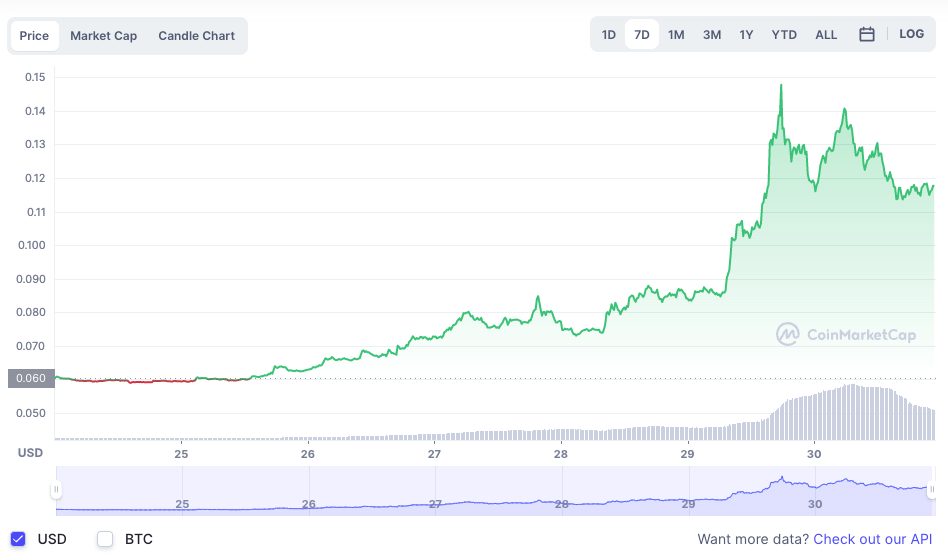

The price of everyone’s favourite dog-themed meme coin, Dogecoin, has surged over the past week on the back of a tweet from the new Twitter owner, Elon Musk. Musk’s tweet got the Doge army’s tails wagging as it outlined his plans for the social media platform, which included a vague reference to payments.

Data from CoinGecko shows Dogecoin’s price jumped from US$0.088 before Musk’s tweet on November 27 to US$0.108 at the time of writing, an increase of 22.2 percent. Over the week, Dogecoin is up a whopping 37.9 percent: a significant increase given the current bear market.

What Did Musk Tweet?

Ever since Musk purchased Twitter last month, Dogecoin enthusiasts have been hopeful that the famously Doge-interested billionaire would somehow integrate the coin into Twitter.

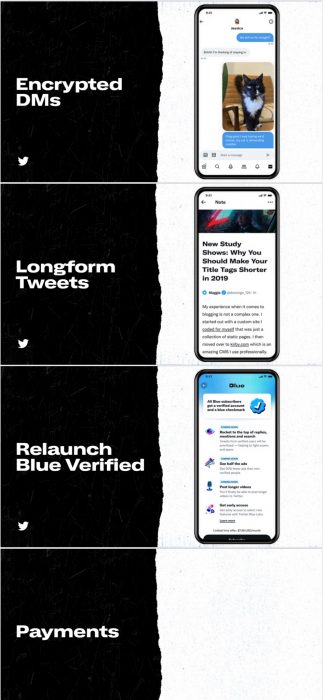

In his Tweet on November 27, Musk outlined the progress he’d made since taking over the platform and also listed some future plans for what he referred to as Twitter 2.0 — The Everything App.

Some of the new features Musk listed included encrypted direct messages, long form tweets, relaunched ‘Blue Verified’, and a vague and mysterious reference to payments.

Despite no direct reference to Dogecoin, the mention of payments coming to Twitter was enough to spark FOMO, triggering something of a buying frenzy and causing the meme coin’s price to spike.

Earlier Rumours Contribute to FOMO

Previously, just after Musk’s purchase of Twitter in late October, rumours had begun circulating, fuelled by speculation from tech blogger Jane Manchun Wong, that the company had commenced work on a crypto wallet that would allow users to deposit and withdraw crypto. This earlier speculation saw Dogecoin’s price jump 40 percent at the time and may have played a part in the excitement about Musk’s tweet.

Some in the crypto community have poured cold water on the idea of Dogecoin for payments — pointing out that unlike many other distributed ledgers, Dogecoin doesn’t natively support smart contracts and may not be suitable as a payments platform due to shortcomings in security, privacy and capacity for scaling.