State and private financial institutions are embracing Bitcoin instead of gold, as traditional fiat devalues and cryptocurrencies are becoming better stores of value. Just recently, Banca Generali, a major private bank in Italy, announced its plans to introduce cryptocurrency services in 2021, by providing their customers cryptocurrency custody.

Generali announced on December 15 a new corporate and commercial partnership agreement with Conio, a fintech firm that serves over 150,000 cryptocurrency portfolios for its customers. The bank is injecting $14 million into Conio’s capital as well.

We predict that the future structure of financial markets will be influenced by blockchain technology, which continues to enable innovation in cryptocurrencies and many other areas of the financial ecosystem.

Stated Generali CEO, Gian Maria Mossa.

Banks Embracing Cryptocurrency

Globally, banks are turning their views towards cryptocurrencies and blockchain technology, considering the tremendous growth that crypto has had in the finance realm these last months.

Even some central banks, like the Bank of England and the Federal Reserve, are considering integrating cryptocurrency services alongside traditional systems into their services — although to a more limited extend at first.

Recently in Switzerland, Sygnum, a major cryptocurrency bank, had successfully tokenized its shares — using a tokenization platform called Desygnate.

We are excited to be the first bank in the world to tokenize our shares. This is an important milestone towards fulfilling our mission of creating more direct and efficient access to ownership and value. This includes new engagement models with our clients and partners, and ultimately providing liquidity for our trusted shareholders.

Mathias Imbach, co-founder of Sygnum and CEO at Desygnate.

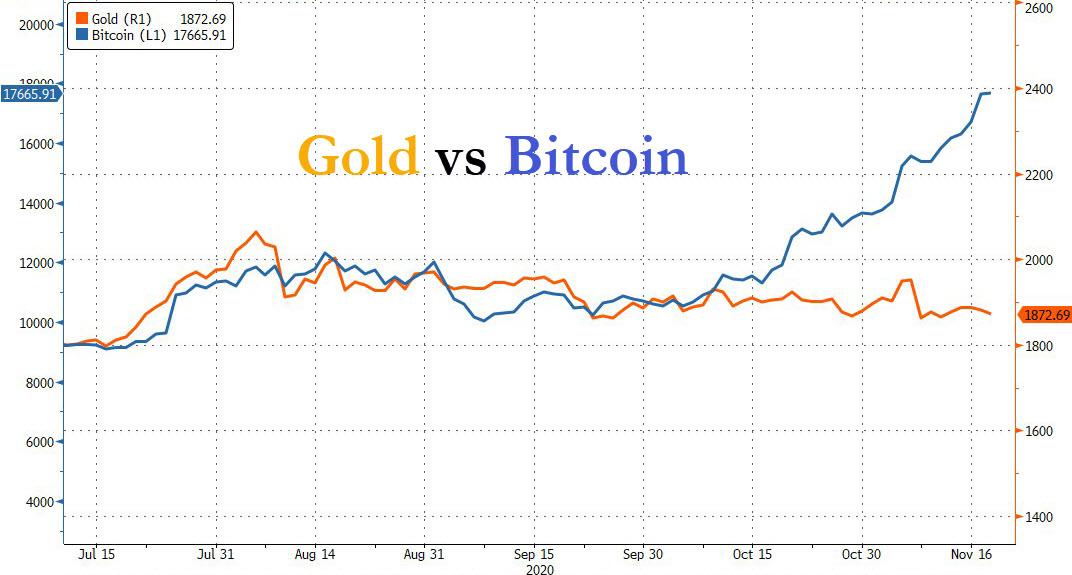

Even the CEO of JP Morgan, Jamie Dimon, suggested that gold could “suffer for years” now that institutional investors are embracing Bitcoin as a replacement to their stores of funds.

And Morgan Stanley, one of the most relevant multinational banks, called bitcoin a hedge fund against fiat inflation, with the potential to replace the U.S Dollar.