Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Polygon (MATIC)

Polygon MATIC is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications. The MATIC token will continue to exist and will play an increasingly important role, securing the system and enabling governance.

MATIC Price Analysis

At the time of writing, MATIC is ranked the 20th cryptocurrency globally and the current price is US$1.60. Let’s take a look at the chart below for price analysis:

October marked a turning point for MATIC, with the price rocketing up almost 80% from its lows to probable resistance beginning near $2.04.

The price is currently struggling with the area between $1.78 and $1.41. This region could provide support after a close above – or resistance after a close below.

A retracement could reach into the daily gap and possible support around $1.53. A more bearish shift in the marketplace will likely aim for the relatively equal lows near $1.50, and the potential support just below that begins around $1.45.

Continuation to the upside will likely target the monthly high near $2.01. However, probable resistance beginning at $1.82 and $1.93 could cap or slow down this move.

2. Cosmos (ATOM)

Cosmos ATOM bills itself as a project that solves some of the “hardest problems” facing the blockchain industry. It aims to offer an antidote to “slow, expensive, unscalable and environmentally harmful” proof-of-work protocols, like those used by Bitcoin, by offering an ecosystem of connected blockchains. ATOM tokens are earned through a hybrid proof-of-stake algorithm, and they help to keep the Cosmos Hub, the project’s flagship blockchain, secure. This cryptocurrency also has a role in the network’s governance.

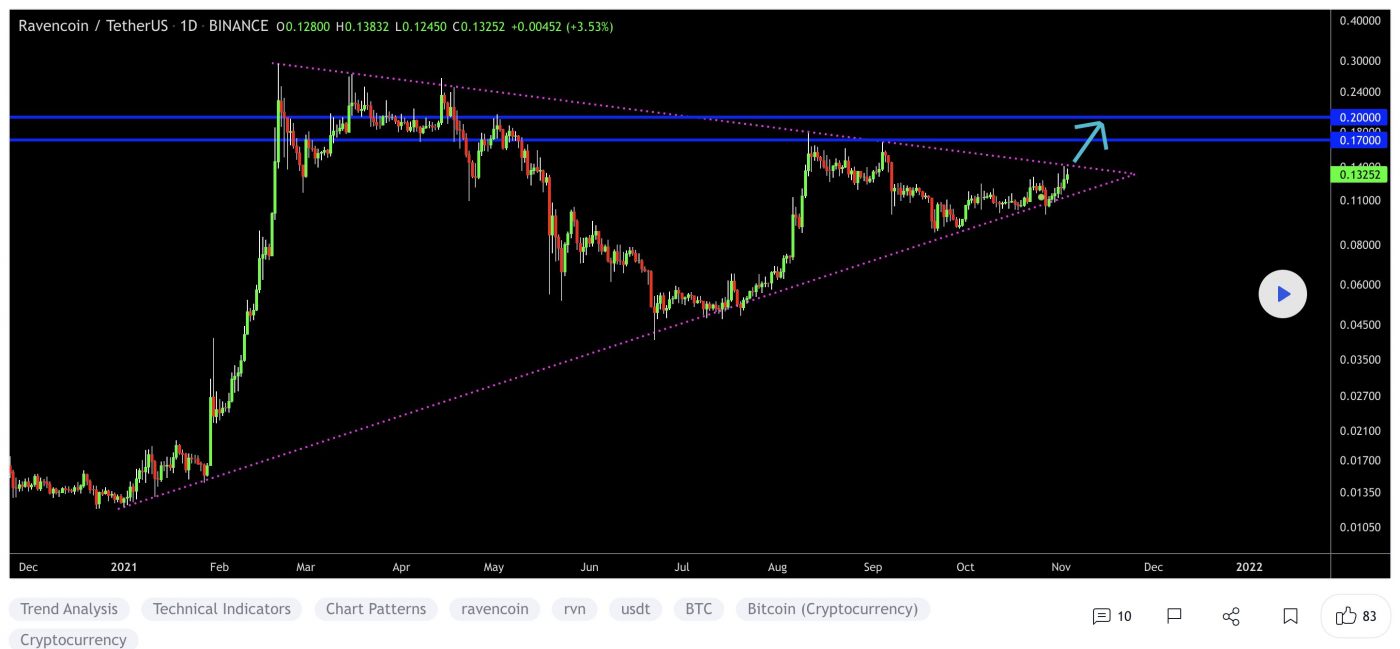

ATOM Price Analysis

At the time of writing, ATOM is ranked the 30th cryptocurrency globally and the current price is US$29.46. Let’s take a look at the chart below for price analysis:

Q3 provided respectable 198% gains for bulls who bought ATOM at the monthly open, with the price finding resistance near $30.12.

If bulls take back control this week, the top of the former gap beginning at $26.44 may provide support for at least a short-term bounce. The top of the consolidation range starting near $22.58 is more likely to provide substantial support.

The most robust support is likely to be found in the overlapping consolidation ranges between $20.74 and $19.06, with a sharp slice through these levels possibly suggesting the end of the bull run.

The region from approximately $35.70 to the most recent swing high is likely to provide some resistance. The swing high provides a reasonable first target for a possible next leg up.

If this high breaks, the 1.0 extension near $39.21 and the 2.0 extension near $45.90 may provide the next primary targets.

3. Axie Infinity (AXS)

Axie Infinity AXS is a blockchain-based trading and battling game that is partially owned and operated by its players. The Axie Infinity ecosystem has its own unique governance token, known as Axie Infinity Shards AXS. These are used to participate in key governance votes and will give holders a say in how funds in the Axie Community Treasury are spent.

AXS Price Analysis

At the time of writing, AXS is ranked the 25th cryptocurrency globally and the current price is US$131.87. Let’s take a look at the chart below for price analysis:

AXS‘s relatively small 45% range could suggest that a much larger move is setting up in November.

Aggressive bulls could look for entries at the most recent area of support formed near $120. However, equal lows near $114 make a tempting target for a stop run into this support. This move could reach support near $105.

A decisive move to the downside could run stops below the second set of relatively equal lows near $97.23, possibly reaching support at an old swing high and a daily gap near $90.58.

A recent level near $142 provided resistance and caused a recent swing high to form near $158, offering first targets. A move through this high may arrive at new high levels near $176 and $180.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6-week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.