Coinbase has blocked 25,000 addresses from Russian customers supposedly linked to “illicit activity”.

Not Your Keys, Not Your Coins

As per a March 6 blog post, Coinbase said it conducted its own investigations to identify and block 25,000 addresses believed to be linked to sanctioned actors and individuals that demonstrated “high-risk” behaviour.

Later, the exchange shared the addresses with the US government to “further support sanctions enforcement”.

Today, Coinbase blocks over 25,000 addresses related to Russian individuals or entities we believe to be engaging in illicit activity, many of which we have identified through our own proactive investigations.

Coinbase blog post

What turned up the heat for the crypto community is that five days ago, Coinbase claimed it would not sabotage Russian customers by freezing their accounts at the request of Ukraine’s vice prime minister as this would “harm economic freedom”.

Most people in crypto Twitter assumed that Coinbase had received pressure from the US Securities and Exchange Commission and the Biden administration to somehow take part in economic sanctions imposed on Russia.

The exchange, however, didn’t elaborate on what it meant by illicit activities:

Is being Russian considered illicit activity now? This move really only hurts Russian citizens.

— Kip DeCastro (@Kipdec) March 7, 2022

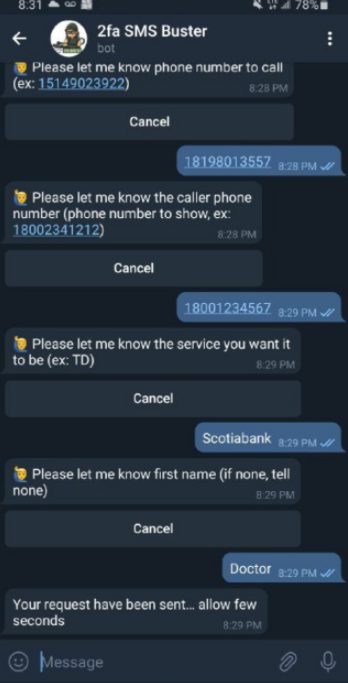

It’s no surprise the announcement caused a lot of controversy, bringing back the old crypto saying – not your keys, not your coins:

Lessons on Crypto

— Crypto Bay Max (@CryptoBayMax) March 8, 2022

1. Never hold your crypto on an exchange

2. Never hold your crypto on an exchange

3. Never hold your crypto on an exchange

4. Don’t share your seed phrase

5. Use a VPN

BUT I WAS TOLD BITCOIN FIXES THIS

— PandaSurge (@PandaSurgee) March 7, 2022

The general reaction of politicians and most Western governments to the Russian invasion was to condemn it and impose severe economic sanctions on the federation’s economy.

A handful of online businesses suspended their services in Russia a few days after the invasion. These included some traditional finance companies, as well as some crypto platforms and products.