The Ethereum difficulty bomb – a crucial step toward Ethereum’s long-awaited Merge – has been delayed, according to core developer Tim Beiko:

The news comes days after Ethereum developers successfully merged the Ropsten testnet with the new proof-of-stake (PoS) blockchain.

The Ethereum difficulty bomb is a special code in the Ethereum blockchain and is an essential part of its major upgrade, the Merge, which will turn the network into a PoS ecosystem.

The difficulty bomb is designed to intentionally increase block difficulty (the amount of time it takes to produce a new block) exponentially over time. After a certain period, it becomes nearly impossible for validators to mine a new block, thus discouraging miners from remaining in the Proof-of-Work (PoW) consensus.

This Won’t Delay the Merge – Hopefully

Ben Edgington, another Ethereum core developer, also tweeted about the bomb difficulty delay, saying: “It won’t delay the Merge. I sincerely hope not.”

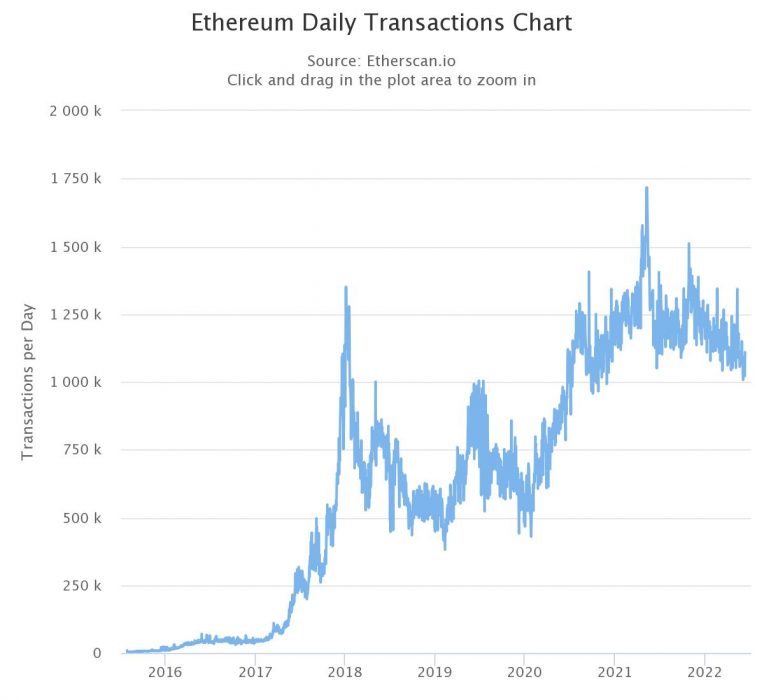

Despite the current bloodbath in the crypto market (ETH dropped briefly below US$1,100 on June 13), Ethereum has managed to sustain its user base throughout the past couple of months. According to data from Etherscan, daily transactions have stayed above 1 million and the number of unique addresses is still growing every month.

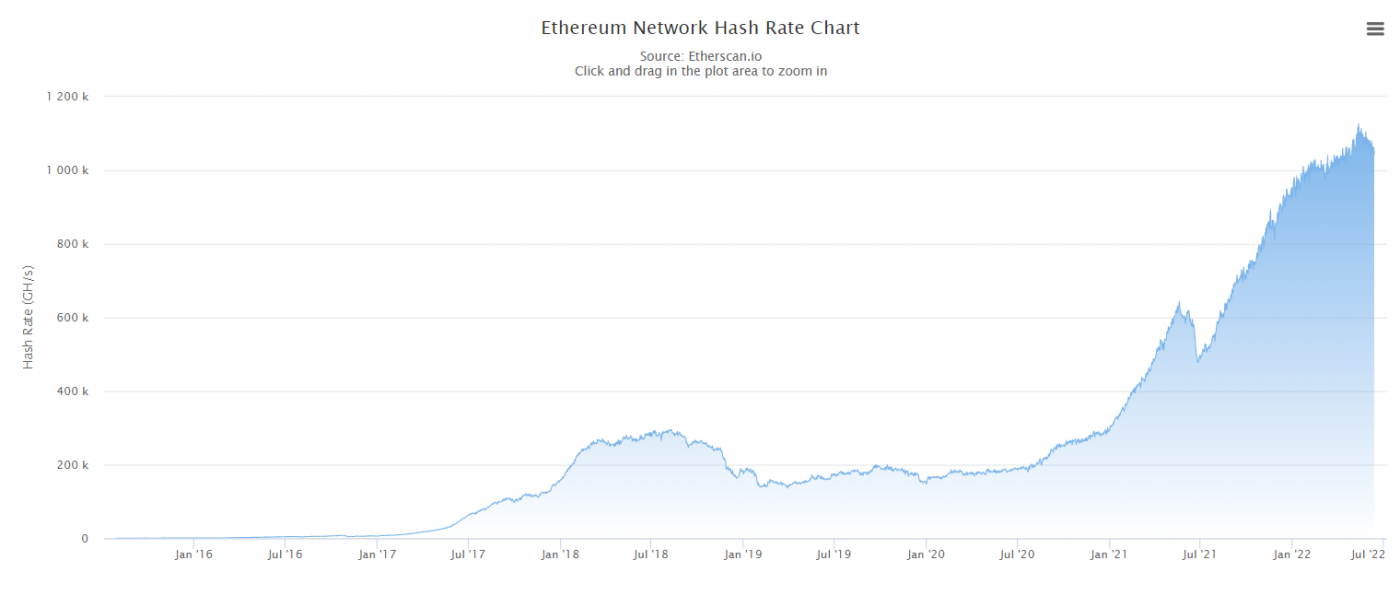

Ethereum’s hashrate has increased in the past six months, reaching an all-time high in February. As per data from Etherscan, the current rate sits at 1.04 PH/s: