As Bitcoin is taking the media by storm with increasing integration to institutions and technology corporations, Craig Wright —the self-proclaimed Satoshi Nakamoto— now calls BTC a “Ponzi Scheme” where everyone will soon “jump in”.

In an interesting turn of events, the Australian man who proclaims himself the creator of Bitcoin is now —ironically— trashing his own “creation” and states that he got “insanely rich” ever since.

A $150 Billion bet on Bitcoin

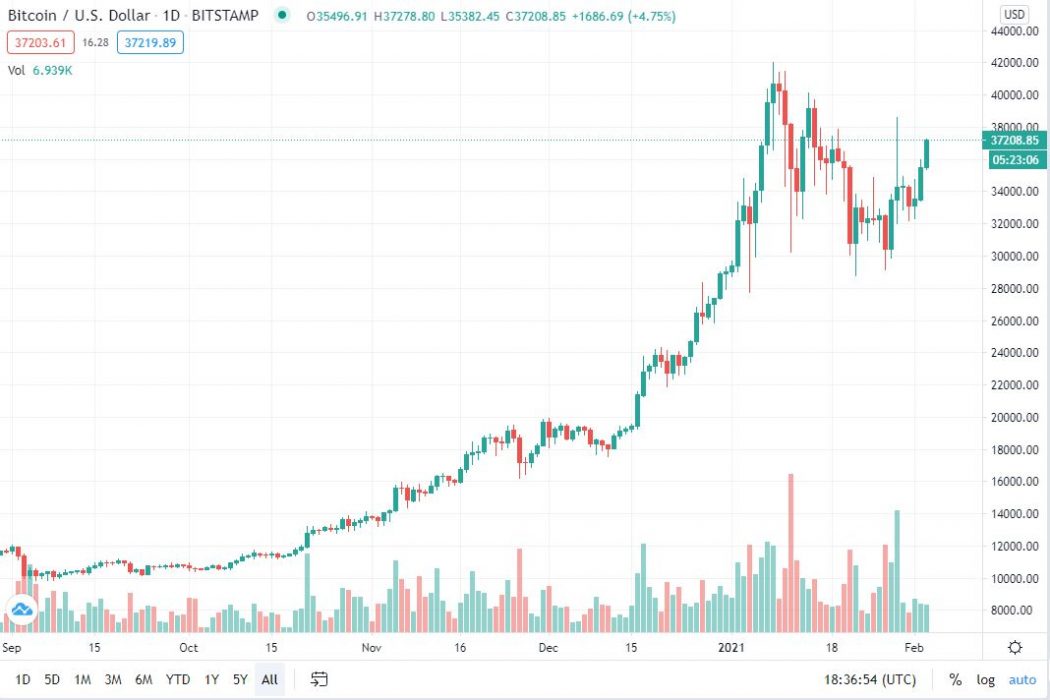

Wright’s comments came shortly after JP Morgan, one of the largest investment banks in America is currently exploring investing $150 billion in Bitcoin with Counterpoint Global —one of the several Active Equity Teams from Morgan Stanley.

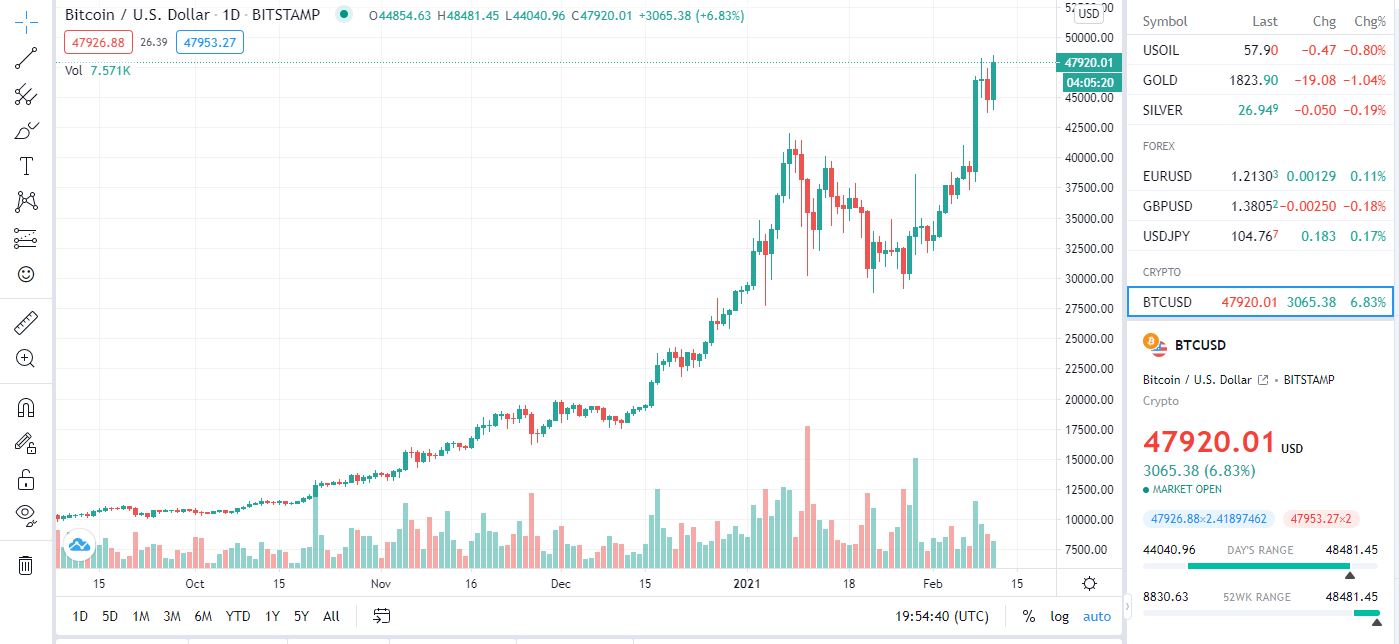

Bitcoin nearly reached the $50,000 price level following Morgan Stanley’s announcement, reaching a maximum trading level of $49,669.

But as Bitcoin takes the spotlight, Wright compares Bitcoin to a controversial $65M Ponzi scheme in the U.S., elaborated by the market maker and financial advisor Bernie Madoff in 2009.

The price goes up because people are paying and the price goes up. But that doesn’t ever last forever. Old Charles Ponzi did that one too. And Mr. Madoff … Eventually, people go. Digital gold is boring. The [paper’s] first section talks about micropayments, which were the holy grail.

Stated Wright

Likewise, this January, Wright went all out with his lawyers against several sites that posted Bitcoin’s Whitepaper, specifically, Bitcoin.org. and Bitcoincore.org. But his claims were dismissed, and several governments including Colombia and Estonia —even the City Mayor of Miami— incorporated the document on their servers.