In a Twitter thread directed to Elon Musk on Friday, the founder and CEO of Elrond, Beniamin Mincu, explained blockchain technology and its potential to revitalize the financial system, and how it’s also going to unlock a massive societal improvement. He further pitched the Elrond technology to Elon Musk, explaining how it can improve transactions between self-driving Tesla.

Elrond is a public blockchain developed to enable high throughput, interoperability, and high-level scalability. It’s reportedly the first to deliver a truly scalable sharding architecture solution.

Blockchain in Tesla

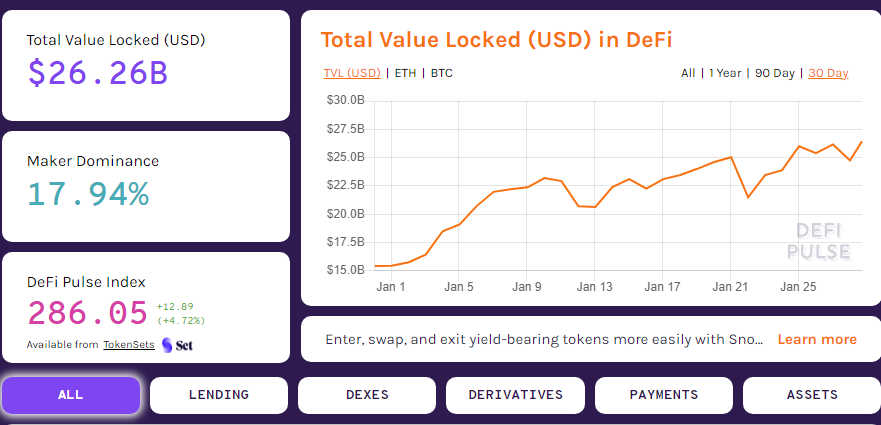

The CEO of Elrond started the thread by explaining how blockchain technology can address the need for a low latency financial, high bandwidth, and decentralized system that can be accessible to people anywhere. While Mincu complemented the Bitcoin and Ethereum blockchain, he mentioned to Elon Musk that Elrond has the capacity to elegantly solve all the above needs.

“Going one step further, I believe Elrond will be the wave that will lift all boats, expanding this space more than any other project. Taking this massive opportunity from a niche group of people, and extending it to everyone in the world,” Mincu wrote.

He then called for a possible integration of Elrond with the Tesla electric cars, saying that the blockchain technology can enable machine to machine transactions between the self-driving vehicles. Mincu further mentioned that the technology can enable a universally accessible financial system when integrated with Starlink, a satellite internet constellation project by SpaceX aimed at delivering high-speed internet to consumers anywhere on the planet.

The CEO of Elrond also said they will donate its native digital currency, EGLD to SpaceX.

Elon Musk Influence on Crypto

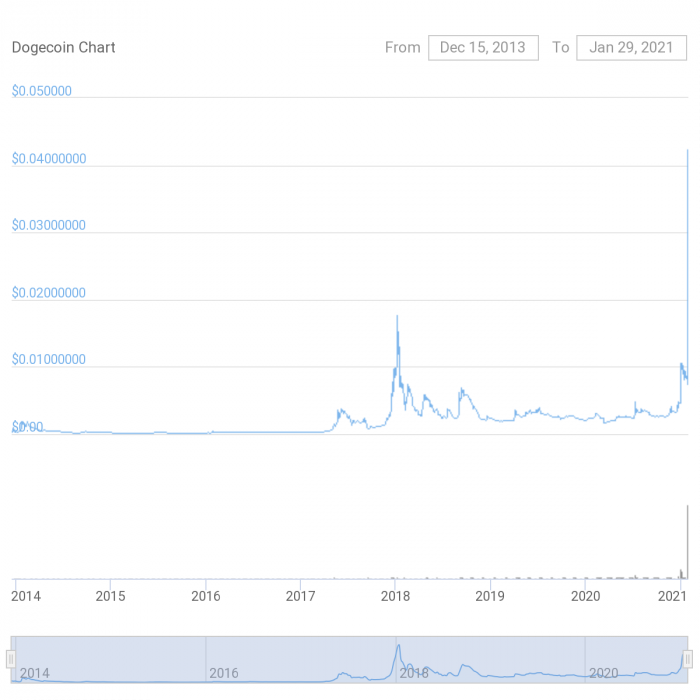

The development today follows Elon Musk’s Twitter trend on Friday, which supposedly prompted a spike in the market price of Bitcoin and Dogecoin, which is his favorite cryptocurrency. Musk added a Bitcoin hashtag on his Twitter, which sparked another bullish tide BTC, as the price rose to over US$37,000. Elon Musk may not have spoken too much about blockchain, but he’s obviously interested in cryptocurrency.