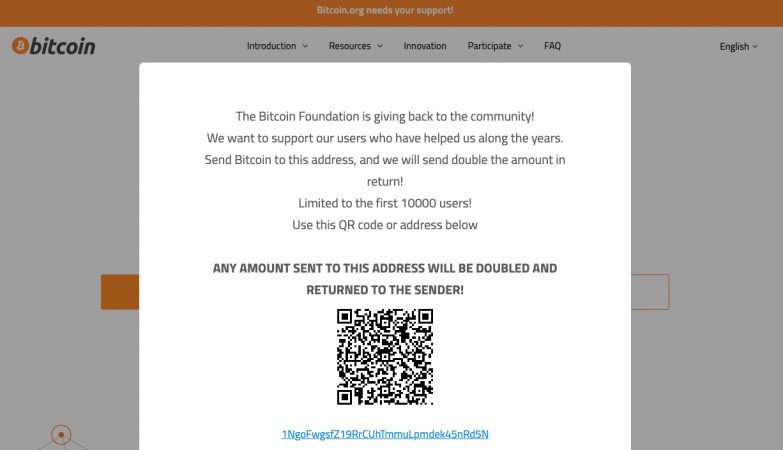

Educational content platform Bitcoin.org has suffered a security breach and ended up in the hands of unidentified attackers who started promoting a shady bitcoin scam on the homepage.

On September 23, several users reported that the Bitcoin.org homepage was displaying a pop-up window requesting users to send BTC to a specific address and receive twice the amount in return. This, of course, rang alarm bells in the crypto community and Bitcoin.org soon announced via Twitter that the site had been compromised.

Bitcoin.org subpages were limited as result of the attack, which did not allow users to scroll through the page and precluded access to the PDF version of the Bitcoin whitepaper. While the site is now virtually up and running again, the URL to the whitepaper displays a “this site can’t be reached” message.

The address displayed on the site received 0.4 BTC (around US$17,000) in a few hours. It’s unknown if those funds belong to any victim who fell for the scam.

Not the First Bitcoin.org Attack

This is not the first time Bitcoin.org has been attacked. Early this year, Crypto News Australia reported that the site had been hit by a DDoS (Denial Of Service) attack. This happened shortly after Bitcoin.org lost a legal battle against self-proclaimed Bitcoin creator Craig Wright, who requested that a British court force the organisation to remove the BTC whitepaper for UK visitors.