Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Bitcoin Cash (BCH)

Bitcoin Cash BCH is a peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy, and high transaction capacity (big blocks). In the same way that physical money, such as a dollar bill, is handed directly to the payee, Bitcoin Cash payments are sent directly from one person to another. As a permissionless, decentralised cryptocurrency, Bitcoin Cash requires no trusted third parties and no central bank. Unlike traditional fiat money, Bitcoin Cash does not depend on monetary middlemen such as banks and payment processors.

BCH Price Analysis

At the time of writing, BCH is ranked the 22nd cryptocurrency globally and the current price is US$581.04. Let’s take a look at the chart below for price analysis:

October marked a turning point for BCH, with the price rocketing up almost 70% from its lows to probable resistance beginning near $716.22.

The price is currently struggling with the area between $615.43 and $465.76. This region could provide support after a close above – or resistance after a close below.

A retracement could reach into the daily gap and possible support around $534.33. A more bearish shift in the marketplace will likely aim for the relatively equal lows near $510.21, and the potential support just below that begins around $490.64.

Continuation to the upside will likely target the monthly high near $612.30. However, probable resistance beginning at $648.55 and $692.05 could cap or slow down this move.

2. Stellar (XLM)

Stellar XLM is an open network that allows money to be moved and stored. When it was released, the goal was boosting financial inclusion by reaching the world’s unbanked – but soon after, its priorities shifted to helping financial firms connect with one another through blockchain technology. The network’s native token, lumens, serves as a bridge that makes it less expensive to trade assets across borders. All of this aims to challenge existing payment providers who often charge high fees for a similar service.

XLM Price Analysis

At the time of writing, XLM is ranked the 25th cryptocurrency globally and the current price is US$0.3457. Let’s take a look at the chart below for price analysis:

XLM set a high near $0.7197 in May before retracing nearly 85% to find a low near $0.2544. The price consolidated around this level before the strong bullish impulse during the past several weeks.

Probable resistance near $0.3778 is slowing the bullish advance down. However, another leg might target the last swing high at $0.4082 and relatively equal highs at $0.4534. Resistance near $0.4859 could cap the move before the second swing high. Beyond these levels, little stands in the bulls’ way before reaching the swing high near $0.5149.

A retracement before a move higher might find support in the daily gap near $0.2923, just above the monthly open. Relatively equal lows near $0.2775 could also provide support. A run-on stops at $0.2616 and $0.2531 might find support in the gap beginning near $0.2426 or a high-timeframe level near $0.2285.

3. Zcash (ZEC)

Zcash ZEC is a decentralised cryptocurrency focused on privacy and anonymity. It uses the zk-SNARK zero-knowledge proof technology that allows nodes on the network to verify transactions without revealing any sensitive information about those transactions. Zcash transactions, on the other hand, still have to be relayed via a public blockchain, but unlike pseudonymous cryptocurrencies, ZEC transactions by default do not reveal the sending and receiving addresses or the amount being sent.

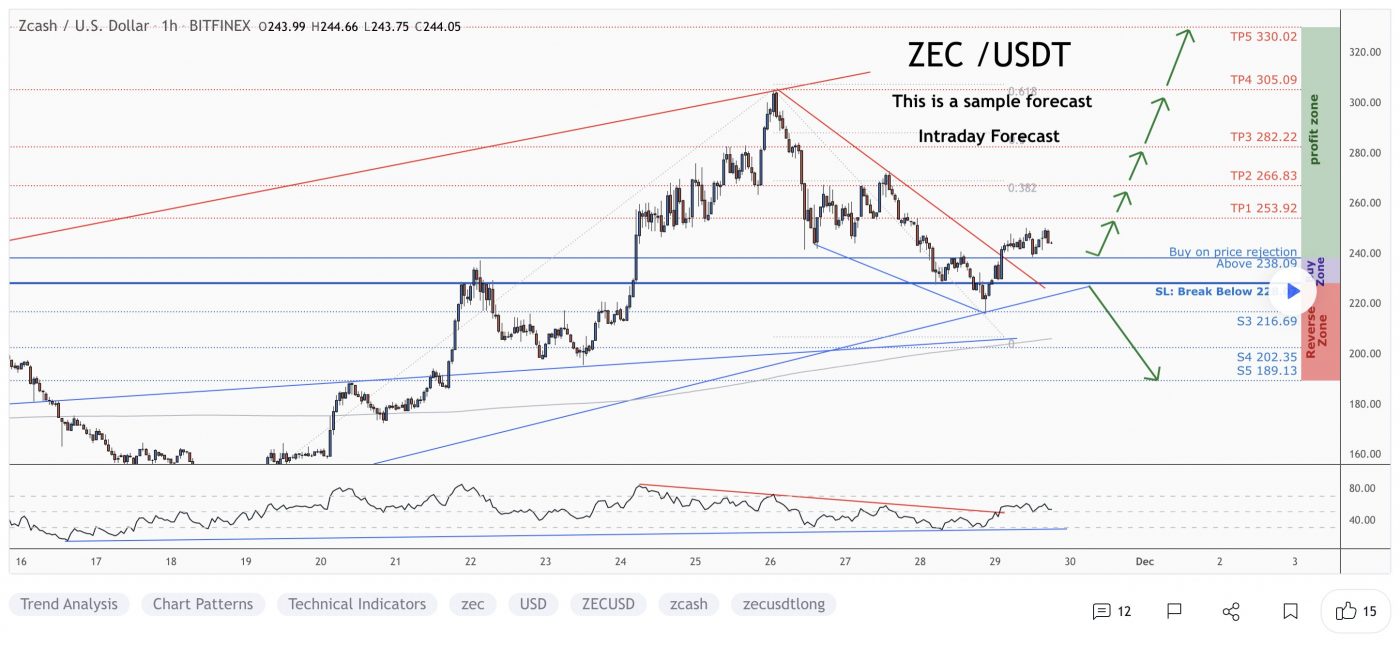

ZEC Price Analysis

At the time of writing, ZEC is ranked the 60th cryptocurrency globally and the current price is US$224.28. Let’s take a look at the chart below for price analysis:

ZEC‘s recent bearish flip of the 9, 18 and 40 EMAs might cause bulls to be less aggressive in bidding. However, possible support near $215.87 and $205.96 – between the 61.8% and 78.6% retracements – could see at least a short-term bounce.

Last year’s long-term consolidation suggests that the areas near $190.45 and $176.23 may be more likely to cause a longer-term trend reversal.

Bears are likely to add to their shorts at probable resistance beginning near $243.50, which has confluence with the 18 EMA. A fast break of this resistance could trigger more selling near $258.12, the start of the bearish move.

If an aggressive bullish move does appear, trapped buyers in the probable resistance beginning near $270.41 might provide a ceiling for this impulse.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6 week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.