Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. DigiByte (DGB)

DigiByte DGB is an open-source blockchain and asset creation platform. A longstanding public blockchain and cryptocurrency, DigiByte uses five different algorithms to improve security, and originally aimed to improve on the Bitcoin blockchain’s security, capacity and transaction speed. DigiByte consists of three layers: a smart contract “App Store”, a public ledger, and the core protocol featuring nodes communicating to relay transactions.

DGB Price Analysis

At the time of writing, DGB is ranked the 112th cryptocurrency globally and the current price is A$0.07139. Let’s take a look at the chart below for price analysis:

After climbing nearly 380% since the beginning of the year, a 115% range has trapped DGB between A$0.06249 and A$0.1073 during Q3.

A consolidation near A$0.06892, visible on the weekly chart, provided support on the last touch. This level could provide support again on a stop run under the A$0.06713.

A deeper run-on stops at A$0.06620 might reach the top of a higher-timeframe gap at the same level. However, a push this low reduces the chance of a new all-time high soon. Below, little significant support exists until A$0.06819.

Higher-timeframe levels overlapping with a daily gap beginning at A$0.07699 are likely to provide resistance, perhaps on a sweep of the equal highs near A$0.07940. Breaking this resistance makes the relatively equal highs near A$0.08255 and the monthly high at A$0.08647 the next probable targets.

2. Fetch.ai (FET)

Fetch.ai FET is a platform that aims to connect Internet of Things (IoT) devices and algorithms to enable their collective learning. Fetch.ai is built on a high-throughput sharded ledger and offers smart contract capabilities to deploy machine learning and artificial intelligence solutions for decentralised problem-solving. These open-source tools are designed to help users create ecosystem infrastructure and deploy commercial models.

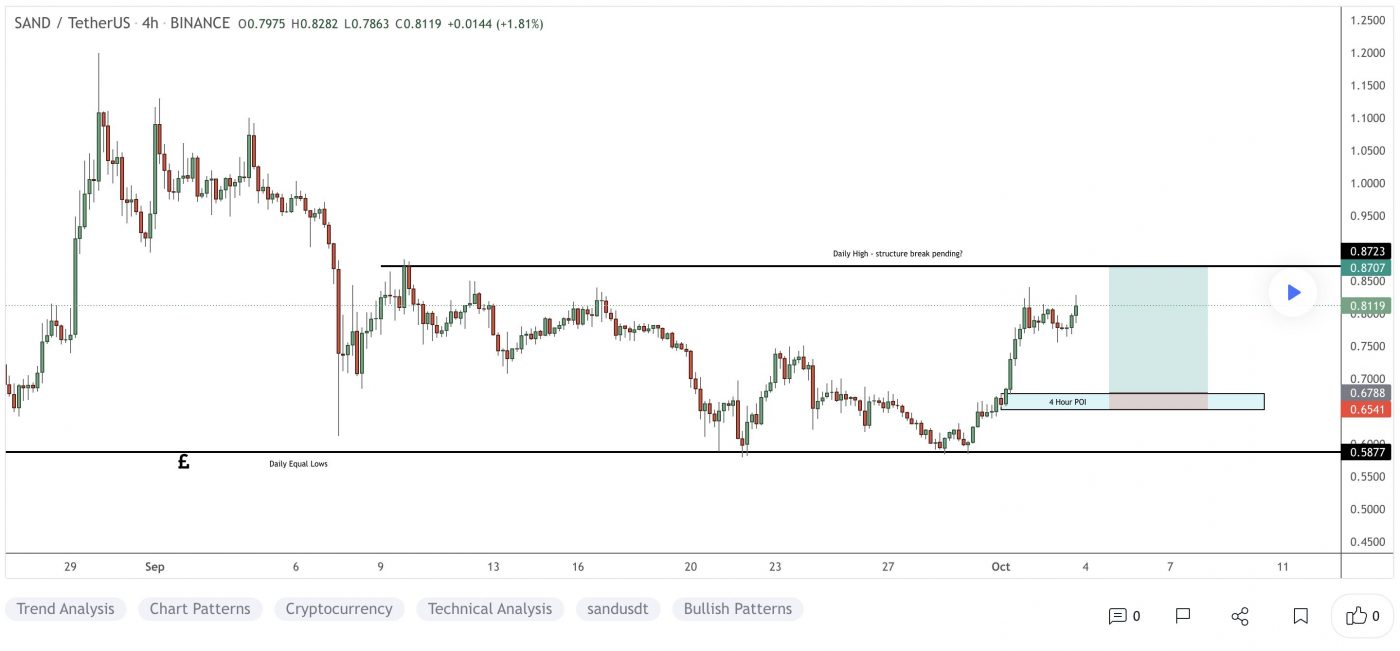

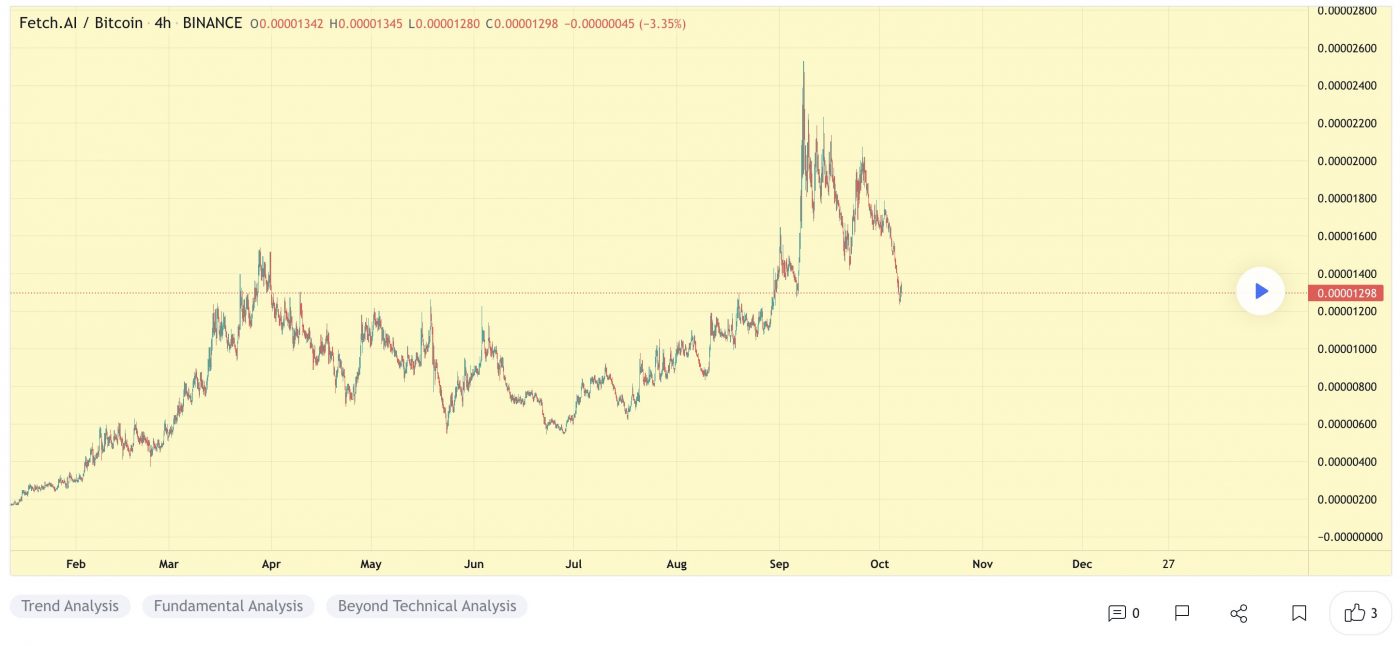

FET Price Analysis

At the time of writing, FET is ranked the 130th cryptocurrency globally and the current price is A$0.9501. Let’s take a look at the chart below for price analysis:

FET‘s euphoric Q3 pump turned into a mid-September 65% retracement, with little higher-timeframe support for bulls to justify entries.

Currently, the price is distributing at the 52% retracement level. A small consolidation near A$0.9244 is visible on the daily chart, with a clearer consolidation on the 4h chart. This area does have some confluence with the 79% retracement level and could offer some support in the future.

The daily gap’s midpoint near A$0.9428 has suppressed the price, although a push through this level could fill the daily gap up to A$1.18. A lack of sensitivity at this resistance could suggest a minor retracement before a possible move to new all-time highs.

3. Smooth Love Potion (SLP)

Smooth Love Potion SLP tokens are earned by playing the Axie Infinity game. This digital asset serves as a replacement for experience points. SLP are ERC-20 tokens, and they can be used to breed new digital pets known as Axies. The cost of breeding begins at 100 SLP but increases gradually, rising to 200 SLP for the second breed, 300 for the third, 500 for the fourth, 800 for the fifth, and 1,300 for the sixth. Axies can be bred a maximum of seven times, and the seventh breed costs 2,100 SLP. This limit exists in order to prevent hyperinflation in the marketplace.

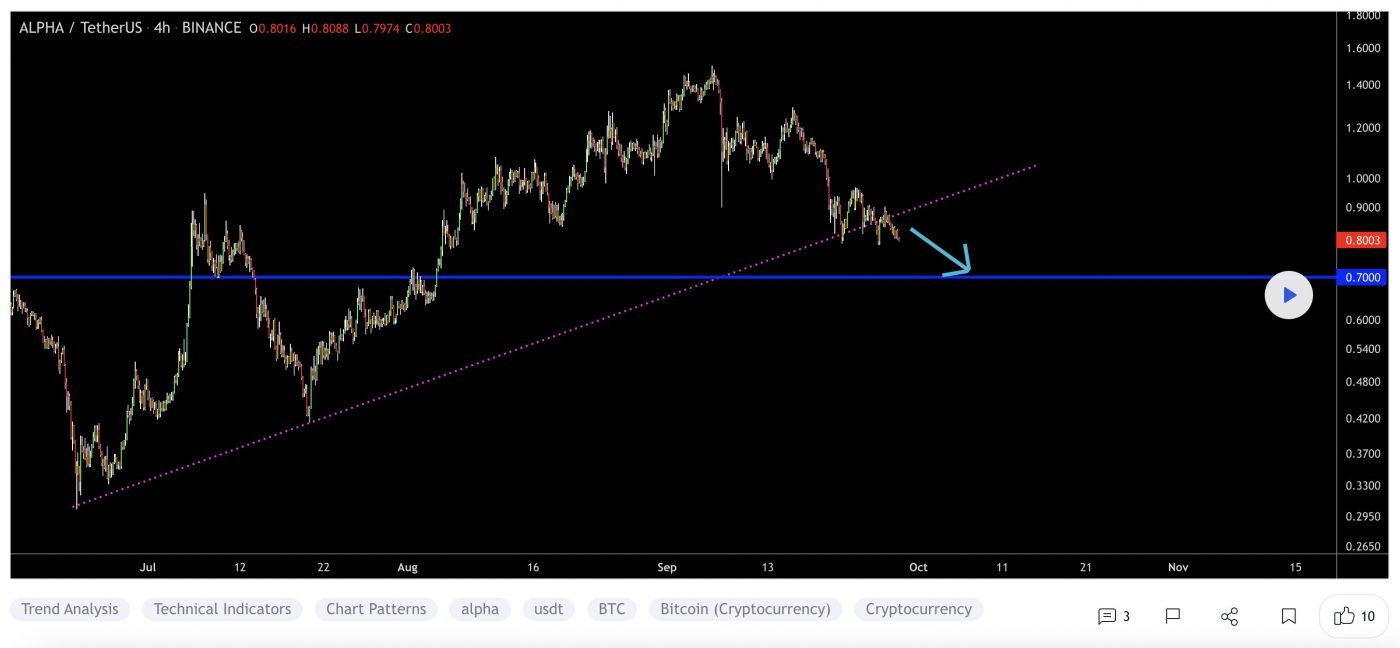

SLP Price Analysis

At the time of writing, SLP is ranked the 285th cryptocurrency globally and the current price is A$0.1191. Let’s take a look at the chart below for price analysis:

SLP‘s 160% pump during early July ran into 85% retracement near A$0.0895 on September 20. Since then, the price has been consolidating in a 120% range between A$0.08724 and A$0.1055.

Just below the mid-September low, A$0.08627 is the first level likely to provide substantial support. If the price breaks down through this level, overlapping levels near $0.08422 might cap a run on the lows near A$0.08314 and A$0.08195.

The higher-timeframe analysis points to the area near A$0.1295 as the next substantial resistance. Significant selling has been occurring here on the daily chart. If this level breaks, the swing highs near A$0.1367 and A$0.1420 may be the next targets.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.