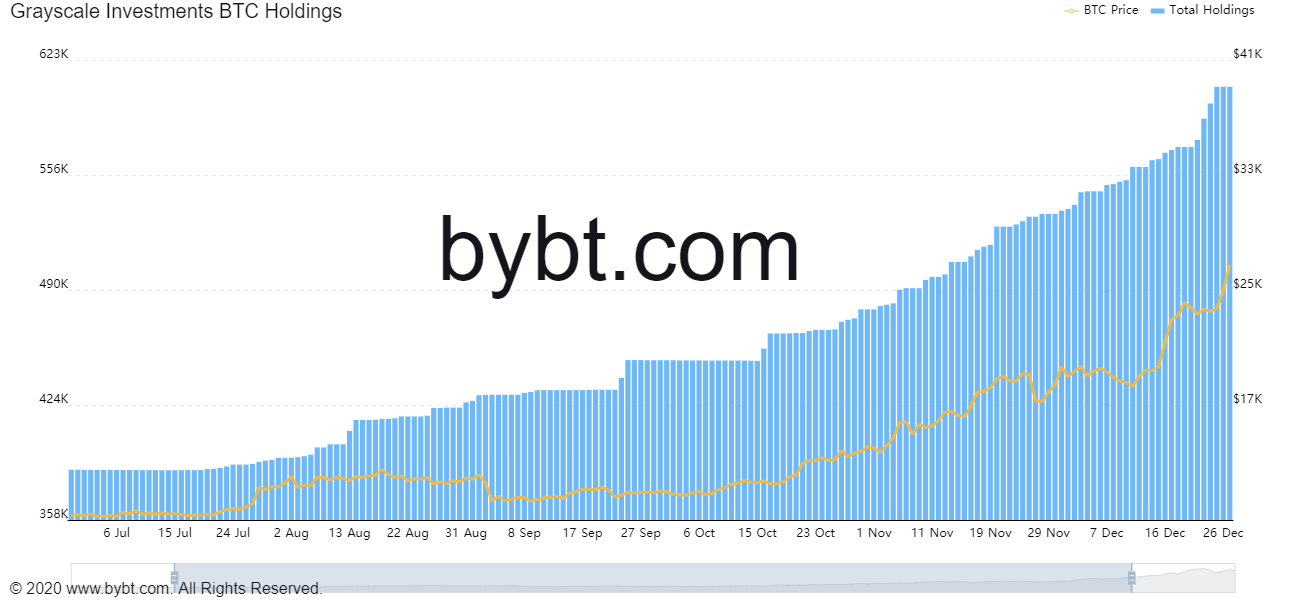

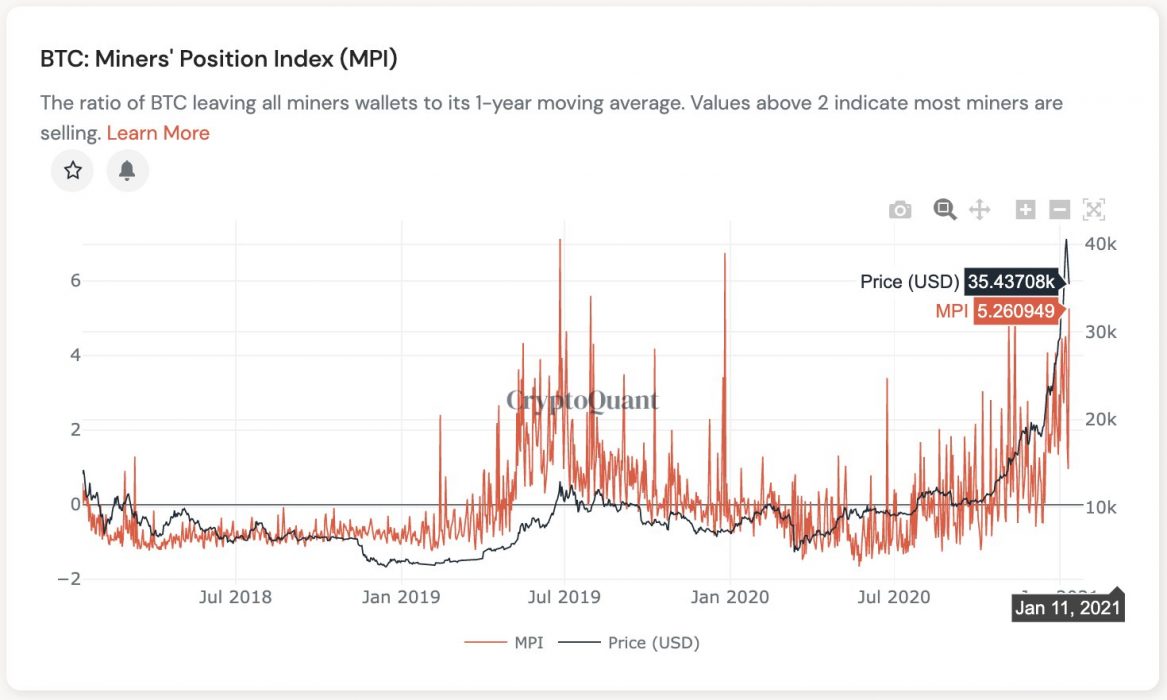

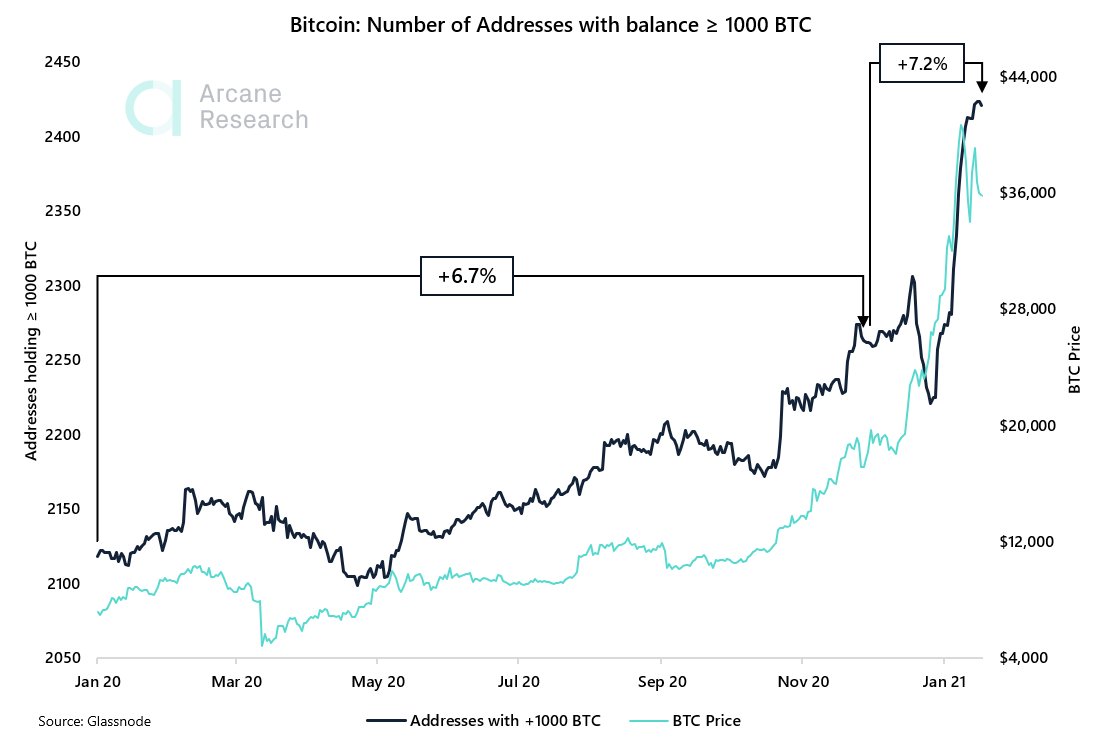

There is a serious growth in the number of Bitcoin addresses containing at least 1,000 Bitcoin (BTC). This is evident as the number of these BTC addresses are already higher this year when compared to the record throughout the past year, according to the information shared by Arcane Research. Such massive growth highlights the increasing level of interest in the leading cryptocurrency among deep-pocketed and institutional investors.

Bitcoin Whales Addresses are Increasing

From January 2020 to December, Bitcoin addresses with at least 1,000 Bitcoin increased by only over 6.7 percent, Arcane Research shared, citing data from Glassnode. However, as the price of Bitcoin began rising notably in December, the number of these whale addresses began increasing as well. From December to January 2021, the addresses increased by 7.2 percent, surpassing the whole record in 2020.

This indicates that there was a strong BTC buying momentum among deep-pocketed investors in the cryptocurrency market, more precisely, in December. For more insight, the Bitcoin distribution list from Bitinfocharts shows that 2,318 addresses are holding between 1,000 – 10,000 BTC. There are only 99 addresses holding at least 10,000 – 100,000 Bitcoin, while only one address holds more than 100,000 BTC (over US$5 billion), which belong to the Huobi exchange.

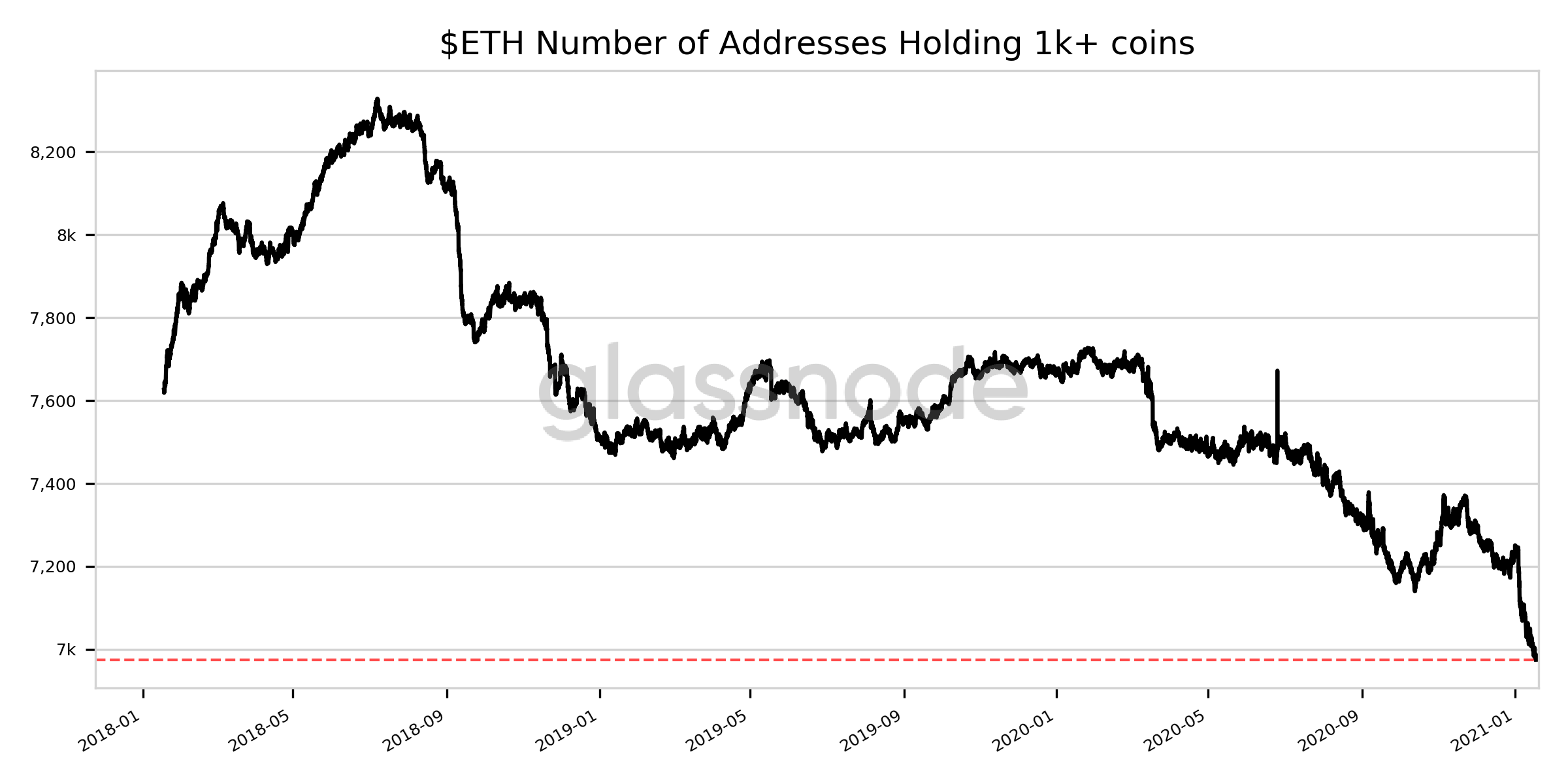

The Number of Ethereum Addresses are Declining

While Bitcoin whale addresses have skyrocketed lately, the second-largest cryptocurrency, Ether (ETH), is seeing a drop in small-sized addresses. Per Glassnode, the addresses with +10 ETH has decreased to a five-month low of 282,063, while the +100 ETH addresses decreased to a six-month low of 50,483. Also, addresses with +1,000 ETH declined to a three-year low of 6,975.

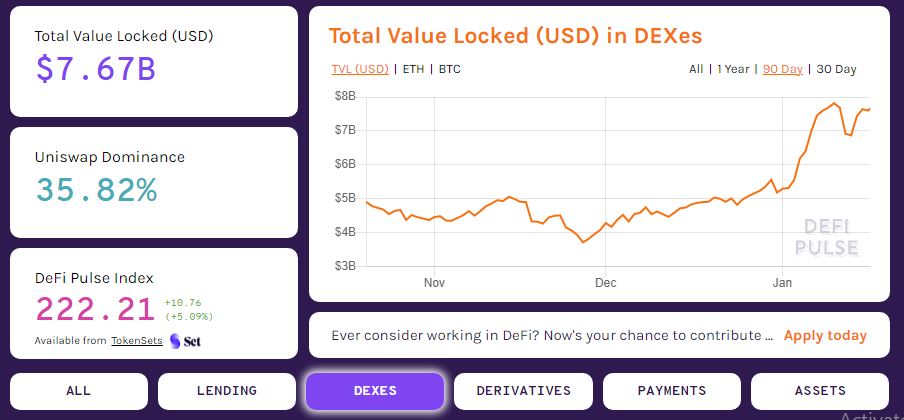

The Ethereum 2.0 staking and DeFi could be two possible reasons behind the decreasing number of Ethereum addresses.