Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Avalanche (AVAX)

Avalanche AVAX is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. Avalanche is blazingly fast, low-cost, and green. Any smart contract-enabled application can outperform its competition on Avalanche. AVAX is the native token of Avalanche. It is a hard-capped, scarce asset that is used to pay for fees, secure the platform through staking, and provide a basic unit of account between the multiple subnets created on Avalanche.

AVAX Price Analysis

At the time of writing, AVAX is ranked the 10th cryptocurrency globally and the current price is US$104.86. Let’s take a look at the chart below for price analysis:

AVAX‘s 188% bullish trend in Q4 ended in a 49% retracement as the rest of the altcoin market dropped. Bulls stepped in near the 61.8% retracement of Q4’s move, creating a consolidation that ended with last week’s bullish impulse to resistance near $112.35.

With the 9, 18 and 40 EMAs stacked bullish and a bullish higher-timeframe trend, it’s reasonable to anticipate retracement to possible support before further bullish expansion.

Near the 40 EMA, a broad zone from $98.00 to $86.35 could see interest from bulls before further expansion. If this level fails, bears might capitalise on any sharp moves down in Bitcoin, aiming for possible support near the 78.6% retracement, at $75.50, and potentially lower to a higher-timeframe support zone between $69.82 and $57.75.

If the higher-timeframe bullish trend resumes and the current resistance near $112.35 breaks, the wicks near $134.84 and the all-time high might see profit-taking.

A more significant expansion could reach near the 80 level, at $180, and potentially the 150% extension of Q4’s move, near $200.

2. Fetch.ai (FET)

Fetch.ai FET is a platform that aims to connect Internet of Things (IoT) devices and algorithms to enable their collective learning. Fetch.ai is built on a high-throughput sharded ledger and offers smart contract capabilities to deploy machine learning and artificial intelligence solutions for decentralised problem-solving. These open-source tools are designed to help users create ecosystem infrastructure and deploy commercial models.

FET Price Analysis

At the time of writing, FET is ranked the 160th cryptocurrency globally and the current price is US$0.4376. Let’s take a look at the chart below for price analysis:

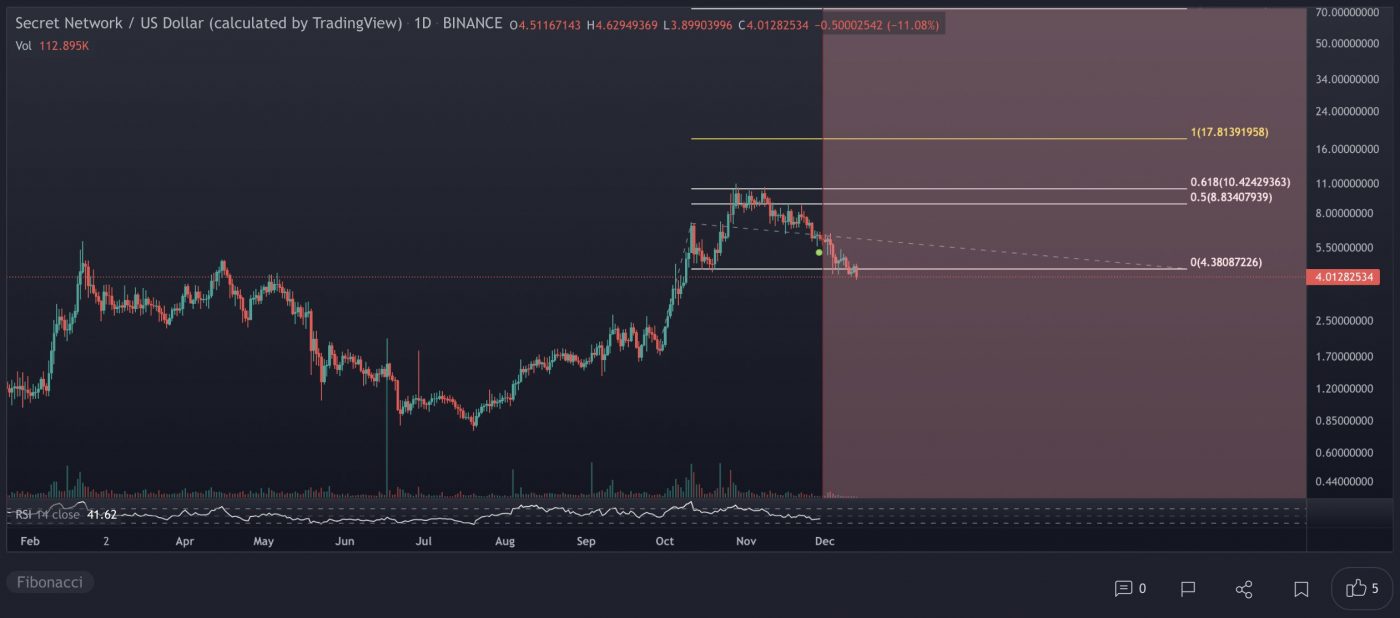

After a lengthy distribution from September to October, FET‘s price finally fell toward 2021’s range low.

The 78.6% retracement of the range, near $0.4389, could support at least a short-term bounce or trigger a consolidation.

Until the daily chart shows signs of reversal, possible support near clustered swing highs and swing lows near $0.3529 could be a bearish target.

If this level fails to provide support, an inefficiently traded area on higher-timeframe charts, from $0.1587 to $0.1197, could be the next draw for price.

Any retracement upward may be capped near $0.5506, around the 61.8% retracement of the higher-timeframe range. However, the two-month consolidation lows near $0.6920 are still a reasonable target for a bounce.

Just above this level, the H1 2021 swing high and midpoint of the consolidation range, near $0.7807, may also provide resistance. If the price clears this resistance, it could signal a new bullish trend.

3. DigiByte (DGB)

DigiByte DGB is an open-source blockchain and asset creation platform. A longstanding public blockchain and cryptocurrency, DigiByte uses five different algorithms to improve security, and originally aimed to improve on the Bitcoin blockchain’s security, capacity, and transaction speed. DigiByte consists of three layers: a smart contract “App Store”, a public ledger, and the core protocol featuring nodes communicating to relay transactions.

DGB Price Analysis

At the time of writing, DGB is ranked the 134th cryptocurrency globally and the current price is US$0.03202. Let’s take a look at the chart below for price analysis:

After climbing nearly 150% since the beginning of Q3, a 115% range has trapped DGB between $0.04749 and $0.03122 during Q4.

A consolidation near $0.03492, visible on the weekly chart, provided support on the last touch. This level could provide support again on a stop run under the $0.03015.

A deeper run-on stop at $0.02920 might reach the top of a higher-timeframe gap at the same level. However, a push this low reduces the chance of a new monthly high soon. Below, little significant support exists until $0.02713.

Higher-timeframe levels overlapping with a daily gap beginning at $0.03495 are likely to provide resistance, perhaps on a sweep of the equal highs near $0.03640. Breaking this resistance makes the relatively equal highs near $0.03855 and the monthly high at $0.04047 the next probable targets.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.