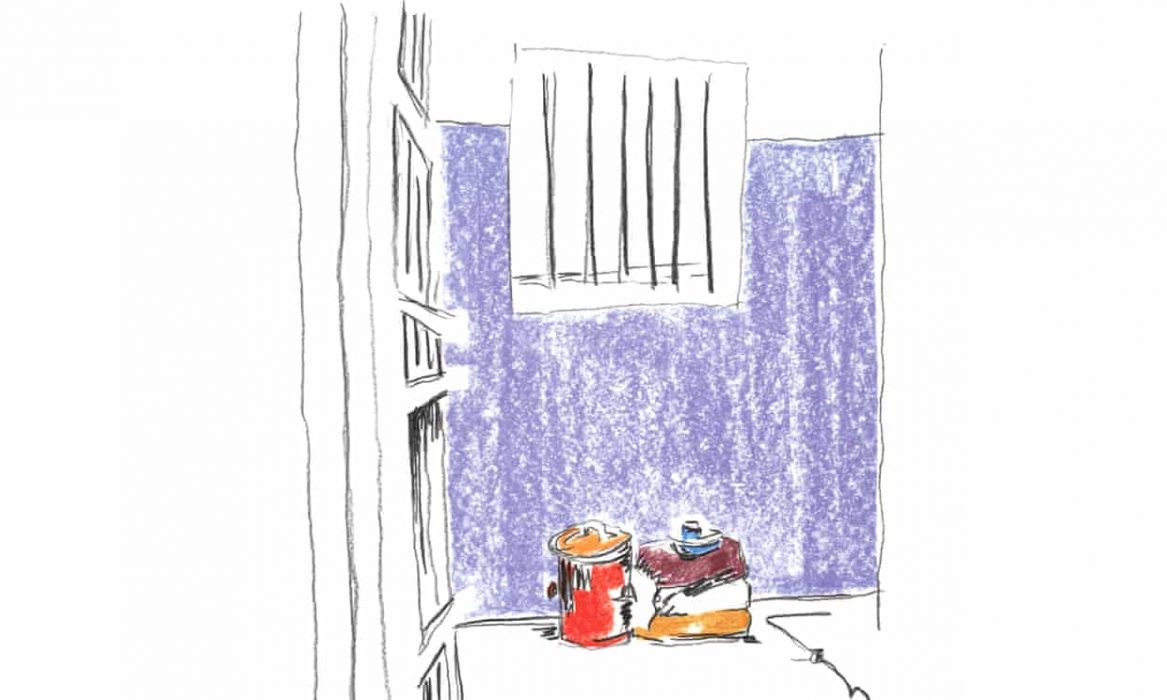

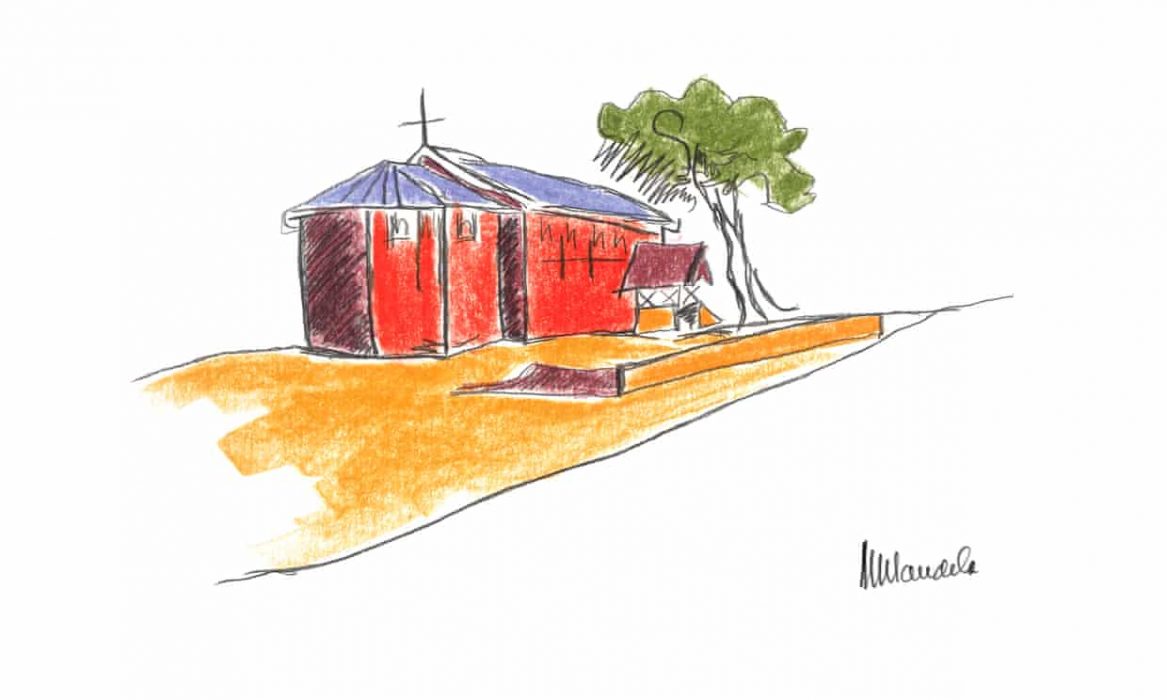

Bonhams in London is set to auction off a set of five paintings minted as NFTs from the hand of former South African president Nelson Mandela. The collection, entitled “My Robben Island”, consists of five watercolour paintings that depict the 18 years Mandela spent incarcerated on Robben Island, a now-inactive offshore prison near Cape Town.

‘The Motivation’ Behind Mandela’s Art

Mandela completed the five paintings after stepping down from the presidency in 1999. The collection also features a piece called “The Motivation”, a handwritten text that explains his visualisations of the harsh prison island where he served his time during the South African struggle to end Apartheid. All six of the works include Mandela’s signature.

It is true that Robben Island was once a place of darkness, but out of that darkness has come a wonderful brightness, a light so powerful that it could not be hidden behind prison walls, held back behind prison bars, or hemmed in by the surrounding sea … The most fantastic dreams can be achieved if we are prepared to endure life’s challenges.

Extract from ‘The Motivation’, by Nelson Mandela

Makaziwe Mandela, daughter of the former president, said the watercolours, all of which were painted in 2002, represent “the triumph of the human spirit”. She added that offering the artworks as NFTs was a way to reach new audiences: “My dad was all about creating an accessible society. This is a way of democratising his art.”

NFTs to be Sold on Nifty Gateway

Giles Peppiatt, director of modern and contemporary African art at Bonhams, has said that the digital arts reach “new audiences that probably don’t go to art galleries and museums”.

These are people who live a lot of their lives through their phones, through the internet, and who have large amounts of money at their disposal – and they are collectors. They are becoming a more and more important part of the art market.

Giles Peppiatt, director of modern and contemporary African art, Bonhams

The paintings will be offered at auction on March 9 on the Nifty Gateway NFT platform, over a six-hour period at a fixed price of US$3,495 for the entire collection, or US$699 for an individual work. Hopefully, the works will fetch prices far beyond the likes of Gary Vee’s hand-drawn doodles, which sold for US$1.2 million last year. But if you’re not convinced they will, you could always short the NFTs.