as a commodity. Hence, exchanges offering related products to US residents must face strict regulations to ensure customer protection and oversight demands. Binance had stated that it doesn’t comment on its communications with regulators. However, it’s unarguable that the exchange has severally warned and blocked US residents from using its main website.

“We take a collaborative approach in working with regulators around the world, and we take our compliance obligations very seriously” Binance noted in a statement.

CZ says it’s all FUD

The CEO of the largest exchange seems unbothered by the circulating rumor. In fact, he dismissed the news as being FUD on Twitter.

Meanwhile, the development today is coming just a day after the exchange appointed a former US senator, Max Baucus, as an advisor to assist them in meeting regulatory requirements with the United States authorities.